In May of this year, Gartner published its 12th annual Supply Chain Top 25, a ranking of the world’s leading supply chains.

As always, a primary goal of the Top 25 is to foster the celebration and sharing of best practices as a way to raise the bar of performance for everyone.

Another objective of the Supply Chain Top 25 is to shine a light on the importance of the function and profession - within our community certainly, but also for corporate executives outside of supply chain and the investment community at large.

The ranking is focused on identifying supply chain leadership, which includes operational and innovation excellence, but also other behaviors such as corporate social responsibility and a desire to improve the broader practice of supply chain management.

While the list always changes from year to year, there are some common characteristics that separate the best from the rest.

This article (download PDF) discusses the insights and trends we’ve seen this year from the leaders.

What is the definition of excellence?

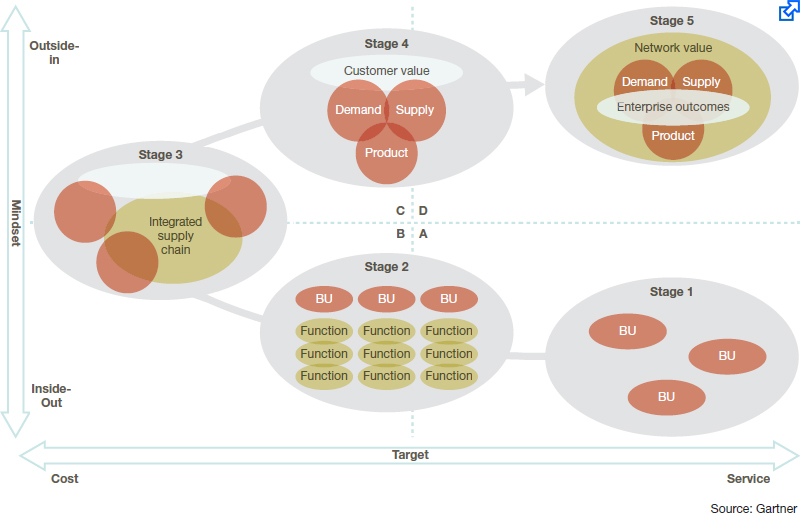

Gartner defines excellence as demonstrating leadership toward a demand-driven ideal.

Our Demand Driven Value Network (DDVN) model has seven dimensions with interrelated areas of capability in supply, demand and product lifecycle management, all enabled by robust strategy and governance.

The maturity model follows five stages of progressive maturity along each dimension and tracks corporate supply chains through a journey from reactively operating in silos to eventually orchestrating for value across both internal and partner networks.

Leading companies have achieved a much higher degree of visibility, coordination and reliable processes both within and across the Plan, Source, Make, Deliver and Return functions, but also in partnership with sales and marketing and product management organizations in lines of business. The design of their supply chains starts with what brings value to customers and then looks back through the supply network. The ability to sense, translate and shape demand, and pair up appropriate supply is also improved and both demand and supply are determined in close collaboration with customers and upstream suppliers.

