Momenta today said it has completed a $500 million (U.S.) Series C+ fundraising round, bringing its total financing to more than $1.2 billion. Investors in the Beijing-based artificial intelligence and autonomous driving technology developer include major automakers and venture capital firms.

“We are honored to have partnered with many leading global automakers and Tier 1 suppliers for strategic investments,” stated Cao Xudong, CEO of Momenta. “This financing marks a milestone for Momenta. The company's autonomous driving products and R&D capabilities have been recognized by customers around the world. The addition of these partners and capital will help us accelerate the implementation of autonomous driving on a larger scale.”

Momenta readies for mass production, rapid scaling

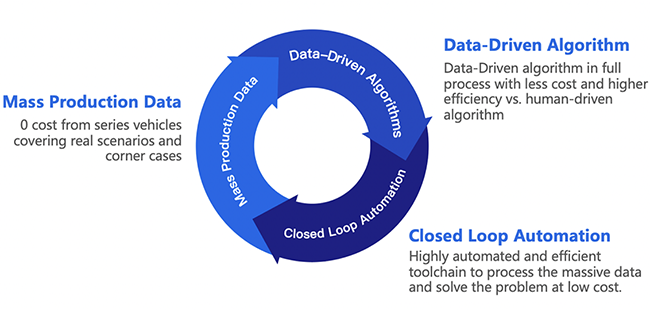

Momenta claimed that it has taken a “unique, scalable path toward full autonomous driving by combining a data-driven approach that quickly iterates algorithms—its 'flywheel' approach.” The company's “two-leg” product strategy includes its Mpilot autonomous parking and in-cabin perception (ICP) system that is designed to be ready for mass production and its Momenta Self-Driving (MSD) system targeting full autonomy.

MSD is intended to replace in-cabin drivers and be widely deployed in taxis and private cars, said Momenta. The company said its “Flywheel Level 4” technical path can effectively and competitively solve the “long-tail” problems of completely autonomous vehicles.

With the continuous accumulation and iteration of mass-production data, data-driven algorithms, and closed-loop automation, Momenta said its flywheel will spin faster and faster, bringing about explosive product and commercial growth. The company asserted that this will enable safer, more convenient, and more efficient smart driving in the future.

Investors and industrial partners

The leading investors in Momenta included Chinese strategic investor SAIC Motor; global strategic investors General Motors, Toyota, and Bosch, as well as Temasek and Yunfeng Capital. Mercedes-Benz, IDG Capital, GGV Capital, Shunwei Capital, Tencent, and Cathay Capital also participated in the $500 million Series C round.

Autonomous vehicle developers and related technology providers have raised more than $26.5 billion in 2021, according to Robotics 24/7. Here are 10 of the biggest totals to date:

| Company | Location | Amount (M$) | Transaction | Date |

|---|---|---|---|---|

| Cruise | San Francisco | 2,750 | Investments | 4/15/2021 |

| Waymo | Mountain View, Calif. | 2,500 | Investments | 6/16/2021 |

| Xpeng | Hong Kong | 2,000 | IPO | 6/24/2021 |

| Momenta | Beijing | 1,200 | Series C, C+ | 11/4/2021 |

| TuSimple | San Diego | 1,081 | IPO | 4/7//2021 |

| Aurora | Pittsburgh | 1,000 | SPAC | 7/15/2021 |

| Plus | Cupertino, Calif. | 920 | SPAC, IPO | 6/23/2021 |

| WeRide | Guangzhou, China | 620 | Series B, C | 6/23/2021 |

| Embark | San Francisco | 614 | SPAC | 6/23/2021 |

| Level 5 | San Francisco | 550 | Acquisition | 4/26/2021 |

The global market for autonomous vehicles will experience a compound annual growth rate (CAGR) of 14%, growing from $719.94 billion in 2020 to $1.3 trillion in 2025, according to Research and Markets. Facts and Factors forecast a 22% CAGR for the self-driving car market, from $23 billion in 2020 to $64.88 billion by 2026, showing the wide range of estimates.

IMARC Group was more bullish, predicting a CAGR of 28% between 2021 and 2026. It attributed this growth to advances in sensors and AI. IDTechEx said that while the U.S. leads in technology development, it lags behind other countries in consistent regulations enabling widespread deployment. Still, by 2030, 20.8 million autonomous vehicles could be operating in the U.S., said Research Reports World.

Momenta has established partnerships with global automakers including SAIC Motor, GM, Toyota, and Mercedes-Benz, as well as NVIDIA and Tier 1 suppliers such as Bosch. The company added that it plans work closely with them to develop and deploy smart driving technology suitable for environments worldwide.

Article topics

Email Sign Up