Apple came up first in a wide-ranging point-by-point platform discussion with the New York Daily News, and while Sanders didn’t go so far as to say the company was one of the corporate fat cats “destroying the fabric of America,” he did express disappointment in Apple’s decision to offshore a bulk of its manufacturing needs.

“No, Apple is not destroying the fabric of America,” Sanders said, referencing his own oft-quoted, and colorful, illustration of corporate America.

“But I do wish they’d be manufacturing some of their devices, here, in the United States rather than in China. And I do wish that they would not be trying to avoid paying their fair share of taxes.”

Asked to name three corporations that do have an appetite for destruction, Sanders said, “JPMorgan Chase, and virtually every other major bank in this country.”

Sanders’ take on Apple is not uncommon. The company’s high-flying financials and deep ties with Asian device makers like Foxconn are great fodder for political stump speeches on America’s economic climate which, according to pols, can be summed up as hazy with a chance of doom.

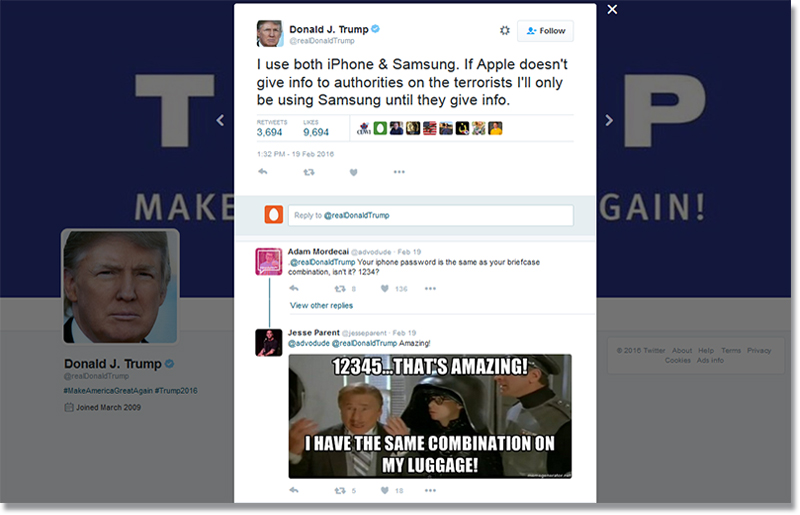

On the other side of the aisle - miles off center - Trump offered his own take on the current state of high-tech, albeit in a more forthright manner than his Democratic opponent.

In January, the steak-hocking business mogul promised that, when elected, he would force Apple into manufacturing its products in America rather than rely on overseas labor. As is his wont, Trump, an avid iPhone user, turned the rhetoric up to 11 a month later, calling for supporters to boycott Apple in an infamous hot take on the San Bernardino encryption row.

After holding out for what must have been an excruciating three weeks, Trump apparently succumbed, returning to iPhone for his usual Twitter tongue-lashings.

As it stands, only one Mac - the Mac Pro - is assembled stateside. In fact, many of the components powering Mac Pro, sourced from third-party vendors, are manufactured outside the U.S.

The tax issue is arguably more polarizing than Apple’s supply chain strategy. Like many multinationals, including a number of fiscally bloated tech firms, Apple adheres to an accounting strategy that routes offshore moneys through subsidiaries in low- to no-tax zones, effectively avoiding high U.S. corporate tax rates. For Apple, the end result is a massive offshore cash pile worth more than $200 billion as of December.

Apple’s technique has raised the ire of U.S. lawmakers keen on taking a slice of any repatriated funds, as well as international oversight bodies like the European Commission, which is currently investigating Apple’s Irish dealings. It was estimated in January that Apple could owe more than $8 billion in European back taxes.

In the end, the sociopolitical arguments posed by Sanders, Trump and other state actors fall flat when measured against a working capitalist model. Manufacturing in America often goes hand-in-hand with extremely high overhead, as compared to equally efficient Chinese counterparts.

Read: U.S. Manufacturing Competitiveness Rising

Apple is a publicly traded company that, despite its admirable Supplier Responsibility and environmental side projects, is ultimately focused on the bottom line. Considering the financials, not to mention billions of dollars and man hours spent on establishing a diverse Asian supply chain, Apple is unlikely to “feel the Bern” anytime soon.

Source: appleinsider

Related: China’s Manufacturing Decline Could Be Good News for U.S. Market

Article topics

Email Sign Up