Over the next five years the global automotive industry faces a reduced market growth, down from an annual 3.1% (between 2007 and 2014) to an annual 2.6% (between 2015 and 2021).

At the same time the industry must invest tens of billions of Euros in C.A.S.E. capabilities, which stands for (C) car connectivity, (A) autonomous or assisted driving, new mobility or car (S) sharing, and (E) electrified powertrains and components.

But the industry’s earnings are currently insufficient to this enormous task, especially for some volume manufacturers. In order to muscle the necessary investments the auto business will see a series of alliances and mergers over the next years.

This is according to a new study, “C.A.S.E. – Car of the Future: The AlixPartners Global Automotive Outlook 2015,” by AlixPartners, the global business-advisory firm.

“We expect a considerable wave of consolidation and partnerships in the auto industry,” said Stefano Aversa, Vice Chairman at AlixPartners. “It may start with the merger of two OEMs, but will also encompass the suppliers and new entrants from the technology sector.”

Global Automotive Market Growth Slows Down

The global light vehicle market will see a reduced annual growth rate of 2.6% for the next seven years, as opposed to 3.1% between 2007 and 2014.

The BRIC countries, the engine of automotive growth for over a decade, are now drifting apart: Brazil has fallen back to 2009 level while taxes and interest rates go up, currency devalues and consumer spending remains low.

The Russian economy is hit by low oil prices and international sanctions, with devaluation and rising interest rates depressing consumer spending and new car sales. Currently Russia faces a recession of unclear duration. India, on the other hand, may finally fulfil some of its promise with robust annual automotive growth of 7% during the next five years, although from a low basis and with low priced cars.

China continues to be the main engine of the growth which slowed down, but is still robust. In the last 7 years China provided 15 out of the 16 million vehicles worldwide growth; in the next 7 years China is expected to provide 9 out of 19 million growth, with other countries, including central-southern Europe contributing.

While the economy grows at an average of 6.8% per year, auto sales are expected to rise only by 4.1% per year. However, the slow-down will increase price pressure in the Chinese auto market and put a squeeze on the margins.

Vehicle demand in the triad countries is saturated at a predicted compound annual growth rate of barely 1% until 2021.

In North America the US automotive boom of the last few years might reach a peak in 2017 and face a downturn after then. In Japan and Korea the market will continue to recede at an average of -2% per year.

The European market will finally recover from its long slump, and deliver annual growth rates of 2.2% over the second half of the decade, if the political and economic situation in Russia stabilizes.

C.A.S.E. Investments for Car of the Future Increase

The acronym C.A.S.E. summarizes the four main development tasks the auto industry needs to master within the next decade: Connectivity, Autonomous driving, Sharing, and Electrification.

These requirements trigger investment needs on top of normal development work for new vehicles and powertrains and will bring significant changes, not only to the existing technology and supply chain, but also to established business models, and profit pools. The industry’s future profit pools will be closely linked not only to the hardware, but increasingly to the car’s software and to real-time data collection and application.

Both software and data based online services will define the future user experience of cars to a very high degree, and the automotive industry must make sure not to lose this critical part of the business to software and internet players.

Embedded Systems to Lead the Way

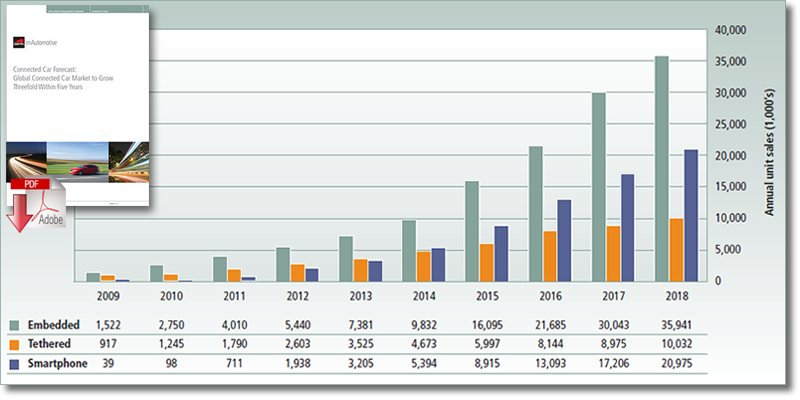

Using a bottom-up methodology, SBD forecasts that almost 36 million new cars will be shipped globally with embedded telematics by 2018 - 31% of the total number of cars shipped in that year. That compares with 5.4 million in 2012. An embedded solution is defined as a system, such as BMW ConnectedDrive and GM Onstar, in which both the connectivity and the intelligence are embedded into the car.

Smartphones to Play a Major Role

SBD forecasts that almost 21 million of the cars sold in 2018 will be fitted with so-called smartphone integration systems (18% penetration). In 2012, 1.9 million cars shipped with smartphone integration solutions, such as Ford Applink or Toyota Entune, which rely on all or some of the intelligence being hosted on the owner’s smartphone.

Tethering to See Steady Growth

SBD expects 10 million of the cars sold in 2018 to be fitted with tethered solutions (9% penetration), up from 2.6 million cars in 2012. These tethered systems, such as Mercedes Command, rely on intelligence embedded into the car, but use the owner’s mobile phone for connectivity.

The four fields of C.A.S.E. are closely linked with each other, especially connectivity is an enabler for practically all aspects of the car of the future.

