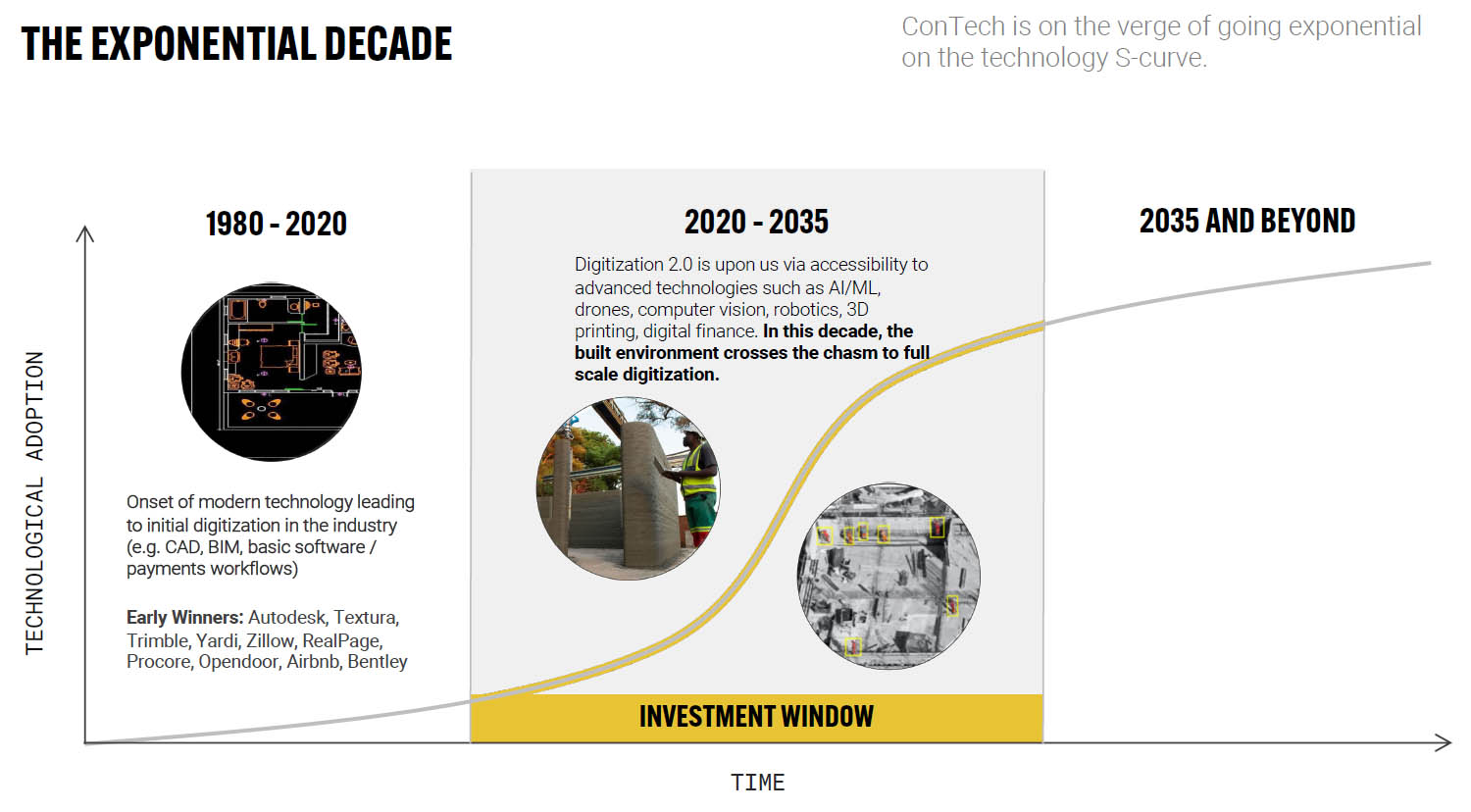

The U.S. construction industry faces challenges including labor shortages, environmental concerns, and capital constraints on the acquisition of new equipment. Technologies such as 3D printing, robotics, and machine learning could help improve planning, productivity, and safety, according to a new report from Shadow Ventures.

