The Supply Chain Council defines perfect order fulfillment as “the percentage of orders meeting delivery performance with complete and accurate documentation and no delivery damage.”

The concept seems straightforward in practice, but it is often very difficult to accomplish. Leading contributors to this problem are outdated planning processes and disconnected execution systems that are too slow to respond to increased demand volatility; they lack visibility, increase supply chain risk, and cannot react quickly to unexpected supply chain events.

Take the example of a large, multinational manufacturer that had siloed back office systems, multiple distribution centers, scores of inventory locations, and a diverse mix of suppliers. They faced challenges around how to standardize business processes in order to gain visibility into inventory levels and the order fulfillment process; build a more efficient supply chain; and ultimately, improve customer satisfaction in an increasingly competitive environment.

Their initial thought was to “rip and replace” their existing legacy systems; however, this ambitious choice would have been extremely time-consuming, expensive, and disruptive. Value would only have emerged at the very end of a lengthy process.

They also considered integrating the systems, an effort that might address today’s problems but lead them into the same situation down the road when their business processes changed again. The company ultimately determined that they needed the flexibility to change their business processes without the hassle of changing out all the systems in which they had invested during the last 30 years.

If that scenario sounds familiar, there is a reason. To deal with the challenges of today’s global economy, maintaining a core competency in order management and fulfillment is more important than ever for companies that want to transform their supply chains into information-driven value chains.

For most large organizations, however, order management complexity creates problems, including escalating supply chain costs, inaccurate promise dates, and higher-than-needed inventory. The mounting complexity has been caused by a number of factors, such as increasing globalization, M&A activity, multiple channels to market, and complex supply chains—factors that are here to stay.

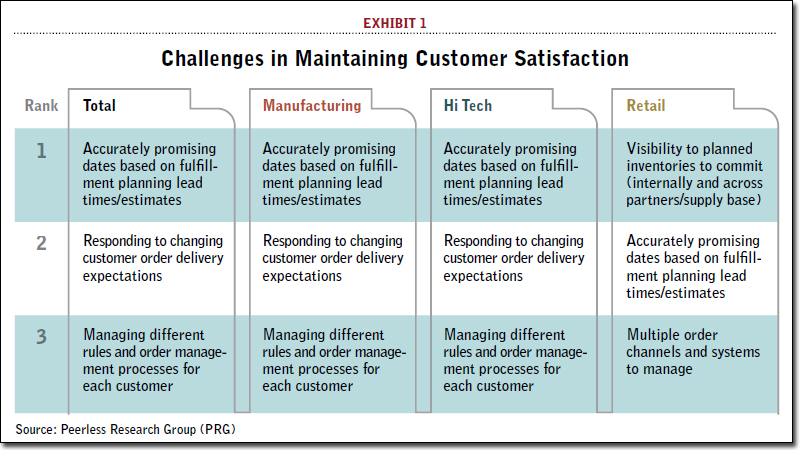

This challenging environment is presenting companies from all industries with a startling reality: How effectively they manage their order management and fulfillment processes has a direct and immediate bearing on the success, even survival of their business. (Exhibit 1).

At the same time, the increase in demand volatility coupled with an explosion of delivery channels, more complex global supply chains, and ever-rising expectations of customers and end consumers, means perfecting order management and fulfillment is incredibly challenging.

Nowhere is this more evident than in some of the most dynamic industry sectors driving our global economy: manufacturing, high-tech, and retail. To fully understand the situation, it is important to consider some of the key issues and opportunities these industries face in order management and fulfillment.

This article, which is based in part on a research study of 589 supply chain executives conducted for Oracle and Capgemini, looks at those issues as well as the opportunities to address them with a portfolio of order management and fulfillment capabilities.

Challenges Threatening the Bottom Line

One of the key findings from our study was the extent of the issues facing organizations from these industries. While many business executives think that their issues are unique to their organizations or industry, businesses across the manufacturing, high-tech, and retail industry sectors face many of the same challenges in managing their supply chains, according to the study responses.

To begin with, businesses across the board are in agreement that managing fulfillment processes is becoming more multi-faceted and subsequently, more complicated. All this is happening as order processing windows narrow and customer demands intensify. Complying with the heightened demands likely increases internal costs to meet these order fulfillment requirements in a short time frame.

In particular, the complexity of order management systems, the ongoing challenge of keeping customers satisfied, adhering to delivery schedules, and combating rising costs related to fulfillment are among the major issues companies now face in all three sectors.

A key area of challenge for companies is understanding and managing customer demand effectively. While the intent of this article is not to discuss demand management in detail, it is important to note that accurate demand/order capture is critical to effective demand management.

