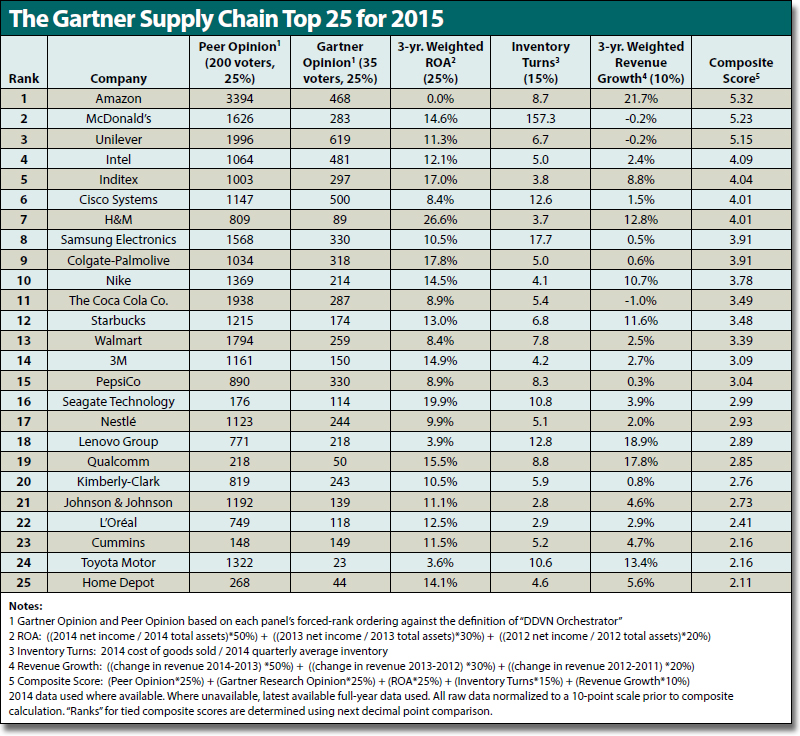

In May of this year, Gartner published its 11th annual Supply Chain Top 25, a ranking of the world’s leading supply chains.

As always, a primary goal of the Top 25 is to foster the celebration and sharing of best practices as a way to raise the bar of performance for everyone.

Another objective of the Supply Chain Top 25 is to shine a light on the importance of the function and profession - within our community certainly, but also for corporate executives outside of supply chain and the investment community at large.

The ranking is focused on identifying supply chain leadership, which includes operational and innovation excellence, but also other behaviors such as corporate social responsibility and a desire to improve the broader practice of supply chain management.

While the list changes from year to year, there are some common characteristics that separate the best from the rest.

What is the Definition of Excellence?

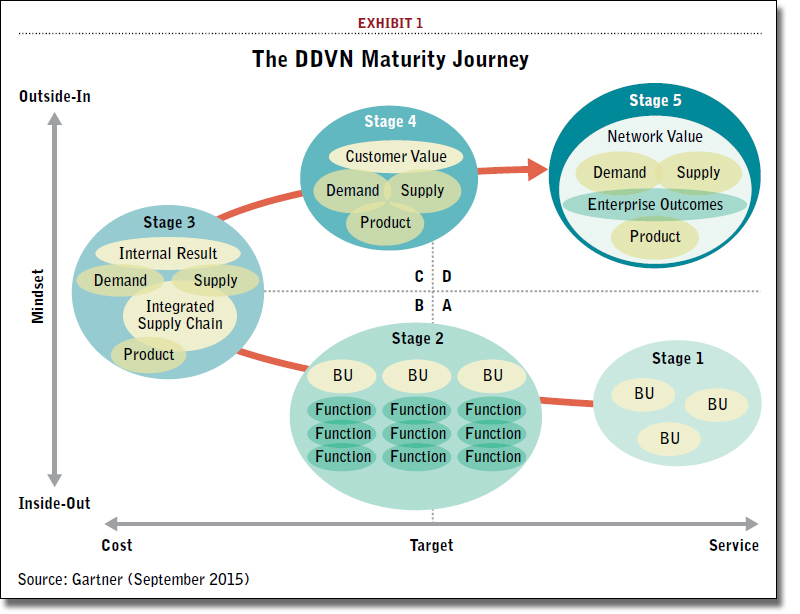

Gartner defines excellence as demonstrating leadership toward a demand-driven ideal. Our Demand Driven Value Network (DDVN) model has seven dimensions with interrelated areas of capability in supply, demand, and product lifecycle management, all enabled by robust strategy and governance.

The maturity model follows five stages of progressive maturity along each dimension and tracks corporate supply chains through a journey from reactively operating in silos to eventually orchestrating for value across both internal and partner networks.

Leading companies have achieved a much higher degree of visibility, coordination, and reliable processes both within and across the plan, source, make, deliver, and return functions - but also in partnership with sales and marketing and product management organizations in lines of business.

