As Tesla reaches for its goal of producing a mass market electric car in approximately three years, they have an opportunity to leverage their projected demand for lithium ion batteries to reduce their cost faster than previously thought possible.

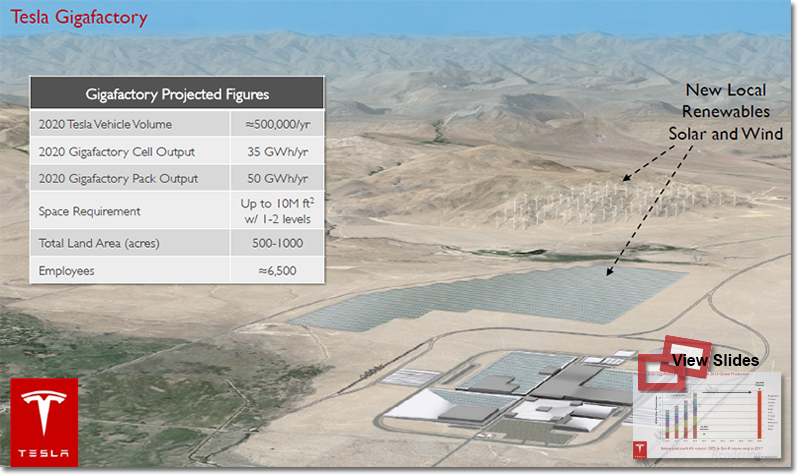

In cooperation with strategic battery manufacturing partners, Tesla is planning to build a large scale factory that will allow them to achieve economies of scale and minimize costs through innovative manufacturing, reduction of logistics waste, optimization of co-located processes and reduced overhead.

The Tesla Gigafactory is designed to reduce cell costs much faster than the status quo and, by 2020, produce more lithium ion batteries annually than were produced worldwide in 2013. By the end of the first year of volume production of their mass market vehicle, Tesla expects the Gigafactory will drive down the per kWh cost of their battery pack by more than 30 percent.

Tesla CEO Elon Musk provided some more details on the company’s proposed battery factory:

- The company just announced a $1.6 billion convertible debt offering. Tesla looks to offer $800 million of convertible senior notes due in 2019 and $800 million due in 2021 to build the world’s largest battery factory.

- Musk predicts that the new factory will produce batteries for 500,000 vehicles by 2020.

- Tesla expects to send the kilowatt-hour price of batteries down by 30 percent.

- The plan is for construction to start in 2014, with production beginning in 2017.

- The facility will hold more than 6,000 workers in 10 million square feet of factory space.

Related: Elon Musk Made $1.1 Billion 2/26/2014

In an earlier statement Tesla Motors announced strong fourth-quarter results with record shipments and gross margin. Its investor newsletter also included a tantalizing paragraph:

Very shortly, we will be ready to share more information about the Tesla Giga factory. This will allow us to achieve a major reduction in the cost of our battery packs and accelerate the pace of battery innovation. Working in partnership with our suppliers, we plan to integrate precursor material, cell, module and pack production into one facility. With this facility, we feel highly confident of being able to create a compelling and affordable electric car in approximately three years. This will also allow us to address the solar power industry’s need for a massive volume of stationary battery packs.

During last week’s earnings call, Tesla CEO Musk said to stay tuned for the Giga factory announcement this week.

Musk also said that Panasonic, currently supplying hundreds of millions of cells to Tesla, would likely join in on the new factory. Samsung has been mentioned as a potential partner. I’ll throw in Apple as a potential partner; computers and tablets need lithium-ion batteries (albeit in different form factors), and there’s been talk of recent Apple-Tesla meetings.

The Tesla CEO envisions “a plant that is heavily powered by renewables, wind and solar, and that has built into it the recycling capability for old battery packs.”

“It is going to be a really giant facility. [...] We are doing that something that’s comparable to all lithium-ion production in the world in one factory,” said Musk in a previous earnings call.

Investment bank Barclays writes, “For the time being, our model does not reflect the additional cost of building out a giga factory, or the significant potential revenue that Tesla could generate from non-automotive sources such as grid storage. Optionality could provide upside for the stock, as investors consider the potential upside to revenue from non-automotive sources.”

“We believe the days when Tesla was known as purely an auto company are numbered,” wrote Morgan Stanley analyst Adam Jonas in a January research note, adding, “We are witnessing the most disruptive intersection of manufacturing, innovation and capital experienced by the auto industry in more than a century.” Jonas also opined that “Tesla may be in a position to disrupt industries well beyond the realm of traditional auto manufacturing. It’s not just cars.”

Global Equities Research analyst Trip Chowdhry said New Mexico would be an “ideal” location for the $2 billion factory according to reports in the Albuquerque Journal. He told the Journal that he believes Tesla will announce plans to build the facility in New Mexico in the next “six to eight months.” According to the Journal, “The analyst said the factory would be capable of generating 30 gigawatts of production capacity a year, which would make it the largest such facility in the world. It may also manufacture a hybrid battery pack that could increase the driving range on Model S cars by 10 percent to 15 percent.”