The Atlanta-based venture capital firm, which invests in “seed-stage technology companies disrupting the built environment,” last month released its “ConTech Scouting Report.” It described industry trends and listed 125 companies that could define eight construction technology, or ConTech, categories over the next decade.

The report, which is based on analyst-verified data from Shadow Insights, found that investment into ConTech has not kept up the construction industry's contribution to gross domestic product. Shadow Ventures also said that the sector's productivity “has decreased to levels unseen since 1968.”

The company cited robotics providers including Dusty Robotics, Path Robotics, and Rugged Robotics, as well as 3D printing providers such as Diamond Age, Apis COR, and ICON Technology.

.jpeg)

Maanav Mahindru, an operational product leader at Shadow Ventures, responded to the following questions from Robotics 24/7:

For the robotics and 3D printing categories, how many companies did you look at?

Mahindru: We started broadly with over 1,000 companies, and many checked boxes to fall into multiple categories. Our team identified where we believe those companies have the most presence or opportunity and put them in that space.

Ultimately, we narrowed the list of robotics firms from 84 to nine and 3D printing companies from 21 to five. For 3D printing, the initial list was broader, but after review, many got classified into building products.

With companies such as FastBrick, HP, Alquist, and SQ4D also entering this space, how competitive are these segments, or is it still too soon to tell?

Mahindru: It’s still early to tell who comes out as the clear leaders, but we know that both sectors require lots of capital, and companies like Alquist and SQ4D will most likely have to raise a lot of money over the next few years to scale. Well-capitalized companies will have better opportunities in these sectors over the next few years.

It’s still too early to tell who leads the competition. However, lots of opportunity exists here in North America and globally. We will see some prominent leaders, but there are still lots of pieces of the pie.

Shadow Ventures looks at adjacent areas, focuses on fundamentals

How much overlap is there between construction and markets such as infrastructure and utilities?

Mahindru: You can’t think about construction without considering infrastructure and utilities; they go hand in hand.

We’ve worked with clients undertaking significant developments to better understand the impacts on the local infrastructure. Or, they need to know the benefits of deploying microgrids due to the existing strains on utilities and potential delays when relying on utility providers to make necessary improvements.

How do macroeconomic headwinds such as rising interest rates affect the availability of capital?

Mahindru: Rising interest rates and economic uncertainty certainly will impact the available capital and how quickly institutional investors deploy capital.

We do see a lot of institutional investors sitting on dry powder; meaning that investments will still be made but not as easily as they have been over the past few years. The diligence process for startups and companies will be more intense, and investors will focus on the fundamentals.

Data and 3D printing show promise, require patience

What are some of the technical challenges that investors are still looking for construction startups to solve?

Mahindru: Many investors have formed a different thesis on the most considerable challenges still looking to be solved.

The industry is generally still highly fragmented, and startups focused on creating deep integrations that drive data-driven decisions for organizations have a lot of potential.

Given the lack of affordable housing in many cities, how can investors and the construction industry work with government on this problem?

Mahindru: Building affordable housing is challenging due to the complex code and zoning requirements that vary from municipality to municipality.

We see significant adoption of 3D printing technologies and the deployment of pre-fab or robotics overseas where it is easier to work with governments on zoning and building policies.

Investors and industry leaders should continue to drive conversations with governments on piloting solutions and continue to build a use case for other municipalities. Driving this change is going to be long and slow.

With 3D printing, augmented and virtual reality (AR/VR), and robotics promising returns in the long term, how long is that, and what can be done to accelerate development and adoption?

Mahindru: We see many promising returns in capital and utilization in the next decade and beyond. We see more capital deployment in technologies impacting these specific sectors, which will continue to help scale.

The adoption will be driven by continued capital as well as need. Construction companies are facing an aging workforce, worse than most other industries. Large and small construction firms will be looking to adopt technologies that help offset the shrinkage of experienced team members over the next decade.

About the Author

Follow Robotics 24/7 on Linkedin

Article topics

Email Sign Up