Apple has never suffered from a lack of advice. As long as I can remember — 33 years in my case — words of wisdom have rained down upon the company, and yet the company stubbornly insists on following its own compass instead of treading a suggested path.

(Actually, that’s not entirely true. A rudderless, mid-nineties Apple yielded to the pressure of pundit opinion and licensed its Mac OS to Power Computing and Motorola… and promptly lost its profits to Mac clones. When Steve Jobs returned in 1997, he immediately canceled the licenses. This “harsh” decision was met with a howl of protest, but it stanched the bleeding and made room for the other life-saving maneuvers that saved the company.)

Now that Jobs is no longer with us and Apple’s growth has slowed, the advice rain is more intense than ever… and the pageviews netwalkers are begging for traffic. Suggestions range from the deranged (Tim Cook needs to buy a blazer), to – having forgotten what happened to netbooks – joining the race to the bottom (Apple needs a low-cost iPhone!), to the catchall “New Categories” such as Wearables, TV, Payment Systems, and on to free-floating hysteria: “For Apple’s sake, DO SOMETHING, ANYTHING!”

The visionary sheep point to the titanic deals that other tech giants can’t seem to resist: Google buys Nest for $3.3B; Facebook acquires WhatsApp for $16B (or $19B, depending on what and how you count). Why doesn’t Apple use its $160B of cash and make a big acquisition that will solidify its position and rekindle growth?

Lately, we’ve been hearing suggestions that Apple ought to buy Tesla. The company is eminently affordable: Even after TSLA’s recent run-up to $30B, the company is well within Apple’s means. (That Wall Street seems to be telling us that Tesla is worth about half of GM and Ford is another story entirely.)

Indeed, Adrian Perica, Apple’s head of acquisitions, met Tesla’s CEO Elon Musk last Spring. Musk, who later confirmed the meeting, called a deal “very unlikely”, but fans of both companies think it’s an ideal match: Tesla is the first Silicon Valley car company, great at design, robotics, and software. Like Apple, Tesla isn’t afraid to break with traditional distribution models. And, to top it off, Musk is a Steve Jobs-grade leader, innovator, and industry contrarian. I can see the headline: “Tesla, the Apple of the auto industry…”

But we can also picture the clash of cultures…to say nothing of egos.

I have vivid recollections of the clash of cultures after Exxon’s acquisition of high-tech companies to form Exxon Office Systems in the 1970s.

Still reeling from the OPEC oil crisis, Exxon’s management was hypnotized by the BCG (Boston Consulting Group) who insisted that “Information Is the Oil of the 21st Century.” The BCG was right, Tech has its Robber Barons: Apple, Oracle, Google, Facebook, Intel, and Microsoft all weigh more than Shell, Exxon, or BP.

But the BCG was also wrong: Exxon’s culture had no ability to understand what made the computer industry tick, and the tech folks thoroughly despised the Exxon people. The deal went nowhere and cost Exxon about $4B – a lot of money more than 30 years ago.

This history lesson isn’t lost on Apple. So: If Apple isn’t “interested” in Tesla, why are they interested in Tesla?

Could it be BATTERIES?

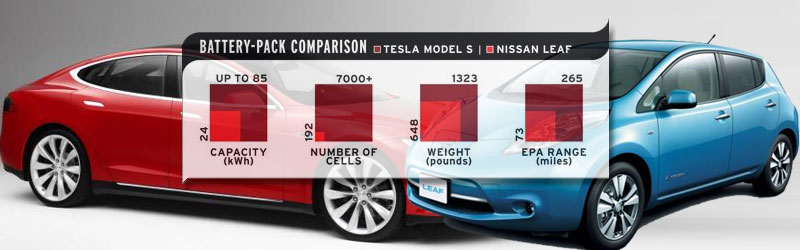

A look at battery numbers for the two companies brings up an interesting parallel. Tesla plans to make 35,000 Tesla S cars this year. According to Car and Driver magazine, the battery weighs 1323 pounds (600 kilograms — we’ll stick to metric weights moving forward):

That’s 21,000 (metric) tons of batteries.

