The optimization, integration, automation, and management of material goods and data within the four walls of a warehouse or distribution center have been getting a lot of attention lately. Interest in intralogistics has grown because of the ongoing COVID-19 pandemic, persistent labor shortages, spiking e-commerce orders, and ever-evolving consumer preferences.

The exhibition hall at the recent MODEX trade show, one of the leading materials handling events in the world, brought the current state of warehouse robotics into clear focus, all under one roof. There, hundreds of vendors from all over the world were showcasing their innovations, most of which were directly or indirectly related to automation and robotics.

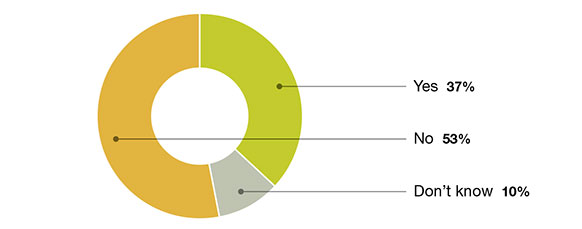

Are you currently using or considering other types of large-scale logistics automation like conveyors, sortation, storage/retrieval, or shuttle systems?

Source: Peerless Research Group

The long line of attendees waiting to get onto that floor each morning of the four-day event further proved just how hungry logistics operations are for equipment, software, and tools that help them get more done with less.

Once inside the exhibition hall, attendees visited spacious booths outfitted with the newest autonomous mobile robots (AMRs), watched robots take on the “heavy lifting” involved with picking and packing orders, and saw how robotics developers and container manufacturers are collaborating to make combined solutions that work in perfect harmony.

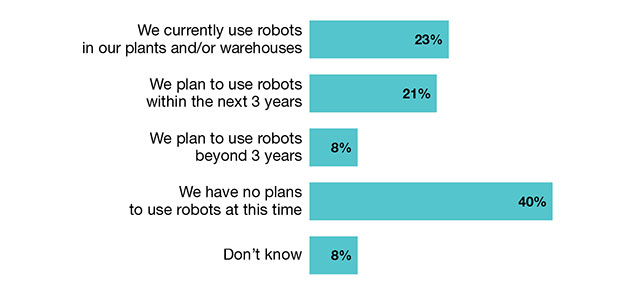

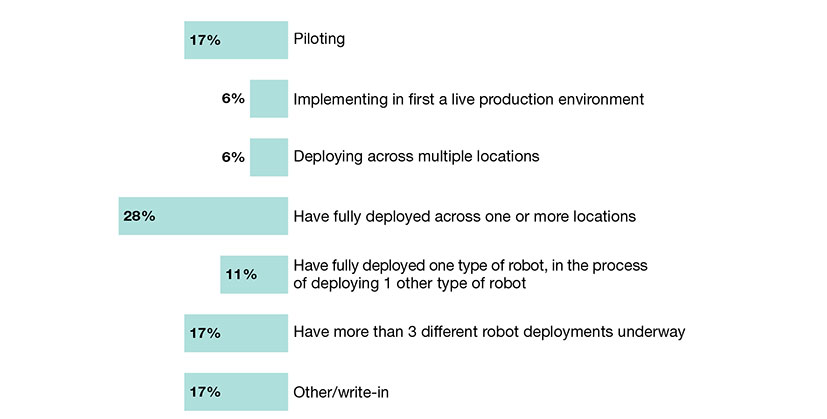

What best describes your organization’s use of automation systems and/or AMRs in your warehouses, distribution centers, and/or manufacturing operations?

Source: Peerless Research Group

The global service robotics market is on track to grow to $45.5 billion this year, according to Global Industry Analysts Inc. With 80% of current facilities lacking any type of automation, companies across all industries are testing and deploying robots in their warehouses, distribution centers (DCs), and fulfillment centers. Supporting this trend is a vendor base that’s optimizing advanced technology and using it to develop newer, better, and more useful machines that meet their own customers’ needs.

“Mobility underpins increased robotics usefulness, as contemporary robots are equipped with sensors such as light detection and ranging [lidar] sensors and computer vision to help them autonomously navigate their environments,” PitchBook, a capital market company, pointed out in its recent robotics report. “This new ability, combined with labor shortages, geopolitical concerns, and productivity-obsessed shareholders, has many companies looking to robots to accelerate their business competitiveness.”

What is the current state of your organization’s pursuit of robots systems in your warehouse or DCs?

Source: Peerless Research Group

To learn more about current and future intralogistics automation implementation trends—including readiness for adoption, barriers to adoption, and the key criteria shippers are using when buying such equipment—Peerless Research Group (PRG, a sibling to Robotics 24/7) conducted its “Intralogistics Robotics Study” in March 2022. Here’s what we learned.

