Wal-Mart Stores Inc expects its profit to take a hit as the world’s biggest retailer works to fend off intensifying competition by perking up customer service and adapting to changing shopping habits.

The company that is known for its low prices and sprawling supercenters also forecast sales for its full fiscal year to be flat, hurt by unfavorable currency exchange rates. Wal-Mart had previously forecast sales growth of 1 to 2 percent.

For its next fiscal year, it said profit could fall by as much as 12 percent.

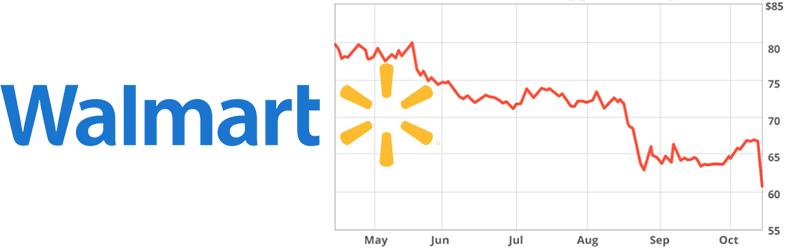

Its shares tumbled nearly 9 percent to $60.83, which put them on track for their steepest one-day fall in more than 15 years.

The disappointing guidance comes as Wal-Mart Stores Inc. works to fix its U.S. business amid pressure from rivals including traditional grocers, dollar stores and Amazon.com.

At its annual meeting in New York City Wednesday, CEO Doug McMillon sought to reassure investors that the company transforming to keep up with a rapidly changing retail landscape.

“We all know that retail has changed and will continue to change at an accelerating pace,” said McMillon, who took the job in February 2014.

Under McMillon, Wal-Mart has accelerated the openings of smaller stores, which tend to be more conveniently located and let customers get in and out faster. The company is also stepping up its e-commerce efforts. On Wednesday, it said it was expanding its online grocery with free pickup to 10 additional markets, making the service available in a total of 20 markets in the U.S.

Such moves, along with a push to improve the cleanliness of its U.S. stores, are expected to help attract more higher-income customers than in the past, McMillon said. But he noted the company would also remain focused on shoppers who are driven by value.

Wal-Mart is under pressure on that front as well, with smaller discounters posing a greater threat. The company said its store brands will play a key role in addressing the “price gap” between itself and discounters.

For its fiscal 2017, Wal-Mart expects earnings per share to be down 6 to 12 percent. The company attributed a big portion of the decline to its investment in raising wages and providing more training for workers, which Wal-Mart is hoping will lead to improved service.

Wal-Mart, which is facing pressure from worker groups calling for better pay, increased its minimum wages for U.S. employees to $9 per hour in April. The figure will rise to $10 per hour by February 2016.

Walmart to Invest $1.1 Billion in E-Commerce in FY 2017

The retail giant said it has drawn up a three-year plan that includes capital investments of about $11 billion in fiscal 2017 and another roughly $1.1 billion to be spent on e-commerce and digital initiatives.

The retailer made this projection today, at its 22nd annual meeting for the investment community. Walmart added that it is also planning to spend about $11 billion in total capital investments for the fiscal year, plus about the same amount in fiscal years 2018 and 2019 - and slightly below this year’s estimate of about $12.4 billion, due to a moderation in its physical store expansion.

“Fiscal year 2017 will represent our heaviest investment period,” Chief Financial Officer Charles Holley said in a statement. “Operating income is expected to be impacted by approximately $1.5 billion from the second phase of our previously announced investments in wages and training as well as our commitment to further developing a seamless customer experience.”

The investments are part of a strategy designed to drive sales growth by strengthening Walmart’s businesses in both the United States and e-commerce, the company said.

“These are exciting times in retail given the pace and magnitude of change,” said Doug McMillon, Walmart’s president and CEO.

“We have strengths and assets to build on and are making progress to position the company for the future. We’re encouraged by recent customer feedback and will continue to get stronger. Our investments in our people, our stores and our digital capabilities and e-commerce business are the right ones. We will be the first to build a seamless customer experience at scale to save our customers not only money but also time.”

While the company’s increased investments have helped to perk up sales and traffic at its stores, they’ve squeezed profits. In early October, it laid off 450 workers at its corporate headquarters as part of a push to become more nimble. There are more than 18,000 people who work at the headquarters in Bentonville, Arkansas.

Last year, McMillon also replaced Wal-Mart’s U.S CEO with Greg Foran, who was previously head of Wal-Mart China business. Foran is spearheading a major overhaul of its U.S. business, which account for 60 percent of its total business.

It’s trying to make sure its stores are cleaner and well stocked. The stores have been criticized for messy aisles and not having enough workers on the selling floor to restock shelves.

By fiscal 2019, the company expects earnings per share to be up 5 to 10 percent from this year.

The company had lowered its profit forecast for this fiscal 2016 in August, saying it expects earnings to be between $4.40 and $4.70 per share, down from $4.70 to $5.05 per share.

The company also authorized a $20 billion share buyback program for the next two years.

Related: Walmart Steps Up Rivalry With Amazon Prime

Article topics

Email Sign Up