This study reveals that many companies today struggle with capturing true omni-channel customer demand through demand/order capture and management systems. Many large companies continue to have complex, fragmented order management processes and technology infrastructure.

Contributing to the complexities of order management processes are the multiple, disparate order capture and fulfillment systems such companies now operate. When an organization has multiple systems in place, it is difficult to get a single compete picture or a single view of a customer.

Roughly four out of five of the executives surveyed rely on several order capture mechanisms (79 percent), while more than two-thirds employ more than one order fulfillment system. In general, the companies in the study manage slightly more than three (3.1) order-taking channels such as e-commerce, call centers, and electronic data interchange (EDI). In addition, they have nearly three (2.7) systems for carrying out orders, which often includes Enterprise Resource Planning (ERP), Warehouse Management Systems (WMS) and Order Management applications.

Survey data further reveals that larger companies, i.e., those with annual revenues of more than $500 milion, have an even greater number of systems, with an average of 3.5 order capture systems and 3.3 fulfillment systems.

Why does this keep happening? The study showed 50 percent of manufacturers have done an acquisition or have been involved in an acquisition during the last three years, and 45 percent of total companies are demanding orders through multiple channels. If there are three distinct channels, customers are often required to put one purchase order through one channel, a second purchase order through the second channel, and a third order purchase through the third channel.

As one vice president of supply chain operations responded: “Currently, we do not have the ability to create one invoice for a customer that has placed multiple lines of shipping from different facilities. The adoption of new technologies could help give us a better picture of what types of orders are coming in, what our average size is by volume and length, and streamline our invoicing process.”

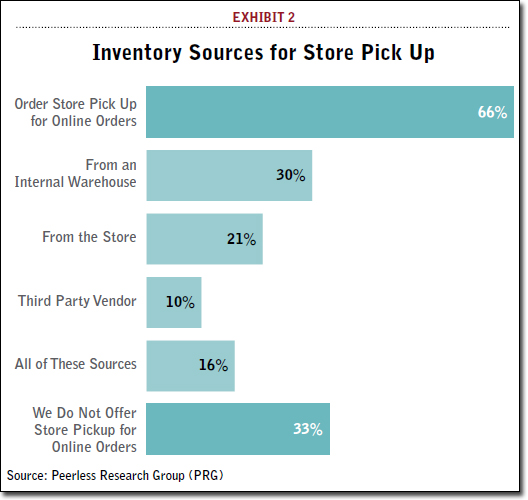

As shown in Exhibit 2, ordering through different channels is particularly common and complex with retailers. Retailers maintain an average of four different selling channels that their customers actually go through. On top of that, only 38 percent of them actually have the software to manage these channels. A retailer with a different set of inventory allocated to its website versus inventory allocated for store replenishment increases the cost inside the entire supply chain, as only 21 percent of retailers utilize the inventory inside their store.

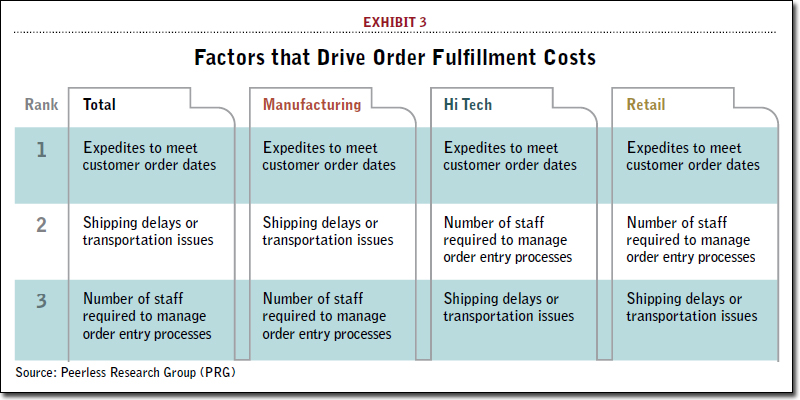

Alongside increasing complexity is an increase in expenses. Expediting fulfillment and shipping to meet order commitments is the primary factor contributing to order management expenses. Adding resources to respond to shipping delays and taking on additional labor to handle order processing are among the other major expense factors. (Exhibit 3).

While our survey went into more detail on the range of challenges presented by today’s economy, the overall point is clear: Organizations in dynamic industries face complex and increasing challenges when it comes to order management and fulfillment. And the potential consequences of ignoring these challenges are steep.

Customer satisfaction and retention are put at risk and businesses are forced to allocate additional spending on resources and labor to address the situation. In short, these trends, coupled with the rising price of raw materials and mounting transportation costs, pose a growing threat to the bottom line of businesses everywhere.