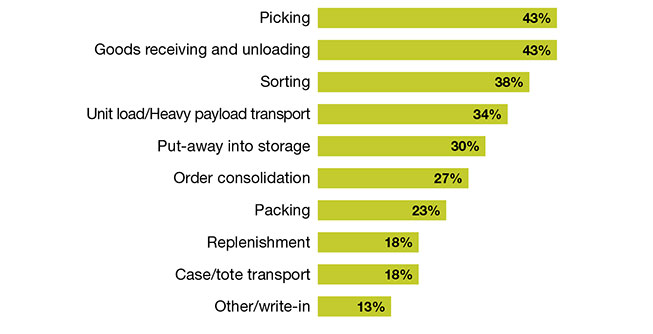

Which of the following use cases would be your top three priorities for using robots today?

Source: Peerless Research Group

Survey breakdown

More than 300 readers of Logistics Management and Modern Materials Handling (sibling sites to Robotics 24/7) responded to the online survey, which was largely focused on the current state of robotics adoption and use cases.

Responsible for hiring, interviewing or sourcing full-time or part-time labor to manage materials handling, distribution, and fulfillment, the survey respondents work in manufacturing (41.8%); transportation and warehousing services (15.3%); wholesale trade (10.2%); and retail trade (8.2%) industries.

The key industry sectors represented for this survey include fabricated metals, industrial machinery, and plastics and rubber. The majority of companies (38.8%) have annual revenues of less than $50 million, while 11.2% have somewhere between $100 million to $249.9 million in revenues, and another 9.2% reported revenues of $2.5 billion or more.

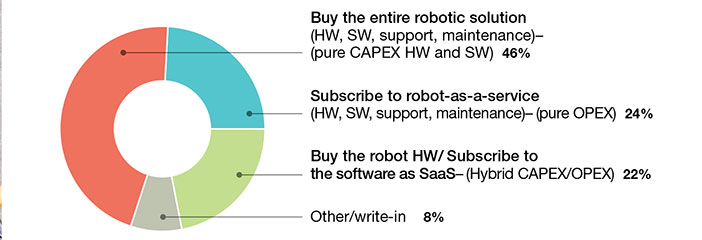

What is your preferred commercial model for your planned robotics initiatives?

Source: Peerless Research Group

Businesses just beginning their robotics journeys

Many companies are just beginning their warehouse robotics journeys, according to the survey. In fact, we found that 40.4% have yet to install any automation systems or services. About 34% of respondents consider themselves “potential buyers” or “current users,” while 15.2% provide consulting and systems integration services, and 7.3% sell robotic systems or services.

Currently, 37% of companies are using large-scale intralogistics automation such as conveyors, sortation, storage/retrieval, or shuttle systems in their operations, and 23.1% are using robots in their plants or warehouses. Just over half of the responding organizations (52.8%) are not using this type of equipment, but 21.3% plan to put it to use within the next three years.

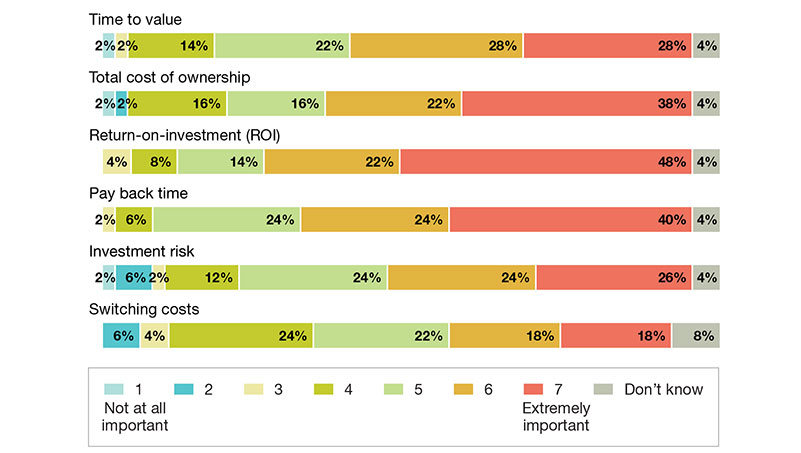

How important are the following business-case factors when you are choosing robotics solutions?

Source: Peerless Research Group

About 40% of survey respondents still say that they have “no plans to use robots at this time.”

When asked for their top reasons for not investing in robotics, respondents said they were going to focus their time and investments in warehousing and storage; order customization; inventory management; and individual pick, pack, and ship. Other obstacles include a lack of management support, too many variables in products, space and cost constraints, and inventory fluctuations.

What is the current state of your organization’s pursuit of robots in your warehouse or DC?

Source: Peerless Research Group

Survey participants look ahead to more automation

Of the survey respondents who plan to use robots, but don’t currently have them in place, 38% of respondents are in the education and knowledge-gathering stage; 22% are in the strategy and vision formulation stage; and 12% plan to roll out additional robots based on previous, successful tests. Other respondents are conducting an impact analysis (8%), documenting requirements (4%), piloting (2%), or already implementing robots in the live production environment (2%).

The companies that are implementing robotics and automation are focused on increasing flow and throughput, better managing the labor crisis, improving current labor productivity, reducing labor costs, improving workplace safety, reducing injuries and improving order accuracy and quality.

