If you ask a supply chain leader how they impact their company’s performance, the response is almost muscle memory, ‘reduce cost and inventory while improving service.’

If you ask the same leader how they impact shareholder value, there is often a long pause.

To shed some light on the subject, the APICS Supply Chain Council conducted a live poll during its jointly hosted Best of the Best S&OP Conference in June.

Two poll questions were developed to examine attendee perception regarding shareholder value.

Almost two-thirds of the respondents reported that they had some form of supply chain scorecard. Conversely, only three-percent reported that they linked supply chain performance to shareholder metrics.

This dialogue with supply chain leaders has sparked a number of research questions, especially in light of the fact that supply chain executives share a seat in the C-suite, including:

- What are the key shareholder metrics that matter?

- What are the supply chain performance levers that intentionally add to shareholder value?

- How does that affect your supply chain strategy?

We examine these questions below to obtain meaningful insights about what the answers mean for today’s supply chain leader.

What are the key shareholder metrics that matter?

For a publicly traded company the ultimate measure is earnings per share or stock price. For privately held companies, the focus tends to be on the attributes that relate to earnings per share: growth, profit, and return.

Growth tends to focus on revenue or net revenue year over year. Profit can be represented by gross margin, operating income before tax, or net operating income after tax. Return can be represented by return on invested capital, return on assets, or return on working capital.

What are the supply chain performance levers that intentionally add to shareholder value?

The Growth attribute is the conundrum that keeps supply chain leaders up at night.

Traditionally, the assumption was that great service level, including both lead-time and reliability, didn’t lose sales and potentially helped grow share of customer’s ‘shelf space’ by having predictable availability.

Now, agility has been added to the list, requiring supply chain leaders to support increasing rates of new product introductions, respond to unplanned demand and supply events, and mitigate increasing risk.

The Profit attribute is the most familiar to today’s supply chain leaders. The list is robust and generally end-to-end and includes total landed price of materials, components, and services; volume independent cost reductions in manufacturing through productivity improvements; network optimization efforts aligning warehouse, transportation, and logistics costs; and overall awareness of the reverse logistics flow and costs.

The Return attribute represents perhaps the greatest opportunity because supply chain leaders are critically involved in investments in both fixed assets and working capital. For example, the growth factor of supply chain agility has added to the physical network debate of make-to-order carrying little inventory at a higher potential unit cost and/or make-to-stock carrying more finished inventory at a lower potential unit cost.

How does this affect your supply chain strategy?

The correlation between supply chain excellence and earnings per share certainly is intuitive, but there is data to suggest that even the best supply chain companies still are not maximizing potential shareholder value.

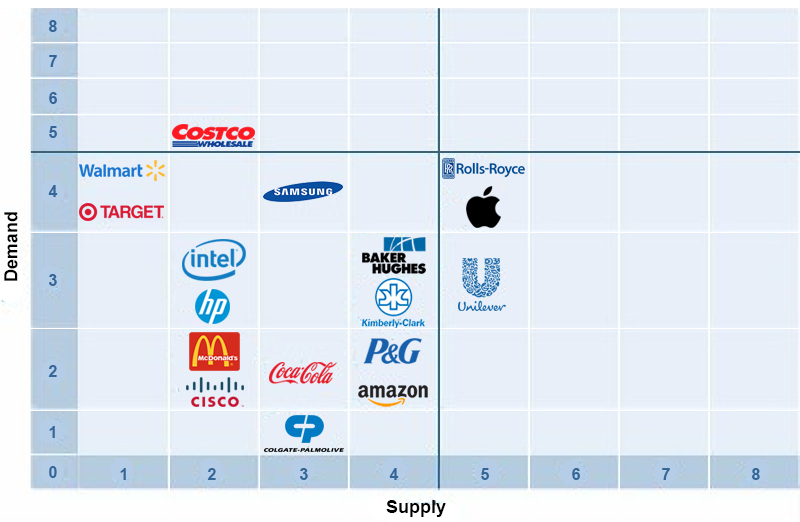

As part of a benchmark study focusing on shareholder value, APICS SCC compared 17 companies identified as “supply chain excellent” by third parties, i.e. Gartner Supply ChainTop 25, Supply Chain Digest top Retail Supply Chains, and firms recognized to be Best-in-Class in S&OP.

The Demand score was calculated by counting the number of instances where annual Return on Invested Capital and Revenue Growth improved over a 4-year period. The Supply score was calculated by counting the number of instances where Gross Margin and Inventory Turns improved over a 4-year period.

A perfect score for each axis is an 8, where a company improved the corresponding pair of metrics each of four years. A score of a 5 indicates that there was only one year where the pair improved.

None of the seventeen scored greater than a 5 in both demand and supply.

Conclusion

There are two facts of life we can make from the data obtained. We don’t know what we don’t know and data speaks.

Based on this, we’ve begun assembling some insights:

- The C-Suite spends most of its time discussing strategic decisions and the effect on shareholder value

- Supply chain executives must be bilingual speaking both supply chain and shareholder

- A stronger correlation between supply chain maturity, performance, and shareholder indices is needed

- The evolving research question centers on how to get into the magic quadrant

- Properly forecasted growth, planned new product introductions, appropriate capacity, and aligned operational and inventory strategies seem to be center stage

- We know that analysts use other factors to evaluate investment value

- We are investigating other pairs of metrics such as Return on Assets to Revenue Growth; Cost of Goods to Inventory Turns

One of the most frequently asked questions by newly appointed supply chain executives is about how to effectively relate to the C-suite. Supply chain executives must learn to “speak shareholder language.”

They can master this language by translating supply chain scorecard metrics into key shareholder indices and correlating process effectiveness to the scorecard measures.

This isn’t an easy language to learn. However, the supply chain leaders who become fluent will be able to understand bigger picture implications of supply chain processes and ensure organizational success.

About the Author

Peter A. Bolstorff is the executive director of the APICS Supply Chain Council. In this role, Bolstorff oversees supply chain research, frameworks, improvement methodologies, training, benchmarking tools, and conferences that help companies make sustainable improvements in supply chain performance. He and his team also spearhead supply chain workforce development strategies including a number of programs that benefit students, faculty and academic institutions.

Related: Seven Core Competencies Identified As Essential For Supply Chain Leadership

Article topics

Email Sign Up