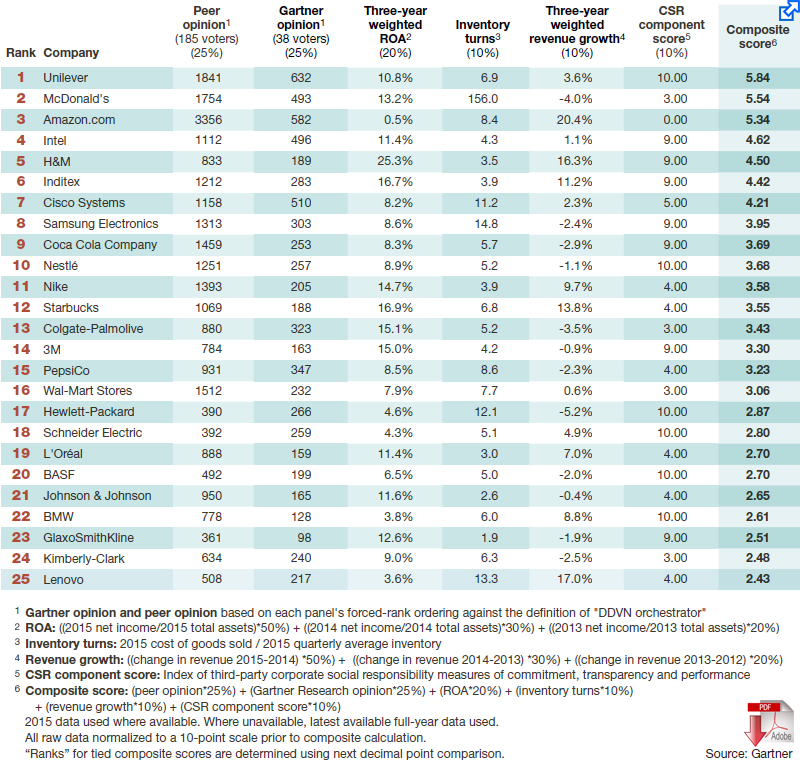

Our methodology is detailed below (see the sidebar “Trends”), but at a summary level it operates as such. Each year, approximately 300 companies are chosen for evaluation. Companies do not apply to be included; rather, we select the companies from publicly available lists using a defined set of criteria, including size and industry sector. Each company gets a composite score, and these scores are force-ranked to come up with the final list. The composite score is made up of a combination of publicly available business performance data, as well an opinion component, providing a balance between objective and subjective perspectives. In completing their ballots, voters are asked to identify those companies that they believe are furthest along the journey toward the demand-driven ideal, as defined in Gartner research and on the voting Website.

Return of the supply chain “masters”

Last year we introduced a new category to highlight the accomplishments and capabilities of long-term leaders. We refer to these companies as supply chain “masters” and define them as having attained top five composite scores for at least seven out of the last 10 years. To be clear, this category is separate from the overall Supply Chain Top 25 list, but it is not a retirement from being evaluated as part of our annual research study.

The Gartner supply chain top 25 for 2016

To the contrary, if a “master” company were to fall out of having a top five composite score for long enough, they would lose this designation and be considered as part of the Supply Chain Top 25 ranking in the same way as any other company in our study. All of that said, both of last year’s inaugural masters, Apple and P&G, qualified for this category again.

Apple continues to succeed by offering platforms that ecosystems of partners build upon to meet customers’ needs, whether that relates to core product features such as access through touch-based security, media content and applications or third-party accessories that convert its products into smart diagnostic devices or payment terminals.

The big forward-facing question for Apple and its supply chain is whether it can deliver on the next big innovations to continue the revenue and earnings parade of the last decade.

A big X-factor will be Apple’s ability to launch an automobile in the future - a completely different proposition than its continued innovation within the consumer electronics market, such as the Apple Watch.

Consumer packaged goods (CPG) giant P&G is our other returning master. P&G received a top five composite score in 2016, marking an impressive nine out of the past 10 years for this accomplishment. For the majority of its products, P&G is running an end-to-end synchronization program.

Every part of the supply chain operates based on the daily cadence of consumption, in some cases triggered by demand at the shelf. Supply chain also plays an active role in P&G’s move toward common product and packaging platforms, where standards are set globally and a more limited menu of options is selected regionally, as required.

The supply chain team brings data and analysis skills to the process, with the ultimate goal of increasing the value that each active SKU contributes to the company.

Both Apple and P&G continue to offer advanced lessons for the supply chain community.

