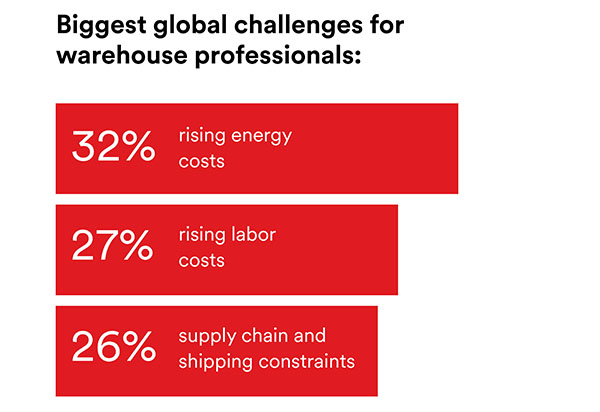

AutoStore AS today announced a new report for which it surveyed more than 300 C-level business leaders in warehouse management and fulfillment. Respondents cited the top three challenges facing their organizations as rising energy costs (32%), increasing labor costs (27%), and supply chain and shipping constraints (26%).

“There is a need to operate more efficiently, which is perhaps why nearly nine in 10 organizations either have, or are planning to install, automation technology in their warehouse in 2023,” stated Ellen Brune, head of global strategic accounts at Nedre Vats, Norway-based AutoStore.

“The intention to meet a challenging macro environment with a technology uptake is good news for customers who want their products quickly,” she said.

AutoStore sees rising demand for automation

“There is strong demand from the market for our technology and the way it fits many different use cases, said Carlos Fernandez, chief product officer at AutoStore. “We've had 25 years of continuous development and improvement, and our installed base passed 1,000 systems worldwide.”

“COVID-19 accelerated e-commerce growth by five years, and there's a lot of macroeconomic uncertainty,” he told Robotics 24/7. “However, trends like urbanization, increasing demand for same-day delivery, and a lack of labor will remain. The need to optimize every inch of space will continue to be a major driver of dense automation.”

Founded in 1996, AutoStore claimed to be a pioneer in automated storage and retrieval systems (ASRS). The company's products are distributed, designed, installed, and serviced by a partner network of qualified systems integrators.

AutoStore said its system includes stacked bins arranged in a grid. Robots ride on rails along the top of the grid, retrieving bins as needed. The bins are then delivered to a port, where warehouse operators are stationed to pick up or fill in products, tag, pack and send them out. A controller acts as the brain behind the whole operation.

The global ASRS market could expand from $6.1 billion in 2020 to $9.1 billion by 2027 at a compound annual growth rate (CAGR) of 7%, projected Research and Markets today. It said North America will capture a “significant market share” because of increasing demand in supply chain and logistics, manufacturing, and trading.

Europeans concerned about energy costs

Forty-four percent of European respondents cited energy costs as a top challenge, while 24% of North American and Asia-Pacific respondents did. Rising labor costs are more of a concern in Asia-Pacific (34%) and North America (27%) than in Europe (22%), said the AutoStore report.

According to the executives surveyed, the most important focus areas for 2023 are improving customer satisfaction levels (34%), investing in automation technology (31%), sustainable solutions (31%), greater workforce efficiency (31%), and delivering goods-to-person faster (30%).

Eighty-eight percent of respondents stated that they plan to implement ASRS by 2024. Thirty-two percent have some sort of automation in place already, and 56% said they are planning to deploy it in the next 12 months.

“Automation technology has shifted to where it is no longer a ‘nice to have’ in the warehouse, but an absolute must have,” said Marcus Mogéus, chief marketing officer at AutoStore. “This report shows that the investment plan for companies when it comes to automation technology has increased dramatically from previous reports.”

“Customers tell us that it's not about installing automation but making sure that it will perform the way it's supposed to and let them sleep at night,” said Fernandez.

Space efficiency tops sustainability as a priority

AutoStore's survey found that energy efficiency (55%), reducing waste (46%), employee well-being (43%), reducing storage footprint (39%), and recycling (36%) were the most important initiatives.

Conversely, when executives were asked what brands are looking for from ASRS providers, sustainability decreased in priority (13%).

