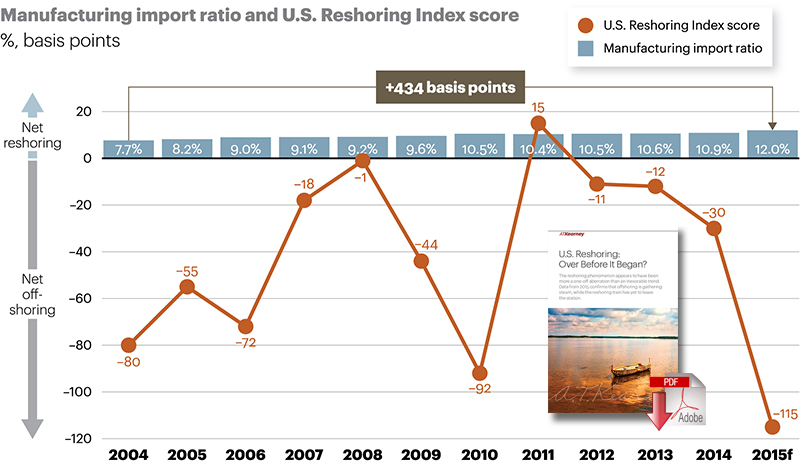

In 2015 the A.T. Kearney U.S. Reshoring Index dropped to -115, down from -30 in 2014, and represents the largest year-over-year decrease in the last 10 years.

Even if the effect of raw material price declines is discounted by, conservatively, holding manufacturing input values constant relative to 2014 while ignoring that same effect on the value of offshore manufactured goods, the U.S. Reshoring Index would drop to -26, still supportive of the view that the widely predicted reshoring trend seems to be over before it started.

Interestingly, foreign companies, including many from China, are the ones most eager to invest in U.S. manufacturing.

Patrick Van den Bossche, A.T. Kearney partner and co-author of the study, stated, “The U.S. Reshoring phenomenon, once viewed by many as the leading edge of a decisive shift in global manufacturing, may actually have been just a one-off aberration. The 2015 data confirms that offshoring seems only to be gathering steam, while the U.S. reshoring train that so many predicted has yet to leave the station.”

The A.T. Kearney U.S. Reshoring Database, which holds roughly 700 reshoring cases that have been announced over the last five years, is forecasting only around 60 reshoring cases for 2015, which is a considerable drop from 2013 (210 cases) and 2014 (208 cases).

Offshoring of U.S. Manufacturing has Consistently Outpaced Reshoring

Industries vulnerable to rising labor costs in China have been successfully relocating to other Asian countries, rather than returning to the United States. They have done so without incurring significantly higher supply chain costs, despite the weaker infrastructure and supporting ecosystems of these new low-labor-cost destinations. Vietnam has absorbed the lion’s share of China’s manufacturing outflow, especially in apparel. U.S. imports of manufactured goods from Vietnam in 2015 will be nearly triple the level of imports in 2010.

Study Findings

The A.T. Kearney U.S. Reshoring Index and the U.S. Reshoring Database provide a number of insights on the factors driving imports of offshore manufactured goods and manufacturing reshoring. Many of the report insights run counter to the points of view and “hype” regarding reshoring of manufacturing to the United States.

- Surprisingly, some of the top sectors for reshoring from 2011 to 2015 are also sectors that have led the pack in further offshoring over that same period.

- The recent increase of nearshoring to Mexico also seems to indicate that, even if U.S. companies consider leaving Asia, they may choose to stop south of the border.

- The forecast strengthening of the dollar, the oil price slide, the tightening U.S. labor market in manufacturing and the Trans-Pacific Partnership (TPP), if ratified by the U.S. Congress, will likely further weaken the case for reshoring in 2016.

- Although reshoring of manufacturing by U.S. companies is on the decline, non-U.S. companies, including Chinese companies, increasingly invest in establishing or expanding their manufacturing footprint in the United States. The insatiable U.S. consumer market, the stable political and economic environment, and the benefit of tapping into America engineering skills and manufacturing know-how are main draws.

Pramod Gupta, A.T. Kearney partner and co-author of the U.S. Reshoring Index, stated, “These findings show that executives whose job it is to make critical business decisions based on what the future holds, need to constantly evaluate global currencies, labor rates, and energy costs, and reassess their manufacturing footprint, and that of their suppliers, on an ongoing basis to see if the boundary constraints have changed enough to warrant an adjustment.”

Supply Chain Management Review Article: Solving the Reshoring Dilemma (PDF)

About the A.T. Kearney U.S. Reshoring Index

The objective of the A.T. Kearney U.S. Reshoring Index is to assess actual reshored manufacturing by aggregating actual U.S. manufacturing and import data. The annual growth of both manufactured goods imports from key offshore trading partners (China, Taiwan, Malaysia, India, Vietnam, Thailand, Indonesia, Singapore, Philippines, Bangladesh, Pakistan, Hong Kong, Sri Lanka, and Cambodia) are analyzed along with U.S. manufacturing gross output. We next calculate a simple ratio of annual offshore manufactured goods import values to U.S. manufacturing gross output, summarized as the manufacturing import ratio. The U.S. Reshoring Index tracks the year-over-year spread in the manufacturing import ratio, measured in basis points.

Related: A.T. Kearney’s Study on Reshoring is Just Plain Wrong

Article topics

Email Sign Up