Environmental sustainability, technological advances, and venture capital are coming together in a virtuous cycle. Legal & General Capital today announced that it and international energy company Equinor have co-led the £15.2 million ($19.9 million U.S.) Series B funding for hydrographic services provider Rovco and computer vision company Vaarst.

“We have a number of unique technologies that can make a huge impact on how companies such as Legal & General or Equinor manage their marine infrastructure,” stated Brian Allen, CEO of Vaarst and Rovco, both of which are based in Bristol, U.K.

“This investment will help propel these solutions forward and bring a real difference to the cost of energy production as the clean energy sector adopts AI and autonomous solutions with Vaarst technology at its heart,” he added.

Vaarst, Rovco develop asset maintenance infrastructure

The labor intensity and high costs of conventional maritime asset maintenance are driving interest in automation, said the companies. A single crewed service vessel for an inspection mission can reach up to £10 million ($13.1 million) per month.

Vaarst provides subsea 3D computer vision technologies supporting the offshore wind, wave and tidal, scientific, maritime security, and civil engineering industries. The company, which spun out of Rovco a year ago, said it is developing technology that uses artificial intelligence and that could revolutionize how energy companies manage subsea infrastructure and improve asset integrity.

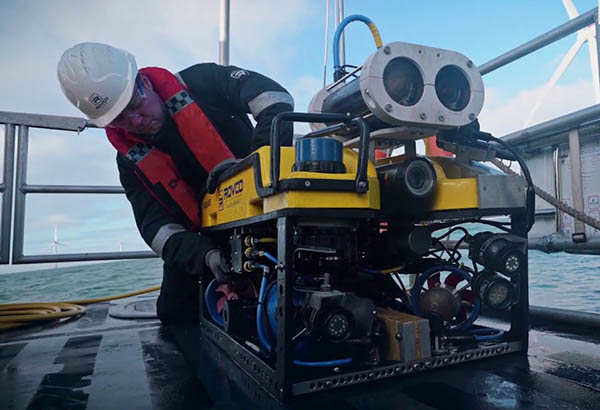

Rovco focuses on the use of Vaarst's technology in the energy transition space. The company uses remotely operated vehicles (ROVs) to conduct subsea surveys in offshore wind and oil field decommissioning.

Rovco and Vaarst claimed that innovative technologies are designed to substantially lower the costs of underwater surveying. They added that Vaarst’s technology can also speed up processes and optimize the long-term condition of assets.

L&G expands energy, global portfolio

Legal & General said it identified the significant opportunity within the offshore wind sector, as well as in serving marine infrastructure, which makes up 10% of all global infrastructure. Rovco and Vaarst join its growing portfolio, which includes onshore wind, solar photovoltaic (PV) technology, electric vehicle (EV) charging, and ground-source heat pumps, among others.

“Our clean energy platform continues to grow, entering new sectors and supporting the growth of innovative new technologies,” said John Bromley, head of clean energy at Legal & General Capital. “Rovco and Vaarst are exciting companies that will help further support the global energy transition by supporting the long-term integrity of maritime assets, reducing costs, improving safety and speeding up processes.”

“We are excited by their huge potential internationally and the synergies this could bring, as we look to the international expansion of our investment in renewable infrastructure such as offshore wind,” he said.

Legal & General will invest £8.5 million ($11.1 million) out of Rovco and Vaarst's £15.2 million ($19.9 million) raise. Other participants included In-Q-Tel, a strategic investor for the U.S. intelligence and defense communities and allied nations, and existing shareholder and private equity investment manager Foresight Group.

The investment in Rovco and Vaarst is part of Legal & General's plans to expand its clean energy portfolio and increase its presence across the U.S., Asia, and Europe. Existing customers include Iberdrola, SSE, and Deepocean.

Legal & General will explore options to scale Rovco through using its data across its existing investments of about £900 million ($1.2 billion) in its U.K. offshore wind portfolio.

About Legal & General

Established in 1836, Legal & General Group (L&G) said it is one of the U.K.’s leading financial services groups and a major global investor. With over £1.24 trillion ($1.6 trillion) in total assets under management, L&G claimed to be the U.K.’s largest investment manager for corporate pension schemes and a market leader in pension risk transfer, life insurance, workplace pensions and retirement income.

Legal & General Capital (LGC) is L&G's alternative asset platform, creating assets for retirement and third-party clients to achieve improved risk-adjusted returns for its shareholders. The company said it creates alternative assets with society's benefit in mind, enabling third-party investment in verticals including clean energy, assets, and infrastructure.

L&G has invested over £30 billion ($39.3 billion) in regional U.K. economies, including through major regeneration schemes in Cardiff, Newcastle, and Salford. Legal & General recently made a commitment to enable all new homes across its portfolio to operate at net zero carbon emissions by 2030, including Legal & General Modular Homes, CALA Group, Legal & General Affordable Homes, Build to Rent and Later Living.

LGC also owns a 36% share in Kensa Heat Pumps, a British manufacturer and installer of high-efficiency networked heat pumps.

Article topics

Email Sign Up