Their supply chains are designed starting with what brings value to customers and then back through the supply network. The ability to sense, translate, and shape demand, and pair up appropriate supply is also improved and both demand and supply are determined in close collaboration with customers and upstream suppliers.

Our methodology is outlined in it’s entirety on our “Supply Chain Top 25 for 2015” Web site, but at a summary level it operates as follows. Each year, approximately 300 companies are chosen to be evaluated. Companies do not apply to be included; rather, we select the companies from publicly available lists using a defined set of criteria, including size and industry sector.

Each company gets a composite score, and these scores are force-ranked to come up with the final list. The composite score is made up of a combination of publicly available financials, as well an opinion component, providing a balance between objective and subjective perspectives. In completing their ballots, voters are asked to identify those companies that they believe are furthest along the journey toward the demand-

driven ideal, as defined in Gartner research and on the voting Website.

The Masters

This year we are introducing supply chain masters, a new category to highlight the accomplishments and capabilities of long-term leaders. At the same time, we want to create room for growth and visibility of even more newcomers.

We are, therefore, recognizing those companies that have consistently had top five composite scores for at least seven of the last 10 years and placing them in a separate category from the overall Supply Chain Top 25 list. In this inaugural year for supply chain masters, we want to recognize two companies demonstrating sustained leadership: Apple and P&G.

Apple dominated the top slots of our ranking since its first appearance at No.2 in 2007. This was based on both its stellar financial performance and the high opinion of the supply chain peer and analyst community. Skeptics point to the fact that for the most part, Apple’s products are mainly “designed in California assembled in China,” but the reality is that it takes skill and, in some cases, sheer will to orchestrate the design, development, and high-volume launch of highly integrated products across a network of hardware, software, manufacturing, and logistics suppliers.

This high tech leader demonstrates the spirit of the Supply Chain Top 25 through the integration of innovation and operations excellence.

P&G, a perennial supply chain and product leader, has appeared on the top five of our ranking for nine out of the last 10 years. The consumer products giant has a long-standing history of innovative supply chain practices, starting with the Efficient Consumer Response (ECR) capability it built with Walmart in the early 1990s. That effort evolved into modern day collaborative planning forecasting and replenishment (CPFR) capability.

Today’s P&G is redefining customer-centricity in how it measures service by adopting differentiated performance metrics representative of the top customers in the channels it serves. The company has also blended its supply chain and product R&D organizations for a seamless approach to new product development and launch (NPDL).

We’re excited to introduce this new masters category to the ranking, and will revisit it each year as companies enter and exit.

The Top 5

Amazon claims the No.1 spot on the ranking this year and makes its fifth appearance in the top five. The e-commerce giant has demonstrated its ability to successfully launch new supply chain services, such as same-day delivery, now available in 54 U.S. metro areas. In another out-of-the-box move, Amazon ran pilots with automakers Audi and Volvo to deliver packages directly to the trunks of customers’ automobiles.

Last year, Amazon released a series of instant ordering devices under the brand Amazon Dash, which enable consumers to push a button on a small, product-branded fob when they need to reorder common household items like laundry detergent, instant coffee cups, and diapers. Where will Amazon go next? Its competitors will be watching closely.

McDonald’s, No.2 on the ranking, is facing significant headwinds this year - new competition from specialty restaurants, innovative products from existing players, changing consumer tastes, and a tightening labor market with increasing wages. Internally, it has had challenges managing a menu that has grown more diverse over the last few years.

With a new CEO at the helm, it is focused on returning the restaurant giant to growth. Supply chain, in partnership with outsource partners, is positioned to help the company make data-driven decisions. Supply chain operations have deepened involvement in the product life cycle to drive profitability and can help the business strike the delicate balance between reigniting growth and stoking complexity that detracts from profitability.

CP leader Unilever is No.3 on the list. As part of the broader Sustainable Living Plan it launched in 2010 to double revenue and halve its environmental impact by 2020, the company announced earlier this year that it had achieved its goal of sending zero waste from all factories to the landfill, a year ahead of schedule.

A big part of the company’s success comes from its partnership with suppliers and it is now forging multi-company relationships between suppliers to foster deeper collaborative innovation on ingredient design and manufacturing processes. Unilever is also rolling out regional centers of excellence (COEs) for customer service and logistics.

With collaboration in its corporate DNA, Unilever’s supply chain team has also embraced a broader role in spreading best practices across the entire community.

Intel, at No.4, is another company whose supply chain has risen quickly up our ranks over the years. Its supply chain vision includes delivering on five key vectors that drive Intel’s competitive advantage in the

marketplace: technology leadership, manufacturing scale, agility, responsiveness, and social responsibility.