For Apple devices the computation is more complicated — and more speculative — because the company publicizes battery capacity (in watt-hours) rather than weight. But after some digging around, I found the weight information for an iPhone 4S on the iFixit site: 26 grams. From there, I estimated that the weight of the larger iPhone 5S battery is 30 grams.

I reasoned that the weight/capacity ratio is probably the same for all Apple batteries, so if a 26g iPhone battery provides 5.25 watt-hrs, the iPad Air battery that yields 32.4 watt-hrs must weigh approximately 160g. Sparing you the details of the mix of iPad minis and the approximations for the various Macs, we end up with these numbers for 2014 (I’m deliberately omitting the iPod):

100M iPads @ 130g = 13,000 tons

200M iPhones @ 30g = 6,000 tons

20M Macs @ 250g = 5,000 tons

Total Apple batteries = 24,000 metric tons

It’s a rough estimate, but close enough for today’s purpose: Apple and Tesla need about the same tonnage of batteries this year.

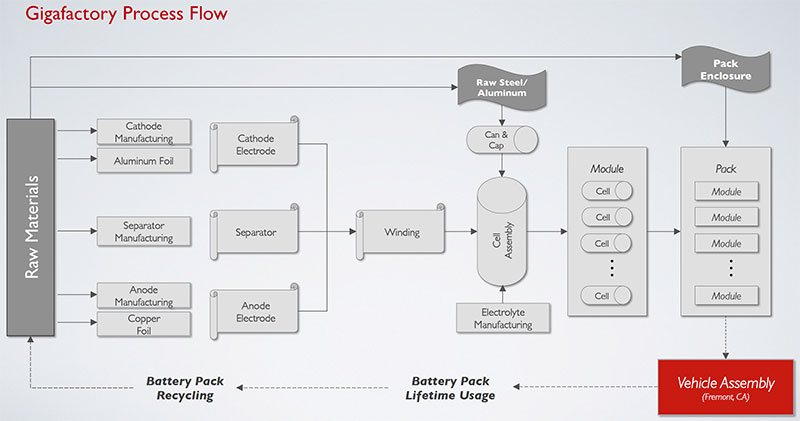

Now consider that Tesla just announced it will build a battery mill it calls the Gigafactory:

According to Tesla, the plant’s capacity in 2020 will be higher than what the entire world produced in 2013.

A more likely explanation for Apple’s conversation with Tesla might be something Apple does all the time: Sit with a potential supplier and discuss payment in advance as a way to secure supply of a critical component.

Of course, neither Tesla nor Apple will comment. Why should they? But a partnership born of their comparable needs for battery volumes makes a lot more sense than for the two companies to become one.

Postscript: Certainly, Apple is no stranger to acquisitions — the company recently disclosed that it purchased 23 small companies in the last 16 months — but the operative word, here, is “small”. Apple has made two large purchases in twenty years: The late-1996 acquisition of NeXT for $429M (and 1.5M Apple shares), and the $356M purchase of Authentec in July 2012. Other other than that, Apple’s acquisitions have focused on talent and technologies rather than sheer size.

This seems wise. In small acquisitions, everyone knows who’s in charge, it’s the acquirer’s way or the highway, and failure rarely makes headlines. Bigger deals always involve explicit or implicit power sharing and, more important, a melding of cultures, of habits of the heart and mind, of “the ways we do things here”.

Latest News: Apple to Pay $3 Billion to Buy Beats

Source: Monday Note

About the Author

Jean-Louis Gassée is currently general partner at the venture capital firm Allegis Capital since 2003. In late 1990, he founded Be, Inc., a multi-media system software company, took it to the Nasdaq in 1999 and sold it to Palm in 2001. Jean-Louis started Apple France in 1981, moved to Cupertino, California in 1985 and became president of the Apple Products Division, covering worldwide product development, manufacturing and product marketing. He has served as a director of publicly traded companies such as Cray Computer Corporation, 3Com and Logitech. He currently sits on the Board of Directors’ of Electronics for Imaging and was until late 2005 Chairman of PalmSource. He is a Mathematics and Physics graduate of Paris (Orsay). He lives in Palo Alto, California.

The Apple Tesla Connection

Article topics

Email Sign Up