Connected: Over the next four years, the global market volume for connectivity services and hardware will double from an estimated $20bn to $40bn, and more than half of it will be services and apps. During the past decade automotive OEMs have shifted from traditional, hardware-centric in-vehicle infotainment and communication systems to software based connectivity solutions.

According to data from GSMA Connected Car Forum more than 20% of vehicles sold worldwide in 2015 include embedded connectivity solutions and more than 50% of vehicles sold worldwide in 2015 to be connected – either by embedded, tethered or smartphone integration. Moreover, it is very likely that every new car to be connected in multiple ways by 2025, according to the study’s findings.

Autonomous: The self-driving car does not come in one big bang. It is a gradual development, and with self-parking assistants, adaptive cruise controls and lane keeping assistants the first steps have already been taken. In five to ten years, fully autonomously driving cars with “hands-off experience” will be technically feasible on motorways, but we expect that liability questions and driving constraints will limit the use of autonomous car to specific applications and to defined environments. Nationwide autonomous driving infrastructures may not be available before 2035. As yet, there are only few key suppliers for complete autonomous technologies, even on a global basis.

Shared: Nearly all OEMs have started to experiment with car sharing, mostly in cooperation with car rental companies. However, in order to build a leading car sharing business, up-front investments are high and earnings difficult to sustain, as the leader, Zipcar, shows. However, car sharing shows a steady growth of some 30% per year, so a foothold in this market may prove to be a crucial strategic asset in the future. Moreover, car sharing is one example of a new ownership approach that many are investing in, be it with specific-use vehicles from GM or Toyota, new business models from Uber or multi-modal mobility solutions from other players.

Electrified: Despite a sales growth of 60% in 2014, EVs remain a niche market with a global share of 0.4% in total sales. But the electrification of the drive train is here to stay. Electric drive trains are also used in hybrids, in range extenders, and in fuel cell cars. More than 50 models are currently available worldwide, and the forecasts predict annual growth rates between 24% and 31% until 2025. This means that many traditional drive train components will gradually change, and supplier sweet spots will start to shift. In a full EV the battery makes up for some 50% of the production costs, while a complex transmission is not necessarily needed. Because moving parts can be reduced by over 50%, electric drivetrains will also have reduced overall service needs.

Looking at the progress, C.A.S.E. implementation still shows many unresolved issues. Technology development and customer acceptance are way ahead of the respective regulation and infrastructure. Liability rules for autonomous driving are missing in total, V2X connectivity standards and protocols still need to be defined, and infrastructure build-up for EVs is in its infancy. As yet, there are some 100,000 charging stations (not all operational) for 700,000 EVs worldwide. EVs will need government help to start and other than Norway, few countries have effective programs and funding allocation for bringing EV markets to scale. However, due to heavy pollution in many urban areas, regional EV privilege zones can be expected to increase. In Europe alone, more than 200 cities already have a low emission zone in operation or are planning such a zone.

“C.A.S.E. is the future of the industry, and no one can afford to stay behind. But the development will cost the auto industry tens of billions of dollars,” said Aversa. “And that is just additional to all the on-going development projects concerning safety, fuel efficiency, comfort, and so on. Nevertheless, it is unlikely that new entrants from the IT-sector are buying an auto-maker because of auto-industry’s relatively low margins versus heavy investments. IT-players seem to be rather interested in earning higher margins with the data.”

Industry Consolidation Expected

In the past decade, the global automotive industry directly reinvested its available income in capital expenditures and R&D for the most years. While this situation has markedly improved over the past years, it is not true for the average of the volume producers like FCA, Ford, PSA, or Renault-Nissan. Also from a sales perspective, these companies have come under pressure from premium brands, raiding their territory with smaller models, and from value brands like Dacia or Hyundai/Kia, offering much the same for a lower price.

“Most OEMs, especially the mass market players, will need to find ways of funding the additional CapEx and R&D investments required to master the Car of the future/C.A.S.E.-challenges ahead”, said Aversa.

On the top of that, AlixPartners expects overcapacity to build up in emerging markets such as Brazil and in Russia, with utilization levels dropping to 50% in Brazil or even down to 35% in the case of Russia. In Europe, the expected market growth will not suffice to fill the already existing overcapacity.

During the past decades, mergers in the car industry followed several waves. A wave of geographical expansion included the take-over of Mazda by Ford and a wave of expansion between premium and volume players such as Ford and Jaguar, Daimler and Chrysler. That wave was followed by liquidity-driven M&A, such as the Renault and Nissan alliance, or the Fiat and Chrysler merger. Recently, a wave of technology and brand-driven M&A could be observed with emerging Chinese and Indian players acquiring Western OEMs and brands, such as Tata with JLR, or Geely with Volvo.

However, this new potential M&A wave driven by scale and return on capital is not a quick fix. Synergies can improve profitability by 1.5-2%-pts but typically need at least five years to fully materialize and trigger one-off cost in early days. Strong proven leadership and careful execution is key to manage challenges such as integrating product and technology portfolios and integrate organizations cultures and dealing with local political and economic interests. These aspects are absolutely paramount to tap the full synergy potential.

About the Study

“C.A.S.E. – Car of the Future: The AlixPartners Global Automotive Outlook 2015” is based on expert interviews and financial analysis of more than 300 global suppliers and global automakers.

Read: Auto Makers Tell Technology Partners “Keep Your Hands Off Our Data”

Article topics

Email Sign Up