The Top 5

We have a new No. 1 this year. Unilever, the Anglo-Dutch CP giant, has steadily moved up the rankings over the past several years and is very well regarded by both the peer and analyst voting panels due, in part, to its willingness to share best practices with the broader supply chain community. The company is a role model when it comes to Corporate Social Responsibility (CSR) and scored a perfect 10 out of 10 on our new CSR component. Unilever says that it is achieving zero waste through its “four R approach” - reducing, reusing, recovering or recycling - and treating waste as a resource with alternate uses, such as converting factory waste to building materials or composting food waste from staff cafeterias. Unilever has made significant investments in regional operational centers and improving its product life cycle management (PLM). Unilever

Returning at No. 2 is McDonald’s. The well-known restaurant chain staged a comeback in 2015, paring unprofitable locations and menu items and introducing its popular all-day breakfast offering. The latter entailed a broad-scale effort to retool restaurants previously configured for a more traditional daily menu schedule. This program successfully moved from pilot in April 2015 to full deployment three months later across 14,000 restaurants in the U.S. McDonald’s supply chain actively participates on both product and menu category teams to help shape the portfolio and better plan for new initiatives. McDonald’s

Amazon dropped to No. 3 after its first ever appearance at No. 1 last year. The main driver was Amazon scoring zero out of 10 on our new CSR measure. The company is known for having a secretive culture that has historically extended to a lack of transparency on supply chain sustainability and governance performance measures. In the past two years, Amazon has brought in a high-powered team of sustainability experts, so we hope to see changes in the years to come. Amazon, of course, continues to be a leader when it comes to innovation in its products and supply chain. Amazon’s Prime Now same-day delivery service has expanded to more than two dozen U.S. cities and London, and includes delivery from local restaurants and stores in addition to company-owned warehouses. Amazon

Intel remained in the top tier of the ranking this year at No. 4, based on a relatively high return on assets (ROA) and strong opinion poll scores. Intel continues to be the largest chipmaker in the world and dominates the markets for PC and server-based microprocessors. The company is actively pursuing growth opportunities, as evidenced by its largest ever acquisition of chipmaker Altera in 2015. Intel’s next challenge is to drive organic growth in new markets. Its supply chain group has proven to be a worthy partner for growth in the past. Over the course of 2014, the team enabled an entirely new ecosystem of China-based technology providers to support the ramp up of new tablet products. Intel’s supply chain is also acting as a test bed for new products offered by its IoT group, using this technology to improve the visibility and coordination of complex inbound capital equipment deliveries and outbound product shipments to customers. Intel

Rounding out the top five group this year is H&M at No. 5. The Swedish fast-fashion retailer climbed two spots on a combination of extremely strong three-year weighted average ROA (25.3%) and revenue growth (16.3%) and a nine out of 10 for CSR, reflecting its strong record in sustainability and workers’ rights. In 2015, its founding family launched the H&M Conscious Foundation, which presents a Global Change Award as a fashion industry innovation accelerator for sustainable clothing. H&M operates its supply chains tailored by product type, with 80% of volume built to plan at standard, cost-efficient lead times and the remaining 20% that is agile and can respond to fashion trends by going from design to hanger in as little as 20 days. H&M

Movers and Shakers: No. 6 through No. 15

At No. 6, is Inditex, Spain’s leading fashion retail group best known for its Zara brand. Inditex posted similar strong performances in three-year weighted average ROA (16.7%) and revenue growth (11.2%) and scored nine out of 10 for CSR. The Zara brand has been quite successful in its e-commerce business, particularly in the U.S. Inditex’s culture is very team-oriented and focused on having talented practitioners run the business using best-in-class processes versus the personality-driven cultures often found at fashion houses. Several years ago, it set up a planning and analytics team that sorts through real-time sales trends to inform future design and production. Inditex has also set a goal to run 100% eco-efficient stores by 2020. Inditex