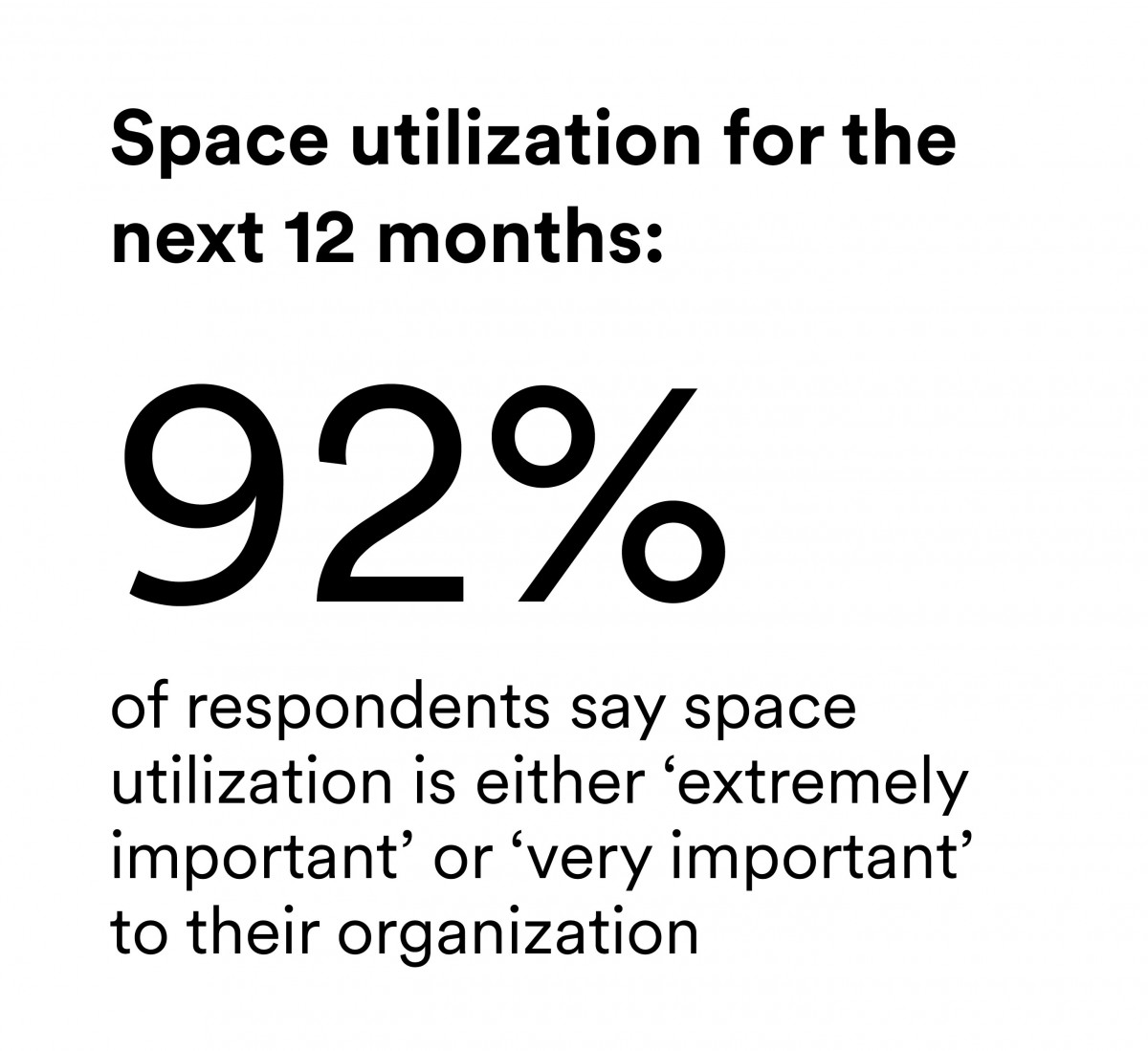

In comparison, respondents cited reliability (24%), simplicity (22%), and space utilization (20%) as more important attributes. According to AutoStore, 43% said saving space will be mission-critical to their business, and 49% cited it as a very important business priority.

“Space is critically important for organizations. We help businesses reduce costs, become more efficient, and deliver a complete ROI [return on investment] in one to three years, while reducing a warehouse footprint by 75% when compared to conventional storage,” said Brune. “Optimizing space closely aligns with the challenge of rising costs.”

AutoStore to continue evolving in 2023

In the past year, AutoStore released its R5+ bin-handling robot, made its Bin Lift 2.0 available in North America, and launched its first public-facing port for consumers to shop online and pick up orders directly from its ASRS. It also introduced the cloud-based Unify Analytics tool and the Pio system for small and midsize businesses, noted Fernandez.

“We want to maximize support for different channels,” he said. “Data from all our installations around the world allows us to further improve our platform, provide insights, and provide condition-based predictive maintenance to give full control to customers.”

“In 2023, we see some hesitation with big investments, with the cost of capital increasing,” Fernandez added. “We're offering more flexible financing models, including a pay-per-pick model where we own the robots and workstation to help companies start with a smaller footprint. We're investing in micro-fulfillment, bringing automation closer to consumers—not only in grocery, but also in other verticals.”

“Another focus area is high-throughput, mega facilities with several million bins or SKUs served on a daily basis,” he said. “These installations are handling much higher volumes that in previous years, based on our omnichannel Router software. How can we reduce the amount of conveyors? Mobile robots are also attractive, since they offer flexibility and ease of installation.”

“At the end of the day, flexibility and scalability are key,” concluded Fernandez.

About the Author

Follow Robotics 24/7 on Linkedin

Article topics

Email Sign Up