From warehouses to hospitals, as businesses prepare to add automation, the question inevitably arises—“How are we going to pay for this?” As with the technology itself, there is a growing range of options, from robotics as a service to financing. First Financial Equipment Leasing is a privately held lender specializing in the acquisition and lifecycle management of healthcare, information technology, and automation and materials handling equipment and services.

The Orange, Calif.-based company said it takes a “solutions-first approach” to understanding customer challenges and sourcing the necessary equipment. For more than 20 years, First Financial has helped businesses implement the latest technologies and discover their leasing options.

Robotics 24/7 spoke with David Sanborne, senior vice president of sales at First Financial, about what companies adopting robots need to know.

How did First Financial get into robotics?

Sanborne: When I became head of sales nine years ago, we were mostly leasing forklifts to midsize to large companies. Assets to be financed make up a big part of the business for us, including equipment financing and leases for a single piece of equipment up to warehouse robotics for a Whirlpool, Keurig Dr Pepper, or Thermo Fischer.

We talked to customers about other equipment, including AGVs [automated guided vehicles], ASRS [automated storage and retrieval systems], and sortation systems. We then started to go to ProMat and MODEX, and we've built up a tremendous amount of knowledge about warehouse automation.

We've heard from both vendors and customers that one barrier is upfront costs. We've built leasing structures to make payments and realize return on investment [ROI] over time. That way, customers can get instant savings from efficiencies. We're one of the rare companies that does this, and we're looked upon very favorably by both robotics suppliers and end users.

How is leasing different from robotics as a service (RaaS)?

Sanborne: The financial benefits are different from that model. The downside to the vendors is that they don't get $5 million in revenue recognition; they have to collect that money over time. If we lease, the vendors get the money in advance, which is better for them.

A lot of those robotics-as-a-service deals aren't fixed-term but month to month or semiannual. That may be more flexible for the end user, but it's less revenue guaranteed for the vendor.

For end users, we can finance RaaS for baseline usage. It's a more complex model, but payments come to First Financial, and we do the same thing for software as a service.

With leasing, how important are service-level agreements (SLAs)?

Sanborne: If we finance RaaS, it still has to have a fixed term. There's a baseline number of picks or sorts, and they have to true up every month or quarter. It's harder to budget for.

We've worked with a few vendors that have a hard time figuring out how RaaS helps their business rather than a true lease.

What sorts of equipment can you finance?

Sanborne: ASRS, picking and sortation, and AMRs [autonomous mobile robots]—we talk to all of them because we can write true leases like a car lease. A lot of finance companies can't leave risk or residual value, even on something as simple as racking or conveyance.

For deep-channel storage robots, AMRs, and AGVs, we bring a financing structure. An “Aha!” moment for the vendors is when they understand how to wrap our solution. It gives them a big competitive advantage.

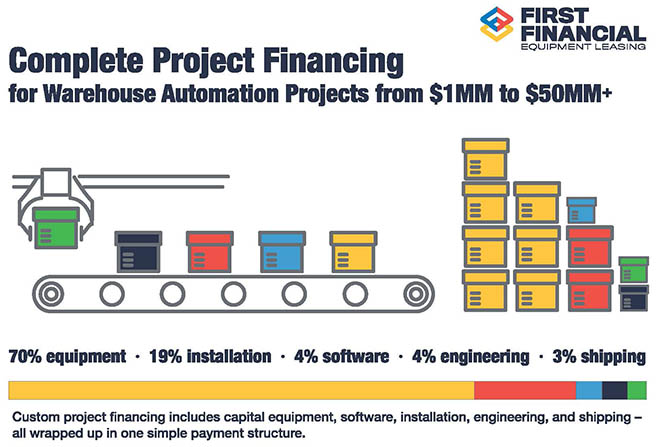

What aspects of deployment does First Financial cover?

Sanborne: FFEL pays all “soft costs,” such as shipping software, engineering, and installation. We wrap that into the solution, and the customer pays over three to seven years. This can save thousands.

We work with all the major manufacturers, including Attabotics, AutoStore, and SSI Schaefer.

How much do you need to educate the market about reducing risk?

Sanborne: There is risk for companies involved with new technologies. Our direct model is less scary.

We work with a lot of robot manufacturers, distributors, and systems integrators. A lot of them are really successful at selling our offerings.

Banks don't understand how to write these leases. For example, the chief financial officer of a Fortune 500 company got nine months into a deployment and wanted to give it to a bank, but the bank didn't have a clue about how to write a lease.

That's going to be a common issue—lots of companies buy technology but can't use their own capital, and banks can't deal with soft costs like delivery, integration, and software, which can be 25% to 40%.

Who are your typical customers?

Sanborne: We try to identify decision makers at end-user customers. It's often the chief financial officer or someone in the treasury department who's trying to budget for automation. It can be people in procurement, supply chain, and direct spend, all the way to warehouse managers.

First Financial generally serves bigger customers—$100 million in revenue and over—but we can deal with smaller customers with $5 million in revenue.

With the COVID-19 pandemic accelerating e-commerce demand, what automation trends have you seen?

Sanborne: A lot of companies are automating existing manual processes, from individual machines to re-engineered distribution centers [DCs]. We've helped some customers go from fully manual, wide aisles with fork trucks to much more automated systems and dense DCs.

The integrator can show the cost of moving a case, as well as the monthly and annual totals. If you put in automation, it can bring the cost down. If you lease the equipment, the day you start operating it, money starts falling to the bottom line.

We've seen explosive interest in AGVs and AMRs. Retailers and logistics providers are having trouble finding employees, and costs have gone up. We've also seen a tremendous amount of interest in sortation of small parcels.

Do you expect this heightened demand for robotics to continue?

Sanborne: If anything, it won't slow down; it will speed up. In Phoenix, DCs are building up for Los Angeles. New half-a-million or 1 million-sq.-ft. DCs are being built all over the U.S.

A number of industries had to prepare for e-commerce. Some were better set up for it, but the ones that couldn't fulfill orders electronically took a hit. We've heard a lot about the grocery business automating.

Is First Financial growing as the market grows?

Sanborne: We're ahead of the curve, and we are hiring a lot of people. We're in the right place, and we're getting the word out how we can help companies.

There is a lot of education of both vendors and end users. If you're thinking of doing something in the warehouse automation space, you might want to finance. This protects you against obsolescence, and it's a formula so you don't put your own cash out front and wait for ROI.

Once people see inefficiencies and labor savings from robotics, the question is “How do I acquire this technology?” When you start seeing others using new technologies, financing can help give midsize and large companies an edge.

About the Author

Follow Robotics 24/7 on Linkedin

Article topics

Email Sign Up