Networking pioneer Cisco is No. 7. Concurrent with Cisco’s changing of the guard at the CEO level last year, it created a new role managing both supply chain operations and the IT group, reflecting the high use of technology in managing supply chains. One area where Cisco has leveraged technology along with process improvement is in supplier collaboration. The team deployed a Cloud-based partnering platform with suppliers that serves as a single source of truth for data, eliminating the bullwhip effect between Cisco, contract manufacturers and suppliers. Another focus area for the team is the digitization of the logistics function. This includes connecting logistics to the broader supply chain with data, standards, automated event management and machine agents. Cisco is also bringing new technologies to bear in its warehouses, including augmented reality, telematics and video analytics. Cisco

Samsung Electronics, at No. 8, has been a familiar face on our ranking for many years. Samsung’s supply chain has enabled a move into business-based products and solutions tailored for industry-specific uses across retail, education, hospitality, healthcare, finance and transportation. It also continues to focus on improving customer collaboration and gaining insight into consumer behaviors through connected devices. Samsung Electronics received high marks (nine of 10) on the new CSR component and recently received two awards for sustainability from the U.S. Environmental Protection Agency (EPA). Samsung Electronics

The Coca-Cola Co. ranks at No. 9. The food and beverage leader is driving growth through product innovations and entering new markets and products, particularly in juices and waters. Supply chain, in partnership with the business, is taking a value-based approach to product and packaging portfolio management. The company continues to use its Freestyle smart delivery systems to tailor supply chain solutions by market and segment. The company scored nine out of 10 for CSR and has set out ambitious sustainability goals for 2020 that include improving water and emissions efficiency by more than 20%, empowering five million women across its value chain and several programs to improve nutritional content and reporting. Coca-Cola

One of the biggest gainers at the top of this year’s ranking is Nestlé, up seven to No. 10. The world’s largest consumer food supply chain scored a perfect 10 out of 10 for CSR, including 99 out of 100 in the environmental dimension of the Dow Jones Sustainability Index for its use of “zero-water” factories and conversion of biowaste into renewable energy. Nestlé’s supply chain has consistent priorities around fresh product availability, customer collaboration, capital efficiency, data-driven decision making, complexity management and people development. It is now focused on optimizing end-to-end process flows and rethinking quality across its broader value chain. Nestlé is also investing in predictive analytics for demand planning and enabling growth in its e-commerce business, which includes packaging tailored more for delivery than display in a store. Nestlé

At No. 11 is footwear and apparel leader, Nike, which continues to post strong financial performance, with a three-year weighted average ROA of 14.7% and growth rate of 9.7%. Nike’s supply chain plays a big role in enabling and ramping new technologies. Last fall, Nike entered into an innovation and manufacturing partnership with outsource provider Flex that is expected to add value in terms of new manufacturing technologies and shorter cycle times. Nike has invested significantly in supply network design and PLM capabilities. Its supply chain also has extended visibility to outsourced factory production and compliance, as well as to how stores are executing on merchandising, inventory and operations plans. Nike

After jumping five slots last year, Starbucks held steady at No. 12. The world’s largest coffee retailer is on a roll and posted stellar results heading into 2016, with a three-year weighted average ROA of 16.9% and growth rate of 13.8%. Starbucks’ prominent CEO, Howard Schultz, has spoken about the criticality of strong supply chain capability to achieving the level of scale required to support its more than 20,000 locations and the consumer trend toward speedy delivery. Starbucks has further rolled out a click-and-collect feature through its online app that allows consumers to place and pay for orders that are routed to the nearest store for fast-lane pick up. Starbucks has been a socially conscious company as evidenced by its programs to reimburse employees’ college costs and to donate leftover food at U.S. stores to charity. Starbucks

CP leader Colgate-Palmolive lands at No. 13. Even in the face of unprecedented currency headwinds, the company pulled off an impressive 15.1% three-year weighted average ROA. The engine behind these results: extensive programs comprised of more than 10,000 projects, focused on finding cost savings and reinvesting them back into growing the business. Continuous improvement and the concept of economic value-add are embedded in the supply chain and the broader company’s DNA. For several years running, supply chain, in partnership with the business, has managed significant improvements in SKU productivity through a disciplined governance process. The Colgate-Palmolive team has also partnered with its enterprise software provider to co-develop supply chain control tower capabilities, including better demand sensing, inventory optimization and supply network planning. Colgate-Palmolive