Intel’s supply chain has taken on an expanded partnership role as an enabler of growth in new product markets. In recent times, that has meant media tablets and solutions that leverage the “Internet of Things” (IoT). In 2014, Intel went from selling almost no media tablet chips to over 40 million of them. Beyond the ability to successfully supply and ramp new products, this is a story about building a new ecosystem of hardware and software suppliers and contract manufacturers to work with in China.

At No.5 this year is Spanish clothing retailer Inditex. It is the owner of eight brands, including flagship Zara, which continues to grow through new store openings and expanded e-commerce offerings in all existing and new markets. Inditex is rolling out a reusable item-level RFID tracking system for all garments sold in its Zara stores.

This system allows for more efficient inventory counts; quick, precision stock replenishment; enhanced security control; and, ultimately, better service for customers looking for specific products within physical stores and online. Its supply chain continues to prioritize social responsibility and was recently recognized by the Dutch Association of Investors for Sustainable Development.

Movers and Shakers: No.6 to No.15

Leading off this group is Cisco at No.6. The networking leader is well down the path of selling integrated solutions and supply chain’s role in ensuring integrated hardware and software quality has evolved in line with this shift. Cisco’s supply chain has also invested in improving customer intimacy. Each director and above is a customer champion aligned with specific end customers and sales teams. Cisco is using IoT as it has branded it, to both improve its supply chain operations and support the company in bringing these solutions to market.

Swedish retail chain H&M moved up to No.7 on the ranking. It continues to grow and, in 2014, established brick-and-mortar stores in nine new markets, including China. H&M’s supply chain is strong at managing the product life cycle with designers and suppliers. Its next challenge will be reinventing the ability to capture demand and fulfill across all channels, given its recent expansion into e-commerce. H&M has received multiple awards for sustainability and social responsibility. The company was recognized as the 2015 World’s Most Ethical Company by the Ethisphere Institute, a global leader in defining and advancing the standards of ethical business practices.

Samsung Electronics was ranked No.8 this year. This perennial leader is well respected in the peer community and continues to post strong inventory turns at 17.7, complemented by a three-year weighted-average ROA above 10 percent. Operational excellence at Samsung Electronics centers on two key factors driving flexibility and profitability. The first is visibility in end-to-end supply chain, which it defines as R&D, procurement, manufacturing, logistics, marketing, sales, and service. The second is the capability of its people, organization, process, and IT infrastructure.

Colgate-Palmolive maintained its No.9 rank. Its supply chain team is testing the use and integration of leading-edge systems, utilizing the latest in-memory computing technology. This will allow it to gain end-to-end visibility and to take real-time actions in the planning and execution horizons. Colgate continues to fund the company’s growth through close management of all investments in capital and capabilities. This growth has tapered due to slowing emerging markets and a strong dollar, but Colgate-Palmolive’s three-year weighted average ROA continues to be a bright spot at 17.8 percent.

Perennial footwear and apparel leader, Nike, is ranked No.10. Nike’s supply chain has strong foundational capabilities in product life cycle and supply network management and is expanding the use of Lean techniques from the manufacturing environment to other supply chain functions. On the innovation front, it has unveiled products using a new ColorDry technology that dyes fabric with recycled CO2 and zero water versus traditional water-intensive dyeing methods. This technology also saves energy and eliminates the need for added chemicals in the fabric dyeing process.

Coca Cola Co.’s supply chain (No.11) is focused on a handful of key objectives this year. In the upstream supply network, it is about quality at the source, with leading metrics and process controls that support its safety culture. Within its manufacturing and distribution environments, it is automating to increase productivity faster than the top line. Customer-facing initiatives are aimed at improving on-time and in-full rates through improved forecast collaboration, value-based product and packaging portfolio management, and tailoring customer service models.

Starbucks (No.12), the world’s largest coffee retailer, runs a broad-spanning supply chain that includes new product development, customer service, and strategy. Talent development is a core focus within the organization, as reflected by its training and rotational programs. Starbucks is still the only retailer to offer no-strings-attached reimbursement for employees pursuing an online undergraduate degree. Sustainability is another priority for Starbucks, as evidenced by its recent verification that 99 percent of the coffee it buys is ethically sourced.

Supply chain pioneer Walmart (No.13) has continued its push into e-commerce and has expanded investment in multichannel drive-thru pick-up centers and a “click-and-collect” grocery service offered at some of its stores. Walmart is also leveraging its expertise in supply network design and optimization in a drive to recapture the low-cost crown from its competition. The company is running multiple social responsibility programs focused on increasing sustainability at suppliers and in its own network, support for women-owned businesses, and the broader communities it serves.

Senior supply chain leadership at diverse industrial 3M (No.14) recognizes that complexity limits the long-term growth potential of the company and is on a mission to optimize operations through Lean extended value streams. The engineering savvy company actively engages with customers to develop innovative solutions to its problems and works closely with key suppliers early in the ideation process for new products with a focus on joint cost reduction and accelerated cycle times.