Striving Toward Perfect Order Fulfillment: Three Enterprise Capabilities for Success

While a list of challenges that spans organization, process, technology, and strategy seems daunting, there are low-hanging opportunities for companies in the manufacturing, high-tech, and retail industries to improve both their competitive positioning and their top and bottom lines.

Here are three capabilities that can help:

1. Accurate Demand Sensing and Shaping

The first step in better order fulfillment is better demand management. Businesses can utilize advanced demand management capabilities to significantly improve their ability to better manage demand volatility, improve demand-planning processes, and realize higher forecast accuracy. Two important capabilities that augment demand planning include demand sensing and demand shaping.

Demand sensing: According to respondents, as shown in Exhibit 4, the number of customers ordering from multiple channels during the last 12 months has either stayed the same (50 percent) or increased (45 percent). Only 5 percent indicated a decrease in customers ordering from multiple channels. With so many customers using various purchase paths, the ability to capture purchase data is becoming increasingly challenging.

Applications such as demand signal repository allow companies to capture real time multi-channel demand signals and analyze, through “slice and dice” capabilities, the demand information to reveal patterns. When combined with demand history for a given product, this information can provide businesses with the insights they need to develop a more accurate forecast.

Demand shaping: Technologies such as trade promotions optimization complement demand sensing by creating incentives to stimulate demand or optimize product promotions to maximize growth and profitability. For example, leading supply chain companies use capabilities such as dynamic pricing to influence demand.

The result of these advanced demand management capabilities is a demand-driven organization with higher service levels and sales, more satisfied customers, and lower inventory and distribution costs.

2. Global Order Promising (GOP)

To meet rising customer and end-consumer expectations, organizations across all industries need to increase their on-time deliveries, improve the reliability and accuracy of their promises to customers, and manage their commitments to key customers.

In fact, in the Oracle and Capgemini study mentioned earlier, 39 percent of respondents named inaccurate order promise dates as a top inventory management challenge. In other words, over promising and under delivering is a huge concern for organizations in dynamic, ever changing industries.

Take, for example, a high-tech company that was developing a product that had a quality issue. At the output part of it, the company had less supply than expected, so a balancing act was needed to determine which customers would receive their orders.

It was difficult for the company to determine what part of the development process was causing the problem. This uncertainty raised questions about how to fulfill all of the orders in a way that upset the least number of customers.

One approach to that issue is global order promising. GOP addresses this issue by enabling organizations to make quick delivery promises that customers can rely on. The technology allows organizations to address customer related issues from basic “available to promise” to “capable to promise” to “profitable to promise.”

By combining dynamic, real-time data-driven processes with manufacturing, supplier, and logistics constraints, organizations can have more responsive, reliable, and profitable promising processes that improve customer service levels and increases fill rates.

GOP similarly enables retailers to balance planning and execution when those cycles are out of synch. Rather than tell customers that a product is out of stock, retailers with global order promising technologies now have complete visibility into their supply chain and can commit to customer orders taking into consideration the total order fulfillment cost.

For example, we worked with one large retailer that was concerned with cost effective fulfillment of customer orders. The retailer had full visibility across the network and could see the available inventory at each store location. However, it used GOP capabilities to utilize inventory without increasing transportation costs.

In addition, tight integration of GOP with order management processes enables accurate order promising of complex configurations while extensive backlog management allows organizations to promise a group of orders in a priority sequence. When combined, these advanced management capabilities help organizations to improve customer satisfaction to retain existing customers while attracting new ones—the key to any successful business.

3. Global Distributed Order Orchestration and Fulfillment

As the survey highlighted, order complexity is a key challenge for supply chain professionals (42 percent of respondents) when managing order management and fulfillment. This difficulty in managing orders efficiently and accurately has been caused by a number of factors, including the explosion of order capture and fulfillment systems that many companies now operate.

The dramatic growth in the number of systems can be attributed to organic growth and M&A activity. Of course, the number of systems isn’t exactly the problem here; instead, it’s more the fact that they are often poorly integrated or not integrated at all. To eliminate these silos and give organizations a holistic view into global operations, a solution is needed that cuts through order management complexity to create a centralized view.

With Distributed Order Orchestration, organizations are able to apply enterprise-wide rules and processes, and identify and rectify problems before they become an issue for customers. By giving business managers complete control over order management processes, they are able to monitor order progress, review issues, resolve problems, and modify fulfillment processes as the business evolves.

For example, the ability to consistently view margins during promising, fulfillment, and particularly expediting activities, can help improve decision making and drive profitability without sacrificing service level agreements.