When selecting and implementing advanced robotics automation to fulfill those needs, most companies turn to material handling suppliers, robotics vendors, industry peers or systems integrators for help.

According to respondents who are planning to implement robotics automation, their top priorities for using such technology include picking (42.9%), goods receiving and unloading (42.9%), and sorting (37.5%). About 43% of companies are considering pallet movement AMRs, while 34% want autonomous retrieval-to-person/put-wall robots, and 30.2% are evaluating robotic picking systems.

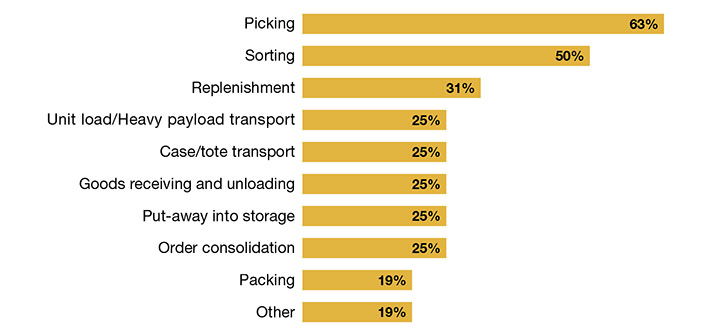

Which use cases are you addressing with robots today?

Source: Peerless Research Group

Around 28% of respondents want to incorporate heavy-payload forked/tugger transport robots into their operations, while 24.5% and 22.6% want sortation robots or stationary industrial robots, respectively. Other types of automated equipment that are currently on logistics operations’ radar screens include heavy payload carry-on-top transport robots, case/tote transport robots, collaborative in-aisle picking robots, and cleaning robots.

Half of companies prioritize ROI

When choosing a robotics solution, 48% of companies say return on investment (ROI) is extremely important to their decision making, while 40% see payback time as extremely important, and 38% point to total cost of ownership. In addition, 28% consider time to value when choosing a solution, and 26% consider investment risk extremely important.

Of those companies planning to implement robots, 32% have yet to secure the funding for these projects, but are working on it, while 24% do have the funding in place. About 10% of respondents say that pre-funding is unnecessary because they plan to use robotics as a service (RaaS), and another 2% say they plan to funnel funds from other projects into their robotics and automation initiatives.

Nearly half of the survey respondents who are planning to use robots would prefer to buy the entire solution (i.e., a pure CapEx investment), 24% say they would rather use the RaaS option, and 22% say they would prefer to buy the robot hardware but subscribe to the software via a hybrid approach.

Customer satisfaction guaranteed

When investing in robotics solutions, more than half of respondents (53.8%) say payback is an “extremely important” factor in the decision.

Robots are living up to expectations in the real-world applications where they’re being put to work. Asked whether their existing installations lived up to early expectations, over 60% of companies say their total cost-of-ownership objectives were either met or exceeded. Nearly 85% of respondents say that the projected ROI either met or exceeded their expectations, and almost 77% say the same about their payback time objectives.

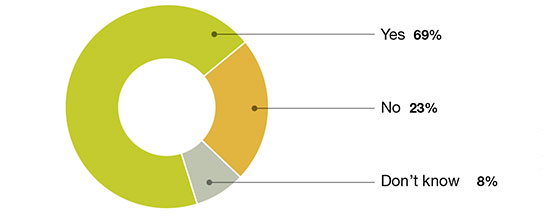

Overall, the majority of companies are satisfied with their robotics and automation investments, with 69.2% of them reportedly achieving their overall business goals from their robotics implementations, 23.1% saying they’ve yet to achieve those goals, and 7.7% unsure of the answer to that question.

Did you achieve your overall business goals from your robotics investment?

Source: Peerless Research Group

More robots, please

Organizations are enthusiastic about future use cases for robotic automation. Nearly all of those with robotics systems currently in place say they have plans for future projects, while 46.2% say they’re already in the middle of new projects. Just over 46% will pursue new use cases over the next two years (with the planning process already under way), while 7.7% have no plans to implement robotics in their intralogistics operations.

When planning out future robotics projects, about 77% of respondents say picking is their top priority, while 46.2% point to sorting, 38.5% to case/tote transport, and 30.8% to replenishment as their key priorities. Other companies want to add more robotics into their goods receiving and unloading processes (30.8%), put-away into storage automation (15.4%), packing (7.7%), and order consolidation (7.7%).

Looking ahead, 61.5% of survey respondents will likely consider mobile goods-to-person systems within the next two to five years, while 53.8% point to robotic picking systems and 46.2% to sortation robots as their key future priorities. About 39% of respondents have set their sights on autonomous retrieval-to-person/put-wall robots; 30.8% want stationary industrial robots; and 30.8% will be considering heavy payload, carry-on-top transport robots.

About the Author

Follow Robotics 24/7 on Linkedin

Article topics

Email Sign Up