Last year, mergers between robotics startups and special-purpose acquisition companies, or SPACs, were all the rage. Occasionally, however, some deals don't work out. Integrity Implants Inc., which does business as Accelus, last week said that it and CHP Merger Corp. have mutually agreed to terminate a business combination agreement “as a result of market conditions.”

“In light of market conditions, we believe that this strategic pivot will best enable our team to execute on our mission to transform the spine surgery space by accelerating the adoption of MIS [minimally invasive surgery] as the standard of care,” said Chris Walsh, co-founder and CEO of Accelus. “We continue to see accelerating demand for our highly differentiated product portfolio, and for robotic-enabled minimally invasive techniques specifically, both in hospitals and ASCs [ambulatory surgery centers].”

Founded last year, Accelus said it is developing enabling technologies for spinal surgery, including a proprietary surgical robotic targeting and navigation platform and implant systems. The Palm Beach Gardens, Fla.-based startup said it offers a portfolio of implants, instruments, biologics, and technologies to address the clinical challenges associated with minimally invasive spinal surgery.

Accelus addresses limitations of existing systems

Accelus said its FlareHawk Interbody Fusion System “features proprietary multidirectional expansion technology, designed for minimal disruption to the patient’s anatomy during insertion and natural load distribution and support.”

The company also offers the Robotic-Enabled Minimally Invasive (REMI) robotic targeting and navigation platform. It claimed that REMI “provides an efficient and economically accessible solution to a broad array of spine surgeons.” REMI was first used in successful MIS procedures at the Baptist Memorial Hospital-Memphis in December 2021, said Accelus.

The stated goal of Accelus' implants and instruments, as well as its robotic targeting and navigation platform, is to address the limitations of existing MIS procedures and widen access to technology for facilities beyond hospitals, such as ASCs.

“As we look ahead, I am confident that our team is more focused than ever on addressing critical constraints related to cost and efficiency and on fulfilling a significant unmet need,” Walsh added. “We are grateful for the support we have received from the CHP team and their enduring commitment to advancing MIS spine surgery.”

Surgical robotics market to keep growing

While robot-assisted surgical systems take years to develop and face the U.S. Food and Drug Administration (FDA) approval process, analysts expect the market to continue growing. The cost of surgical robots is a major hurdle for wider adoption.

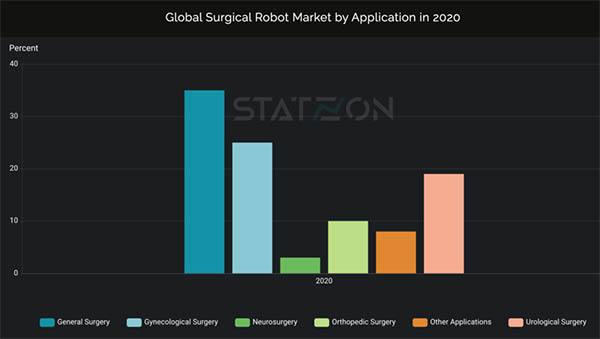

Still, the global market for robotic surgery could grow from $6.4 billion in 2021 to $14.4 billion in 2026, experiencing a compound annual growth rate (CAGR) of 17.6%, according to Markets and Markets. Similarly, Statzon predicted a 13.8% CAGR, from $5.4 billion in 2020 to $15 billion in 2028.

Grand View Research Inc. was even more bullish, projecting a CAGR of 19.3% to $18 billion between 2022 and 2030, while Emergen Research was more cautious, forecasting a CAGR of 24.6% from $2.04 billion in 2020 to $11.94 billion in 2028.

CHP to liquidate stock

Accelus and CHP (for Concord Health Partners) originally announced their plans to merge in November 2021. Despite going their separate ways, the Summit, N.J.-based SPAC said it remains supportive of Accelus' concept.

“Accelus has developed a revolutionary portfolio of MIS implant solutions and robotic targeting and navigation technology that delivers an extremely compelling value proposition with improved quality and outcomes at a significantly lower overall cost of care,” said Joseph Swedish, chairman of CHP. “With a strong and capable management team and great commercial momentum, Accelus is well-positioned to be the market leader in MIS. We look forward to finding other opportunities to collaborate and support Accelus in the future.”

Pursuant to its amended and restated certificate of incorporation, CHP will liquidate common stock issued in its initial public offering (IPO). It will distribute the stock to holders who have not previously redeemed their shares their pro-rata portion of the funds held in the trust account established for their benefit.

The amount will equal to the aggregate amount on deposit in the trust account, said CHP. This includes any amounts representing interest earned on the trust account, less any interest to be released to CHP to pay its franchise and income taxes, estimated to be less up to $100,000 of such net interest to pay dissolution expenses.

CHP added that it will liquidate and distribute the stock on April 25. As provided for in CHP’s Current Report on Form 8-K, filed with the U.S. Securities and Exchange Commission (SEC) on Nov. 22, 2021, the company will not fund a monthly contribution into the trust account on April 26.

Article topics

Email Sign Up