Industrial innovator 3M retained its No. 14 position. For a diverse manufacturer, it boasts a very high three-year weighted average ROA of 15%. 3M scored nine out of 10 points for CSR and has set aggressive 10-year sustainability goals for water usage, energy efficiency, “zero landfill” status and helping customers reduce CO2 emissions. For decades, the company has grown its top line, mostly through more creative use of resources. Supply chain’s role in this growth is centered on three elements. The first is regionalizing supply chains to reduce complexity, enhance operational impact and improve customer service. Next is accelerating disruptive technology to leverage innovation and deliver higher-quality, lower-cost and even-more-innovative products. The third is harmonizing global processes in alignment with a global ERP platform to deliver world-class productivity, inventory management and capital efficiency. 3M

Forward thinking food and beverage purveyor, PepsiCo is last in this middle group at No. 15. PepsiCo is leveraging its near-real-time direct store delivery network visibility to support hyper-local marketing, including tailored assortments and perimeter displays at the right store and time to drive sales. Another focus area is a global rollout of a standardized demand and supply planning platform that delivers base capabilities to emerging markets and a larger menu of capabilities for complex, mature markets. PepsiCo is also using tools and models to perform advanced inventory analysis and decision-making. This includes self-service dashboards that allow users to drill into root causes for problem areas and to simulate the quantitative impact of corrective actions. PepsiCo

Rounding Out the List: No. 16 through No. 25

Mega-retailer Walmart, at No. 16, continued its push into e-commerce channels in 2015 with more than $1 billion in new investments. Global revenue in that channel increased 22% to $12.2 billion. The company set up large, dedicated online fulfillment centers to support this volume in the United States. By stocking product centrally, it has been able to simultaneously increase assortment by 60% to over 10 million items. About 75% of Walmart’s online sales come from non-store inventory, providing a source of growth outside of brick and mortar. One of Walmart’s community investments has been a Global Women’s Economic Empowerment Initiative, which provides training, access to markets and career opportunities to nearly 1 million women, many on farms and in factories. Walmart

After several years away, the legendary Silicon Valley innovator, HP, rejoins the list at No. 17. In November 2015, HP split into two separate entities, HP Inc., which owns the PC and printer businesses, and Hewlett Packard Enterprise, which primarily owns the enterprise computing and services businesses. While the split took dedicated focus, the two HPs were still able to simultaneously improve their individual businesses. The enterprise business delivered a visibility and data analytics platform that is now leveraged for improved demand forecasting, among other areas. Meanwhile, HP Inc. has focused on improving the customer experience through perfect order fulfillment and other means. HP scored a perfect 10 on the CSR component and is a longtime leader in this area. HP

Schneider Electric joins the list for the first time at No. 18. The global specialist in energy management and automation jumped 16 slots from No. 34 last year, based on increasing opinion poll vote sentiment and scoring 10 of 10 for CSR. Schneider Electric has spent the last several years moving from decentralized supply chains supporting its extremely diverse customer base to one that is tailored to align with customer requirements, in a scalable way, through a small number of differentiated end-to-end flows through ordering, planning, sourcing, manufacturing and delivery. It is also focused on maturing its sales and inventory operations planning process, deploying network optimization and leaning out warehousing and transportation functions. Schneider Electric

L’Oréal, the world’s largest cosmetics company, ranks at No. 19, up three slots from last year. Its supply chain has focused on improving demand forecasting and supply and demand matching capabilities. The results have been impressive, as it has been able to improve service levels by more than 2%, while holding inventory constant. In the area of product innovation, the supply chain organization closely coordinates with R&D on new product introduction (NPI). The company manages a considerable amount of item complexity in its portfolio - 30% to 50% of products refresh annually - through a mature governance process focused on product contribution. The supply chain team is also continuing to develop and deploy its supplier management program on a best-of-breed platform. L’Oréal