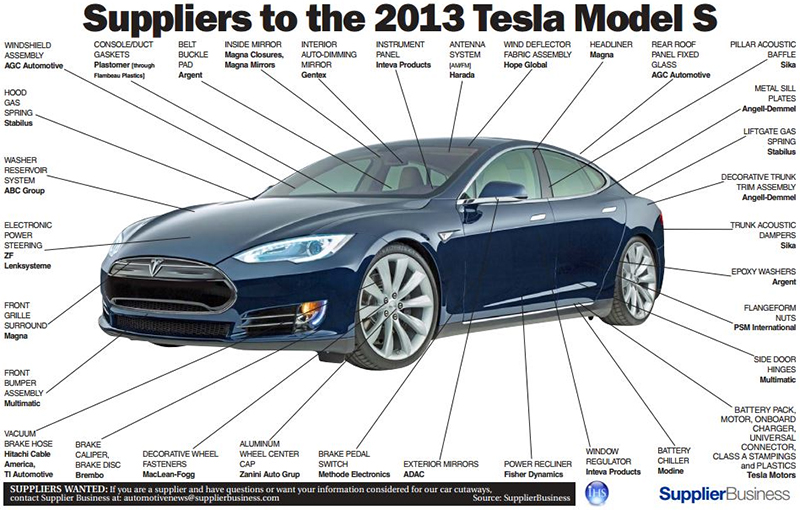

An energy investor contact emphasized that the battery pack is the strategic component to Tesla’s vehicle, and just as Apple often does for critical technology, Tesla is vertically integrating—or possibly taking an Apple/Foxconn funded manufacturing partnership approach. “Musk has the ability to mark up the price of his high-end finished vehicle, whereas most battery manufacturers/developers are stuck in an incredibly competitive market, requiring massive scale, with little pricing power and visibility to end consumers,” the contact said.

Chet Lyons, principal at Energy Strategies Group (and author of our grid-scale energy report), writes, “This audacious move by Tesla and Panasonic will be the subject of heated crisis discussions in board rooms around the world. Collective reaction to it will lead to global retooling of supply chains and manufacturing and distribution strategies…and result in disruptively lower cost structures for both the EV and grid-scale energy storage industries. This development sounds a death knell for some companies…and signals a new frontier opportunity for many others. In short, I see this as a total game-changer.”

Haresh Kamath, energy storage expert at EPRI, notes, “Everyone knows that the big cost that makes EVs more expensive than conventional ICE cars is the cost of the battery, although there’s some cost difference in other components too. The question is, how do you make the battery as cost-effective as possible?” He adds, “Most auto OEMs take the strategy of reducing battery cost by maximizing value. They make the battery as small as possible and try to make sure it’s highly utilized, so the battery is discharged as much as possible on each drive. And then they try to maximize the value some more by using the battery for the grid, say through V2G or post-vehicle second-use. The extreme example is Toyota, which puts this tiny battery in the plug-in Prius that only gets around 11 miles electric range, but it’s relatively low cost and most people use 100 percent of it on every drive.”

Kamath continues: “Tesla takes the diametrically opposite approach. Tesla has a gigantic 85 kilowatt-hour battery pack. That’s part of its design philosophy: Tesla wants high power and long range in the car, but it’s expensive. But now, since they’re producing so many kilowatt-hours for each car, Tesla has the opportunities to reduce cost through sheer scale. The firm can make a giant plant producing as many kilowatt-hours as possible and amortize the cost of the plant over the kilowatt-hours produced, to try to reduce the fixed cost per kilowatt-hour. Instead of second use, they produce more battery and put it directly into stationary use right now. The whole idea is to get production volume as big as possible as soon as possible so that cost falls through economy of scale.”

This isn’t a new strategy for Tesla. The company has been using commodity 18650 battery cells all along, and those cells are manufactured at a scale like nothing else in the battery world. The difference now is that Tesla wants to use a unique technology, and to make its $/kWh cost numbers, the company needs to try to achieve production scale immediately, which means investing in giant capacity.

Kamath adds, “Tesla isn’t completely alone in this strategy. This was the basis of Nissan’s approach too, and we’ll see if its huge new factory in Tennessee pans out. But this strategy is risky. If the market doesn’t materialize, you’re stuck with this huge factory on your hands. Several other companies tried this just a couple of years ago, with government money no less, based on some pretty aggressive ideas on how quickly the market would materialize. But maybe it’s different with Tesla. This is a company that’s used to making its own market, and it’s been very successful with that.”

SolarCity Plus Tesla Batteries

The Q4 investor newsletter mentions the “solar power industry’s need for a massive volume of stationary battery packs,” and presents one of the wild cards of this Giga factory scenario. In addition to vertically integrating its automotive business from the ground up, Tesla has the potential to disrupt the storage and solar industries as well.

Tesla’s cousin company SolarCity has already started deploying Tesla-battery-pack-based energy storage systems combined with solar in both residential and commercial applications. Tesla’s lower-cost batteries could help energy storage pencil out better than it currently does. Combine the improved economics of lithium-ion energy storage with the SolarCity sales and leasing machine—and these emerging storage markets could grow big and fast.

Some Q4 Tesla Financials

Tesla had Q3 revenues of $615 million at a 25.2 percent gross margin. The firm sold a record 6,892 Model S vehicles during the period—expecting to ship 35,000 Model S units in 2014, representing more than 55 percent growth over 2013. Production is expected to increase from the current level of 600 cars per week to about 1,000 cars per week by the end of the year. First-quarter production is expected to be about 7,400 vehicles. Battery cell supply will continue to constrain production in the first half of the year, but will improve significantly in the second half of 2014.

Source: Greentech Media

Related: Tesla’s Revolutionary Supply Chain

Download the White Paper: Moving Beyond Supply Chain Visibility to Multi-Enterprise Orchestration: Virtual Vertical Integration & Supplier Collaboration Combined

The Apple Tesla Connection

Article topics

Email Sign Up