Editors’ Picks

Found in Robotics News & Content, with a score of 24.54

…called off its planned merger with special-purpose acquisition company (SPAC) Hennnessy Capital Investment Corp. V earlier this month, investors are still putting billions of dollars into development. Earlier this month, Kodiak Robotics raised $125 million in Series B funding. In September, tire maker Goodyear participated in Gatik's $85 million Series B round, and medium-duty driverless truck developer DeepRoute.ai closed $300 million in Series B funding. Inceptio raised $270 million in its Series B in August. In July, Aurora Innovation announced a $1 billion SPAC merger, and in June, Embark Trucks said it expected to raise $614 million in a SPAC…

Found in Robotics News & Content, with a score of 24.16

…the manufacturer of previously impossible geometries.” Special-purpose acquisition company (SPAC) JAWS Spitfire said it is a “blank-check company incorporated as a Cayman Islands-exempted company.” Its backers include tennis player Serena Williams, who was appointed to its board in December 2020. After the merger, subject to shareholder and regulatory approval and other customary closing conditions, the combined enterprise will have a value of about $1.6 billion at the $10-per-share private investment in public equity (PIPE) and assuming no public shareholders of JAWS Spitfire exercise their redemption rights. VELO3D said it will receive up to $345 million in proceeds from JAWS Spitfire’s…

Found in Robotics News & Content, with a score of 22.54

…announced its intention to merge with special-purpose acquisition company (SPAC) Rotor in April. Rotor's stockholders approved the combination on Sept. 15, and the transaction closed on Sept. 24. Wolff spoke with Robotics 24/7 about why robotics startups are choosing SPAC deals, the target markets for Sarcos' products, and which system will find buyers first. Why did Sarcos choose to go with a SPAC rather than raise capital in another way? Wolff: A company in our shoes has three ways for raising capital. The first is a traditional private round, and we've done Series A, B, and C rounds over the…

Found in Robotics News & Content, with a score of 22.34

…first quarter, including some mergers with special-purpose acquisition companies (SPACs), a recent trand in venture capital. Additive manufacturing contributed to this total. After that was supply chain and logistics, with more than $1.7 billion in reported transactions. This is not surprising, given the surge in e-commerce during the pandemic and ongoing interest in robots for materials handling and delivery. Healthcare companies, mostly providers of surgical robotics, were involved in more than $250 million worth of deals, followed by agricultural robots, with more than $130 million in total transactions. Note that this slideshow of the top 10 robotics transactions is not…

Found in Robotics News & Content, with a score of 22.23

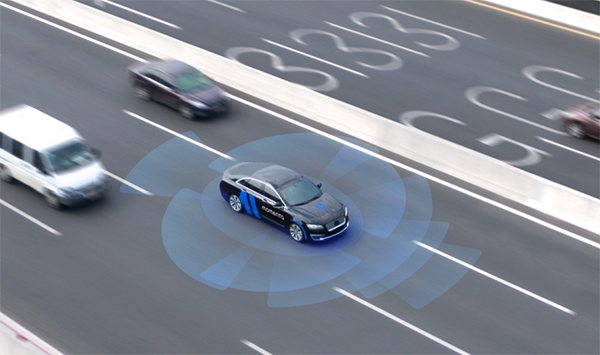

…TuSimple San Diego 1,081 IPO 4/7//2021 Aurora Pittsburgh 1,000 SPAC 7/15/2021 Plus Cupertino, Calif. 920 SPAC, IPO 6/23/2021 WeRide Guangzhou, China 620 Series B, C 6/23/2021 Embark San Francisco 614 SPAC 6/23/2021 Level 5 San Francisco 550 Acquisition 4/26/2021 The global market for autonomous vehicles will experience a compound annual growth rate (CAGR) of 14%, growing from $719.94 billion in 2020 to $1.3 trillion in 2025, according to Research and Markets. Facts and Factors forecast a 22% CAGR for the self-driving car market, from $23 billion in 2020 to $64.88 billion by 2026, showing the wide range of estimates. IMARC…