Another newcomer to the Supply Chain Top 25 is BASF at No. 20, the world’s largest chemical company, leaping 16 slots from last year’s ranking. BASF has a long history of focusing on safety and sustainability and scored 10 out of 10 on the CSR component. It is running projects to digitize supply chain management, in line with Industrie 4.0 standards. This includes digitization of its logistics function and horizontal digital integration from its customers through its internal operations and upstream to suppliers. Prescriptive analytics are being built to aid in daily decision-making and strategy planning. Another key initiative is differentiation in supply chain services. Through its focus, this effort has also improved service delivery for customers and identified value-based pricing opportunities for special services. BASF

Healthcare leader Johnson & Johnson, at No. 21, has been on the Supply Chain Top 25 list every year since its inception. This year, the supply chain group developed an end-to-end operating system that defines a standard way of working across all internal functions with external partners and between segments. J&J’s customer experience program, launched four years ago, is targeted at improving customer experience and creating joint value delivered through customer focus teams staffed by dedicated supply chain professionals. Its supply chain team has improved supplier collaboration through tighter integration, created digital visibility through serialization and track and trace, and deployed control towers for supply chain planning (SCP) and analytics to sense and respond to issues. Johnson & Johnson

Also new to the list this year is BMW at No. 22. The German luxury automobile company received high marks from the opinion panels and a top score of 10 on the CSR component. It has long been recognized as a leader in automotive sustainability, reducing the volume of resources utilized and the emissions per vehicle produced by an average of 45% since 2006 through a variety of projects. Its supply chain has implemented a risk filter for suppliers that take into account location-specific and product-specific risks. Its sourcing group uses this filter to consider ESG risk potential for new and existing suppliers and follow up with supplier self-assessments and audits, as needed. BMW has also made significant investments in supply network visibility and digital manufacturing in line with Industrie 4.0 objectives. BMW

GlaxoSmithKline, at No. 23, returns to the ranking after a nine-year hiatus. It had a strong three-year weighted average ROA of 12.6% and scored nine out of 10 on the CSR component. The British pharmaceutical company is partnering with suppliers to reduce its environmental impact and expects to cut value chain emissions by 25% by 2020. GSK is on a multiyear journey to simplify and spread best practices across its end-to-end to supply chain, which includes the introduction of the GSK Production System (GPS) across its pharmaceutical manufacturing sites to identify and eliminate the root causes of accidents, defects and waste. More recent initiatives and capabilities include product portfolio complexity analysis and end-to-end logistics coordination and visibility. GlaxoSmithKline

Leading personal care and paper product company Kimberly-Clark, at No. 24, continued its steady rise up the supply chain maturity curve over the last year. As part of this evolution, it created a new chief supply chain officer (CSCO) position with global responsibilities for procurement, transportation, continuous improvement, sustainability, quality, safety and regulatory operations. Three of the top initiatives for Kimberly-Clark’s supply chain are improvements in on-shelf availability, e-commerce fulfillment capabilities and continued refinement of its world class Supply Chain Efficiency Fund (SCEF) program. Kimberly-Clark

Lenovo rounds out the list at No. 25, this year. The Chinese high-tech company made significant acquisitions over the past two years and its supply chain took a disciplined approach to integrate and return the IBM System X server and Motorola mobility businesses to profitability in 18 months. A large part of this success story was a detailed network design analysis that led to a decision to merge acquired product production into Lenovo’s existing in-house manufacturing network. Its supply chain team is running multiple programs to enhance customer experience and operational excellence. In line with that commitment, a supply chain staff member is assigned as an executive sponsor for each major account. Lenovo

Characteristics of Leaders

As demonstrated above, each company develops supply chain strategies and priorities tailored to its corporate and market context. While these are useful for others to learn from, in our research we also look for shared characteristics. For many companies, these characteristics are easier to talk about than to actually implement. What differentiates the leaders is that they have moved beyond the discussion phase to make the hard changes that are required throughout the organization.