Coupled with supply chain execution and real time global visibility (i.e., logistics and transportation, global trade management, and warehouse management), Distributed Order Orchestration Processes can also enable companies to close the loop—capture, orchestrate, manage, and fulfill customer orders more efficiently.

Automotive and high-tech companies are examples of industries that often struggle to meet commitments to key customers at the time of order execution. One manufacturer wanted to develop a system that allowed it to commit to and manage allocation commitments. In order to avoid or reduce errors and costs related to change orders in the fulfillment process, the company wanted to offer a program to encourage customer commitment well in advance of product availability.

It also wanted to integrate its planning and order capture systems. This was a brand new process that was not supported by its current mainframe system, and it was too expensive to simply throw people at it. Instead, a Distributed Order Orchestration solution served as a hub to provide the integration between planning, order capture, and fulfillment.

The business process layer organized the allocation commitment process and provided visibility into the end-to-end processes, including proactive monitoring of customer complaints with their agreed-upon allocation commitments.

While Distributed Order Orchestration systems benefit organizations of all sizes, they represent a major opportunity for large, complex organizations. By streamlining order management processes across global organizations, they can help lower costs, increase margins, and greatly improve customer service.

Key Takeaways

It is not a big surprise that this survey revealed the increasing complexity and costs associated with managing and fulfilling orders. The survey did, however, reveal several opportunities for companies in the manufacturing, high-tech, and retail industries to embrace these changes and improve their competitive positioning and bottom lines. (See sidebar).

Success in order management and fulfillment relies on the speed of decision making and continuous monitoring of the impact of those decisions at all levels in the organization. This can be achieved with advanced systems, like the ones outlined in this article, which enable best-in-class processes across all order management and fulfillment processes.

Returning to the story of the large, multinational manufacturer, this company found a solution to design and implement a new, integrated, end-to-end business process without re-implementing non-value added functionality. They inserted applications that could co-exist with their existing legacy systems to create a new standardized process, across all sites.

By leveraging systems that separate the master data, business rules, and business processes from the physical integrations, they now have a platform for the future that delivers immediate benefits, including: greater transparency and a single source of inventory information, reduced cycle times for proposals, orders and fulfillment, and improved ability to address complex customer needs more quickly and with fewer data errors.

The insights this analysis delivers will help in the development of new models that can be implemented across people, processes, technology, and metrics. But as anyone that works in the complex world of supply chains will know, that alone is not enough. As to ensure success, organizations must strive to continuously enhance their order management and fulfillment processes to improve both their competitive positioning and business results.

What should industries do to improve order management and fulfillment capabilities?

Here are recommendations by industry.

When addressing this challenge, an organization should start by evaluating its current demand management and order fulfillment processes and models and performing a gap analysis by benchmarking its results against industry leaders/best practice models. Here are recommendations for improvement across industry segments.

- Manufacturing: Manufacturers should ensure that they have visibility to true end customer demand through the retailer. Technology integration with retailer demand capture systems can allow the manufacturer to get the accurate demand visibility as a product is consumed at a retail outlet. In addition, the manufacturer should consider following retailers in embracing the new multi-channel reality by evaluating up-sell and cross-sell opportunities, and in some cases, end-customer direct across product lines. They should also consider focusing on creating a consistent customer experience across all channels. Investing in a technology platform to help manage these changes will make it easier to adopt new business processes and create a single face to the customer.

- High-tech: High-tech companies should collaborate, enforce, and measure their allocation commitments with their key customers. As demonstrated in the survey, even if high-tech firms do a good job of planning their allocations, customer commitments are not being enforced at the time of order execution. To address this situation, companies need to integrate their allocations into the promise dates that are provided to customers. High-tech companies should measure their effectiveness in keeping these commitments and, on the flip side, have honest conversations when customers deviate from the agreed upon plan.

- Retail: Multi-channel commerce is a reality that retailers must embrace. It is critical for retailers to capture true omni-channel customer demand. Demand signal repository and demand management capabilities are key enablers for retailers to ensure that they have real-time customer demand visibility at all times. With better omni-channel demand visibility, retailers can now stock the right products at the right inventory levels in the right locations based on real time visibility to demand and consumption patterns.

About the Editors: Maha Muzumdar is Vice President of Supply Chain Management Marketing for Oracle. He can be reached at, [email protected]. For more information, visit Oracle’s SC24/7 Company Page. Anijay Zinzuwadia is Distributed Order Orchestration Solution Lead, North America at Capgemini. He can be reached at [email protected]. For more information, visit Capgemini’s SC24/7 Company Page.

Article topics

Email Sign Up