Found in Robotics News & Content, with a score of 21.88

…merge with SCVX, a special purpose acquisition company or SPAC. Upon completion of the transaction, which is expected to occur in the second half of 2021, the combined company will operate as Bright Machines and be a publicly traded company. “Our industrial automation platform, powered by proprietary software and AI-driven solutions, allows even the most traditional manufacturing companies to quickly and easily deploy flexible automation solutions at scale,” stated Amar Hanspal, co-founder and CEO of Bright Machines. “We believe that our technology represents a big leap in the transformation of manufacturing, as companies adapt to growing consumer demand, intensifying competition,…

Found in Robotics News & Content, with a score of 21.04

…SVF Investment Corp. 3 is a special-purpose acquisition company (SPAC) sponsored by an affiliate of SoftBank Investment Advisors (SBIA), which has invested more than $175 billion in leading technology companies. They include AutoStore, Berkshire Gray, JD Logistics, and Uber. The business combination was approved at a special meeting of SVFC shareholders held on June 3. As a result of the transaction, the combined company received additional growth capital to supplement its existing $363 million of combined cash on the balance sheet as of March 26 and proceeds from a May 20 warrant exercise. “We are thrilled to complete our business…

Found in Robotics News & Content, with a score of 20.84

…15 reported mergers and acquisitions last month, continuing the trend of robotics companies working with special purpose acquisition companies (SPAC). While many companies did not disclose the amounts of their transactions, the following deals reflect the ongoing interest in increasing automation across vertical market segments.

Found in Robotics News & Content, with a score of 19.66

Memic Innovative Surgery Ltd. has entered into a definitive agreement for a business combination with MedTech Acquisition Corp., according to an announcement yesterday by investor Peregrine Ventures. Memic has been developing proprietary surgical robots. “Memic brings to the market a robotic technology that enables robotic surgery with an accuracy not known before at an affordable price,” stated Eyal Lifschitz, co-founder and managing partner of Peregrine Ventures. He is the vice chairman of Memic as well as the chairman of the business committee on Memic's board of directors. Founded in 2013, Memic is based in Tel Aviv, Israel, with a wholly…

Found in Robotics News & Content, with a score of 19.21

…combination with Gores Holdings VI, a special-purpose acquisition company (SPAC). The Sunnyvale, Calif.-based company said that it has received nearly $640 million in gross proceeds and that it will be listed as “MTTR” on Nasdaq starting tomorrow. “Becoming a publicly traded company is a strategic transaction for Matterport that strengthens our position as the market-leading spatial data company for the built world, and propels the global property market into the future,” stated RJ Pittman, CEO and chairman of the board of directors of the combined company. “We’re at the dawn of a new era for what’s possible when buildings become…

Found in Robotics News & Content, with a score of 19.08

…of Reinvent Technology Partners Y. The special-purpose acquisition company (SPAC) is led by Pincus, Michael Thompson, and Reid Hoffman. Investors and Aurora partners have committed $1 billion in a private investment in public equity (PIPE), and the proposed transaction represents an equity value of $11 billion for Aurora. Investors in the PIPE include Baillie Gifford, funds and accounts managed by Counterpoint Global (Morgan Stanley), funds and accounts advised by T. Rowe Price Associates, Inc., PRIMECAP Management Co., Reinvent Capital, XN, Fidelity Management and Research LLC, Canada Pension Plan Investment Board, Index Ventures, and Sequoia Capital. Uber, PACCAR, and Volvo Group…

Found in Robotics News & Content, with a score of 19.03

…of ‘AUV [autonomous underwater vehicle]-native’ tooling design, supervised autonomy, and recent improvements in remote communications.” Nauticus sets course with SPAC deal In December 2021, Nauticus Robotics entered into a definitive business combination agreement with CleanTech Acquisition Corp., a special-purpose acquisition company (SPAC) that would result in Nauticus becoming a public company listed on the Nasdaq Stock Market LLC under the ticker symbol KITT. CleanTech Acquisition Corp. was formed in January 2021 with the purpose of entering into a business combination with one or more businesses. CleanTech Sponsor I LLC and CleanTech Investments LLC, an affiliate of Chardan, are the founders…