We’ve talked about many of the following these in past articles, and they remain relevant.

Outside in focus. Most companies think they are demand driven and focused on the customer, but the two concepts are not identical. You can be focused on the customer from either an outside-in or inside-out mentality. Leaders start with the customer experience of their supply chain and work their way back through their supply chain designs for an appropriate, profitable response.

Embedded innovation. Indicates a supply chain’s close integration into product lifecycle management both internally and with up and downstream partners. There is also the ability to innovate supply chain practices. This means not only adopting and adapting others best practices, but also breaking the rules, defying conventional wisdom and writing new rules for the supply chain community, as a whole. These companies are not afraid to experiment, fast fail in some areas and drive competitive advantage in others.

Extended supply chains. More mature companies are managing multi-tier networks with strong visibility and agility to support rapid changes in demand or disruptions in supply.

Excellence addicts. Are never satisfied, even if their performance in an area would be considered world class by objective standards. Most often there is an underlying culture driving this behavior and strong governance mechanisms managed through centers of excellence.

Raising the Bar

In our engagement with supply chain leaders over the past year, it is evident that the bar of performance has risen considerably for the top of the group. As Gartner’s supply chain research organization, we remain committed to providing a platform for informed and provocative debate about supply chain leadership. We look forward to leveraging this research to share the lessons, best practices, and characteristics of leaders to inspire and challenge the entire supply chain community to new levels of performance and contribution.

Supply Chain Trends

Each year, our analysts research the supply chains of hundreds of companies. Through this work, we note the trends: What are the leaders focusing on, where are they investing time and effort, and what can be applied broadly? Three key trends stand out this year for these leaders that are accelerating their capabilities and further separating them from the rest of the pack.

Customer-driven partner integration. Gartner’s supply chain research is centered on the concept of running a demand-driven value network (DDVN). While customer centricity is a natural extension and enabler of DDVN, in the past year, some companies and ecosystems have raised the bar in terms of what this means.

For instance, a popular trend in leading consumer product companies is to centralize customer service and other customer-facing functions in more cost-effective regional hubs. This allows for standardization of best practices and economies of scale, with the ability to stay relatively close to individual customers. One leading CP company has piloted having supplier representatives sit side-by-side with their supply chain support counterparts in these service centers to speed up collaboration cycles and, ultimately, the response to customer requests, issues and priorities. This is a deeper level of integration than we’ve seen to date and bodes well for the long-term satisfaction of customers in this industry.

Meanwhile in high tech, there are dynamic federations of hardware, software and service providers coming together for the sole purpose of bringing solutions to customer’s requirements. This collaboration is sometimes for extended periods of time and, in other cases, it is a one-time project to deliver a tailored response to customer needs. We’re particularly seeing this type of arrangement in the delivery of Internet of Things (IoT)-based solutions. Consider a solution that allows for the remote monitoring and management of refrigerated cases holding beverages in a large number of distributed locations.

The solution is comprised of sensor chips, gateway devices, embedded software and an analytics platform for tracking inventory replenishment requirements, case temperature failures and other performance parameters. There is also a service component for maintenance of the solution hardware and software. The orchestrator of the group is situation-specific. It could be an equipment OEM, a chipmaker, an electronics distributor, a contract manufacturer, an integration partner or otherwise. The rules surrounding who owns the intellectual property (IP) and who bears the risks for the broader integrated solution are still unclear in some of these arrangements. Despite the uncertainty in this brave new world, the end result is that customer’s underlying challenges are being solved.

More broadly, digital business has emerged as a key enabler of tighter integration across value chains. Leading companies in the process and industrial discrete manufacturing industries are not only getting better visibility into their own manufacturing and outbound transportation networks, but also integrating that visibility with similar data from upstream partners to provide a holistic view of supply to their customers and to sense and respond to potential disrupters earlier than they have in the past.

