Wohlers Associates Inc., an analyst firm that focuses on 3D printing (also called additive manufacturing or AM), has just released an annual report detailing the state of the industry.

According to the press announcement from Wohlers, “The AM industry grew by 17.4% in worldwide revenues in 2016, down from 25.9% the year before, according to the new report. Much of the downturn came from declines by the two largest system manufacturers in the business. Together, they represent $1.31 billion (21.7%) of the $6.063 billion AM industry ... If these two companies were excluded from the analysis, the industry would have grown by 24.9%.”

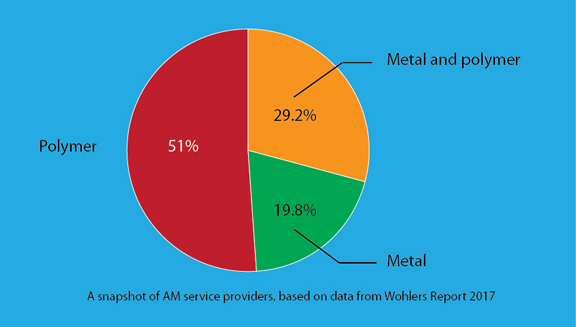

Wohlers Assoc. publishes 2017 report on 3D printing market. Data reveals nearly half of the service providers surveyed offer metal printing (chart by DE, based on data from Wohlers Assoc.).

Wohlers Assoc. publishes 2017 report on 3D printing market. Data reveals nearly half of the service providers surveyed offer metal printing (chart by DE, based on data from Wohlers Assoc.).Explanation for the Momentum Change

Terry Wohlers, principal consultant and president of Wohlers Associates, attributes the revenue dip in 2017 to a combination of factors. “An election year creates uncertainty,” he points out. “The introduction of the HP machine has caused some to push the ‘pause’ button on major investments in equipment. Weakness by the two largest companies in the business contributed to the downturn more than anything else. While 17.4% is down from the year before, it’s still pretty darn good. Most industries would love to see growth at this level.”Because of the enthusiasm for 3D printing in the consumer sector, some professional AM vendors expanded their reach with the launch of smaller, inexpensive consumer-friendly models. Others use acquisitions to increase their footprints. Stratasys’s acquisition of MakerBot in 2013 was an example of this strategy.

“We believe that relatively few consumers are buying [the consumer models]. Most are being sold to companies and educational institutions. The market for low-cost, desktop 3D printers grew by 49.4% worldwide, compared to 14.9% for 3D printing systems at all price levels,” says Wohlers.

New Audience for Consumer Models, New Markets for 3D Printing

Because of their affordable price point and ease of use, the consumer models may have found a place in the professional market, among engineering and architecture firms that benefit from having on-premise rapid prototyping equipment. That could explain the robust sales growth of the consumer models despite the consumers’ reluctance to purchase them.Initially 3D printers used polymers to produce quick prototypes and scale models. But in the recent years, vendors began exploring ways to print metal parts, driven in part by automotive and aerospace manufacturers’ desire to use AM to produce end-use parts and components. According to the 2017 Wohlers report, “Nearly half of all AM service providers surveyed are running AM systems that produce metal parts.”

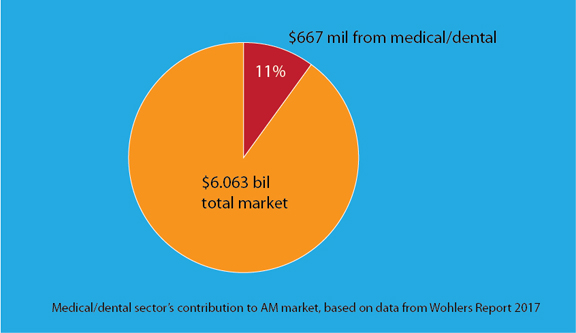

The emerging medical and dental segment contributed $667 million, accounting for roughly 11% of the market’s $6.063 billion total in 2016, according to Wohlers.

According to the Wohlers Assoc. 2017 report on 3D printing market, the medical/dental sector contributed roughly 11% to the overall market revenue (chart created by DE based on data from Wohlers Assoc.).

According to the Wohlers Assoc. 2017 report on 3D printing market, the medical/dental sector contributed roughly 11% to the overall market revenue (chart created by DE based on data from Wohlers Assoc.).The 344-page Wohlers Report 2017 includes 28 charts and graphs, 26 tables, and 232 photographs and illustrations. It also includes more than 160 pages of supplemental online information that is available to buyers of the report. For more, visit http://wohlersassociates.com/2017report.htm.

About the Author

Follow Robotics 24/7 on Linkedin

Article topics

Email Sign Up