As the economy continues to chug along at a healthy pace, the rail/intermodal market goes right along with it. It’s important to keep in mind that, due to the robust infrastructure investment in the nation’s extensive rail network over the last 15 years, this market has consistently done a solid job of growing volumes even as other modes were hitting operational challenges during the Great Recession.

And that investment continues to pay off in 2018. As group news editor Jeff Berman recently reported, intermodal, container and trailer volumes through May were up 6%, or 336,944 units to 5,993,583—representing the highest year-to-date volume through May for intermodal and well ahead of 2017. In the meantime, average weekly intermodal volume through that period, at 279,641 units, was the second highest reading ever recorded, trailing only February 2018.

“As has been the case for about three years, intermodal unit volumes continue to outpace rail carload volumes, something that didn’t occur consistently in the past, but is now becoming more common,” says Berman.

Economic picture aside, the ongoing truck driver shortage and increasingly tight capacity across all trucking modes has been another big boost for intermodal volumes—and shows no signs of stopping. “There’s no question that this trend will continue for the foreseeable future, as truckers raise rates and continue to search for drivers to fill their seats,” adds Berman.

And as the volume picture remains rosy, intermodal players are certainly looking for pricing gains at the same time that shippers continue to feel that service levels overall could stand for some improvement. One thing is for sure, though, the seven rail/intermodal service providers below are not only meeting capacity needs, but are exceeding expectations on the ever-important service front.

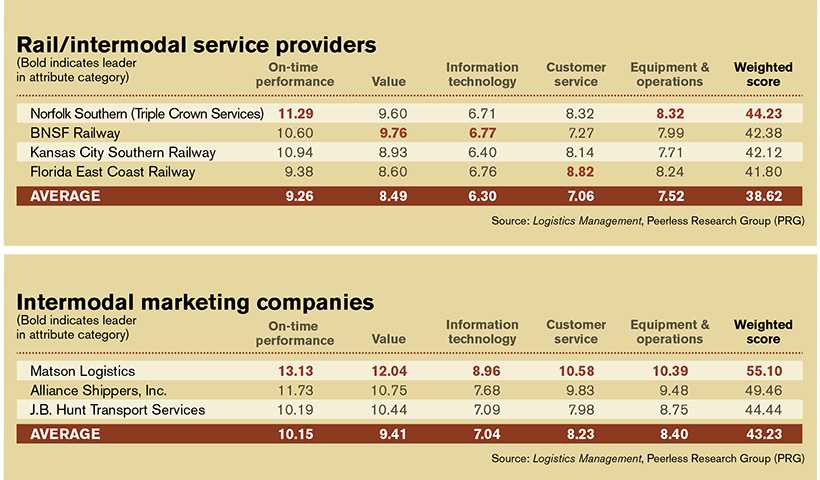

In this year’s Rail/Intermodal Service category, Norfolk Southern (Triple Crown Services) pulls in with a 44.23 weighted average to lead the overall scoring. The provider put up top marks in On-time Performance (11.29) and Equipment & Operations (8.32) on the way to that score. BNSF lead the way in Value (9.76) and Information Technology (6.77), while Florida East Coast Railway put up an impressive 8.82 in Customer Service.

Matson Logistics earned an impressive 55.10 weighted average, one of the highest marks in this year’s overall Quest for Quality. Matson led the way in all of the attribute categories this year on the way to that category-leading average.

|

|

|

|

2018 Quest for Quality Winners Categories NATIONAL / MULTI-REGIONAL LTL | REGIONAL LTL | TRUCKLOAD | RAIL/INTERMODAL | OCEAN CARRIERS | PORTS | 3PL | AIR CARRIERS and FREIGHT FORWARDERS | |

Article topics

Email Sign Up