Read: Real Time Value Network Live With More Than 50,000 Partners across Six Continents

Adoption of advanced analytics. Another trend we see at leading supply chains is the use of advanced analytics to aid in running multiple parts of their operations, spanning the entire end-to-end supply chain. Consider an equipment manufacturer mining historical CRM and sales data and using machine-learning algorithms to predict which deals in the pipeline have the highest probability of converting into real demand and which are at risk, requiring intervention. Some CP companies have enabled permission-based auto-replenishment of their products based on signals from internet-connected smart sensors embedded in the products at consumers’ homes. The usage data captured as part of this process is used to generate better demand forecasts based on usage personas and to inform the design of new products entering the pipeline.

On the product side, leaders in various discrete manufacturing industries are using artificial intelligence to analyze digital photographs of their products from source through manufacturing and delivery. They are matching this information up with customer complaint data to spot negative patterns and identify quality problems sooner. A high-tech company is piloting real-time use of big data analytics to tailor test scripts executed based on the most current risk-profile of individual circuit boards. Component-test performance data from suppliers and customer product performance data from the field provide a holistic view of product quality that is factored into which scripts are executed on products as they progress through the testing line.

One process manufacturer is consolidating near-real-time information from customers, internal manufacturing and distribution nodes, suppliers, logistics partners, and complementary third-party sources. It then applies data analytics combined with business rules to generate prescriptive recommendations and support daily decision-making, business optimization, and long-term planning of network capacity and capabilities.

In each case, the value for these companies is in the algorithms that convert disparate data points into operational insights. In most cases, the output is predictive of a future outcome or prescriptive of what the supply chain planner or operator should do about it. In some domains, this capability will be an interim step in a longer journey toward running autonomous supply chain functions.

Read: How Raytheon Uses Data Visualization, Predictive Analytics, and Big Data as a Competitive Advantage

Increasing emphasis on corporate social responsibility. Running socially responsible supply chains aligns with what investors, customers, employees and the general public expect from companies today. Our research shows that mainstream institutional investors are paying greater attention to a company’s nonfinancial performance indicators, including its handling of environmental, social and governance (ESG) factors. Supply chain executives should expect their organizations to become a bigger part of their company’s investor relations story as these stakeholders expand their awareness of ESG issues.

Large corporate supply chains have enormous impact on people and the planet. As Gartner analysts, we’re increasingly hearing from companies about their efforts to increase transparency and performance in running socially responsible supply chains. A very high-profile example of this was Unilever’s recent announcement that it sends zero waste to landfills from its global manufacturing facilities and is well on its way to being an overall zero waste to landfill company. Earlier this year, chipmaker Intel announced that its entire supply chain will be certified as conflict-free to ensure that profits from metals sourced for its chips are not funding human rights atrocities in the Democratic Republic of the Congo (DRC). These are just two of many milestones accomplished by those committed to running ethical, sustainable supply chains.

The companies we see as further along in developing mature corporate social responsibility (CSR) practices have moved beyond mere regulatory compliance and have figured out how to link these efforts back to support for their underlying corporate strategies. That may be part of a brand promise attracting more customers or identifying and mitigating ESG risks that could cost their company dearly. In one stark case highlighting the stakes, it is less than a year since the announcement that Volkswagen knowingly evaded U.S. auto emissions testing standards, but the reputational damage, tallying in the billions, has been done.

Read: Exposing the 116 Million ‘Hidden Workers’ of 50 Global Supply Chain Companies

About the Authors

Stan Aronow and Mike Burkett are research vice presidents, Jim Romano is a senior program manager, and Kimberly Nilles is a research analyst at Gartner Inc. They can be reached at [email protected], [email protected], [email protected] and [email protected].

Related: Time to Get Supply Chain Management to the Board

Article topics

Email Sign Up