Another perennial leader, PepsiCo landed at No.15 this year. Its new demand signal repository tools are driving significant results based on the ability to do real-time promotion display management at the SKU level. PepsiCo’s supply chain is also making significant automation investments in manufacturing and its distribution centers. The PepsiCo team has continued its focus on social responsibility and sustainability, with programs aimed at environmental quality, ethical sourcing, and community improvement, including its innovative PepsiCorp program.

Rounding Out the List: No.16 to No.25

The supply chain team at storage company Seagate Technology (No.16) has developed a global network of customer value centers to provide more efficient fulfillment and deliver customer-specific solutions. Seagate Technology has spent the last few years developing a cross-functional supply chain transformation office focused on landing new capabilities, developing talent, and rolling out metrics for improved visibility.

Nestlé (No.17) runs one of the largest and most complex consumer foods supply chains in the world and was recognized by community-based organization, Oxfam, as a top-ranked company for responsible sourcing. Nestlé’s supply chain culture centers on decentralized, locally-empowered teams. Major focus areas for these teams are driving capital efficiency, enabling e-commerce businesses as a growth driver, and upstream product traceability to ensure consumer trust.

Chinese technology company Lenovo’s supply chain strategy (No.18) cascades from its continuing corporate strategy to protect PC-based businesses and attack mobile, enterprise, computing ecosystem, and cloud services businesses. The supply chain team continues to drive new capabilities such as inventory and order support visibility, while ensuring the smooth integration of large mobile and enterprise computing businesses.

Chipmaker Qualcomm (No.19) is leveraging investments in supply capacity optimization and inventory management as competition intensifies in the wireless telecommunications component market. The company continues to invest in new applications for its products including use of smartphone technologies for new consumer robotics applications such as the use of GPS and machine vision to guide delivery drones. The chipmaker is also making a push into the connected car market.

Kimberly-Clark (No.20) continues on a multiyear journey to improve its supply chain organization and capabilities. It is extending Lean expertise out in partnership with customers to improve collaborative processes for joint value. The supply chain, in partnership with the business, has established a standard product portfolio governance process aimed at improving overall SKU health. This work, along with effective demand shaping capability, has enabled a relatively high forecast accuracy for the company.

Healthcare leader Johnson & Johnson (No.21) has a legacy of decentralized decision making, but its supply chain has become more center-led over the years as a Center Of Excellence (COE) formed to drive cross-business unit improvements. One of these programs is focused on complexity management and data-driven governance of the company’s diverse product portfolios. The COE team is also working to better understand the voice of the customer in the pharmaceutical business.

L’Oréal lands at No.22 after a long hiatus from our list. Its supply chain team has a dedicated effort in partnership with the business to improve demand forecast accuracy. The cosmetics and beauty products company is leveraging optimization techniques in supply planning to improve customer service levels, while holding less inventory. L’Oréal is also using a collaborative supplier platform with its top strategic upstream partners to feed them weekly demand forecasts and pull through consumption requirements.

Engine and power equipment leader Cummins (No.23) has a strong COE organization. This team has partnered with operations to evolve to end-to-end differentiated SCM and, eventually, the orchestration of the extended supply chain through collaborative governance. Cummins’ analytics team is starting to move beyond basic descriptive reporting of operational performance to more predictive applications such as network, inventory, transportation, and warehouse optimization modeling.

Toyota rejoins the list at No.24 after last appearing in 2009. Its eponymous production system as well as its pioneered leveraging of Lean principles has been emulated by the rest of industry and beyond. Its supply chain team is focused on building logistics control towers and mitigation plans to avoid the supply disruptions of the recent past. Toyota is also building a next-generation customer service platform where vehicle owners, dealers, and service agents can exchange information via the cloud.

Closing out this year’s list at No.25 is Home Depot, the world’s largest hardware retailer. Home Depot’s supply chain team is reaping the rewards of a multiyear improvement journey. It is introducing direct fulfillment centers that will be able to ship to 90 percent of U.S. households within 48 hours. E-commerce, while a small portion of its total business, spans a wide variety of products and one-third of the volume is “click and collect” at its brick-and-mortar stores. Upstream, Home Depot has set up a vendor source program tapping into vendor-managed inventory (VMI) stocks.

The Bar Has Risen

In our engagement with supply chain leaders over the past year, it is evident that the bar of performance has risen considerably for the top of the group.

As Gartner’s supply chain research organization, we remain committed to providing a platform for informed and provocative debate about supply chain leadership.

We look forward to leveraging this research to share the lessons, best practices, and characteristics of leaders to inspire and challenge the entire supply chain community to new levels of performance and contribution.

Related: 2015 Gartner Supply Chain Top 25: 3 Key Trends

Article topics

Email Sign Up