Falling prices and greater choice—proven forces that lay the groundwork for significant market growth—are now playing a hand in helping metal additive manufacturing systems gain traction.

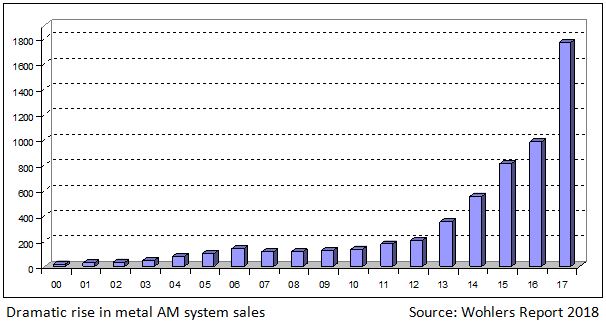

According to a the Wohlers Report 2018, released recently by the 3D printing market research consultancy Wohlers Associates, an estimated 1,768 metal AM printers were sold in 2017 compared to 983 systems in 2016—a significant leap of nearly 80%. In addition, metal materials sales grew significantly this year: While the 2017 market for AM polymers increased by 22.5%, demand for metal materials jumped 44.6% during the same time period, indicating surging interest in the 3D printing technology, confirmed Terry Wohlers, president of the firm.

Wohler’s Report 2018 shows a dramatic rise in the deployment of metal additive manufacturing systems. Image Courtesy of Wohlers Associates.

Wohler’s Report 2018 shows a dramatic rise in the deployment of metal additive manufacturing systems. Image Courtesy of Wohlers Associates.Two significant contributors to the growth spurt were the release of a low-cost metal AM system from Desktop Metal and a wave of lower cost metal AM offerings released by Chinese manufacturers into the U.S. market, he says. “It moves the needle—there is more choice, marketing, and distribution of these systems that wasn’t there in previous years,” Wohlers says.

In particular, the Desktop Metal system had a sizeable impact on the category as this was the first year it reported commercial sales of its desktop style 3D printer, he explains. Announced in 2015 to great fanfare and with major backing, Desktop Metal’s Studio System is an office-friendly, low-priced desktop metal 3D printer accessible to designers and engineers for making prototypes or short-run production parts. The system is marketed as a complete platform, including a printer, a debinder, and a sintering furnace, and sells for around $120,000, which is significantly less than traditional metals-based AM systems that are priced upwards of hundreds of thousands of dollars or even into the millions. Desktop Metal is also working on a production system version of its technology, built for metal 3D printing at scale, slated for introduction in 2019.

There were a couple of other factors fueling metal AM’s strong showing in 2017. As early adopters of metal AM technology hit their stride this year, they are moving from buying one or two systems to certify designs and qualify processes into full-blown production mode, where they need more machines to meet their objectives, Wohlers says. In addition, advances in design software, including analysis applications for optimizing support structures and generative design tools, also helped to fuel interest. “These tools help companies build good parts without warping so there is less trial and error,” he explains.

While metal AM is certainly becoming more mainstream, Wohlers says there are still challenges, particularly related to changing the traditional design mindset as well as training engineers on the still-emerging technology. “If you don’t design to the process and take advantage of it through techniques like parts consolidation, then it’s almost impossible to justify the use of metal AM for production,” he explains. For example, a conventional part might cost $25 to manufacture with traditional processes and tens times that with metal AM. However, if engineers redesign the components specifically for metal AM processes, they can conceivably reduce many parts into one, which could be the game changer in terms of ROI.

“It’s an evolutionary process for companies,” Wohler says. “The light bulb has to come on, and companies are starting to become aware.”

Check out this video for a look at Desktop Metal’s metal AM offering.

About the Author

Follow Robotics 24/7 on Linkedin

Article topics

Email Sign Up