Ryder System Inc. today announced that it has agreed to acquire Whiplash, a provider of omnichannel fulfillment and retail logistics services, for about $480 million in cash.

“The acquisition of Whiplash is consistent with our strategy to accelerate growth in our higher-return supply chain business,” stated Robert Sanchez, chairman and CEO of Ryder. “It also expands our e-commerce and omnichannel fulfillment network and reflects our continued focus on technology and innovation.”

“Whiplash’s best-in-class e-commerce platform and key geographic strongholds—coupled with Ryder’s industry-leading transportation logistics solutions, including our robust Ryder Last Mile delivery network for big-and-bulky goods—positions us to deliver incredible value for our customers who are looking for more advanced e-fulfillment solutions in today’s ever-changing landscape,” he added.

With its expanded footprint following the acquisition, Ryder said it expects to be able to deliver to 100% of the U.S. within two days and 60% of the U.S. within one day.

Whiplash expects to scale out

PLG Investments I LLC, which does business as Whiplash, said it provides end-to-end customer care, transportation, distribution, and value-added warehouse services. The City of Industry, Calif.-based company said its scalable supply chain, dedicated transportation, and fleet management systems serve more than 250 brands.

Whiplash operates 19 distribution centers with nearly 7 million sq. ft. (650,000 sq. m) of space in addition to its international partner network. It has worked with autonomous mobile robot (AMR) provider Locus Robotics.

“This announcement signals a new accelerated phase of growth for Whiplash that will benefit our current customers and dramatically enhance our ability to scale and deliver innovation for digitally-native brands and omnichannel retailers,” said Jeff Wolpov, CEO of Whiplash. “Ryder’s supply chain expertise, facility network, and last-mile transportation solutions are a perfect complement to the Whiplash e-commerce platform, and we’re excited to be part of the Ryder team.”

Ryder to retain Whiplash facilities, staff

Ryder said it plans to integrate Whiplash’s facilities, operations, technology, and warehouse automation and robotics into its e-commerce fulfillment solution within the supply chain solutions business unit. In addition, the Miami-based company plans to retain Whiplash’s executive team and workforce.

“With e-commerce sales continuing to hit record levels and omnichannel retailing becoming mainstream, we’re seeing a significant uptick in brands looking for more dynamic fulfillment services,” said Steve Sensing, president of global supply chain solutions at Ryder. “Whiplash has built a proven model that meets today’s consumers where, when, and how they choose to engage with brands—whether that’s online from a mobile device or laptop, in-store, or a combination.”

“We expect that our combined customers will benefit from that additional flexibility, as well as Ryder’s vast nationwide network, extensive technology suite, best-in-class warehouse management practices, and end-to-end transportation logistics solutions,” he said.

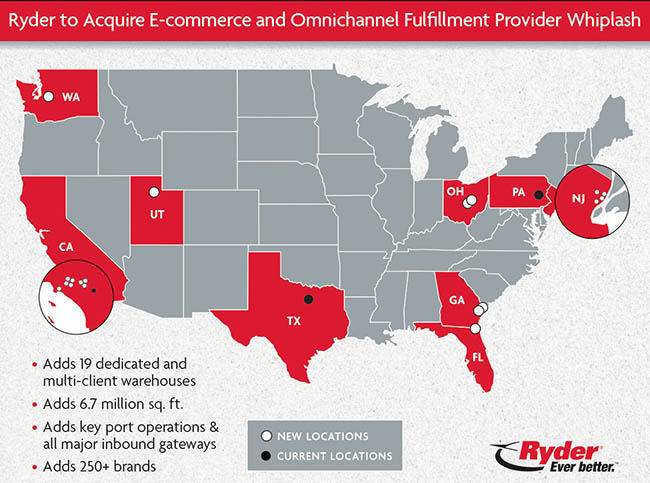

The acquisition will add to Ryder’s current e-commerce fulfillment network with new facilities in Chino, Calif; City of Industry, Calif.; Long Beach, Calif.; Jacksonville, Fla.; Savannah, Ga.; Newark, N.J.; Secaucus, N.J.; Clifton, N.J.; Columbus, Ohio; Salt Lake City, Utah; and Sumner, Wash.

The company noted that the acquisition will also strengthen its presence in key port operations, providing four-corner coverage of major U.S. inbound gateways via Seattle/Tacoma, New York/New Jersey, Savannah, and Long Beach. Ryder already manages nearly 235,000 commercial vehicles and operates more than 300 warehouses, encompassing approximately 64 million sq. ft. (5.9 million sq. m).

Ryder is also working with autonomous truck developers Waymo, Embark, and TuSimple.

Transaction to close soon

The transaction is accretive to shareholders, and Ryder expects it to add approximately $480 million in gross revenue to its supply chain solutions business segment in 2022 and provide incremental growth to its earnings in 2022.

Ryder and Whiplash said they expect to complete the transaction in late December 2021 or early January 2022, subject to satisfaction of antitrust approvals and customary closing conditions.

Wofford Advisors LLC acted as lead strategic advisor to Ryder, and Blank Rome LLP acted as legal counsel on the transaction. J.P. Morgan Securities LLC acted as exclusive financial advisor, and Paul Hastings LLP served as legal counsel to Whiplash.

Article topics

Email Sign Up