“Sometimes you’ll be out on the highway, you see two giant trucks loaded up with logs, and they pass each other on the highway… I don’t understand that. I mean, if they need logs over there… and they need ‘em over there, you’d think a phone call would save ‘em a whole lot of trouble.”

Brian Regan, Comedian

After news broke last month that Uber was unleashing a trucking offering, it came as no surprise when it launched Uber Freight, an online trucking marketplace for US LTL.

There are two stages to this logistics play:

- Leveraging load-matching technology to connect carriers with customers.

- Rolling out a fleet of autonomous trucks (quite possibly owned by Uber) with its $680 million acquisition of Otto.

Load-matching technology (even the Uber For Freight model) isn’t new. What is new is the scope of Uber’s operations, their sophistication of their load-matching technology and, perhaps most exciting, Uber-owned infrastructure (including both self-driving trucks and flying cars).

Read: Armstrong Highlights the Inaccuracy of the Term “Uber for Trucking”

So what does this all mean for the industry?

Technology, Infrastructure: Make Freight Great Again

Trucking has been steadily evolving for over 60 years.

Two major developments - the Interstate highway system and deregulation - changed US trucking in the past 50 years.

The Federal Aid Highway Act of 1956 enabled unfettered national transportation with four lanes and no traffic lights.

The next boost came in 1980, when the Motor Carrier Act eliminated excessive regulation from the Great Depression, pushing trucking prices down by 50%-75% and, as intended, made competition more fierce.

Technology connecting customers and truckers is far from a new idea.

US domestic trucking has been shifting towards technology for nearly 50 years. Truckers and customers used to coordinate loads through bulletin boards at truck stops.

This was digitized when Dial-a-Truck (now called DAT) launched a telephone freight matching service in 1978, followed by an electronic version years later.

Electronic load boards evolved into a $150 billion dollar freight brokerage market, with brokers leveraging sophisticated technology to manage both inbound and outbound shipments for clients.

So domestic trucking in the United States has two key drivers (pun very much intended) - incredible infrastructure and outstanding technology.

Together, they helped lower the US’s percentage of GDP spent on logistics to “only” 8.2%, compared to around 18% in China and well over 20% in less developed countries.

What Uber’s Announcement Means

In 2015, trucking revenue reached $726.4 billion dollars, with 3.6 million trucks moving 10 billion tons of freight. That’s a lot of freight. But it can get more efficient.

As a matter of fact, there are at least 10 companies that have billed themselves as an “Uber of freight,”:

| Company | Established | Funding | Notes |

|---|---|---|---|

| 10-4 Systems | 2012 | $13.9m | Spun off from GlobalTranz (July 2016). Offers multiple trucking technology solutions. |

| Cargo Chief | 2012 | $10m | |

| Cargomatic | 2013 | $20.8m | Recently faced difficulties after pivoting to freight broker model |

| CargoX | 2013 | $15m | Brazil-based with funding from Uber co-founder |

| Convoy | 2015 | $18.5m | Investors include Amazon’s Bezos, Salesforces’ Benioff and eBay’s Omidyar |

| DAT Solutions | 1978 | N/A | Began as telephone matching service. Owned by Roper Industries (S&P 500 company) |

| LaneHoney | 2012 | N/A | |

| Transfix | 2013 | $36.5m | |

| Trucker Path | 2014 | $20m | Focus on long-haul, not local |

| TugForce | 2015 | N/A | Platform launch in May 2016 |

Writing on the Wall

Uber’s move is no surprise. Uber CEO Travis Kalanick was talking about logistics back in 2014 (although he called it “icing on the cake” back then). Acquiring an autonomous trucking company was another clear indicator, as was the 2015 Uber Cargo test runs in Hong Kong.

Finally, when Uber handed Uber China over to hometown rival Didi Chuxing in August 2016, Kalanick’s letter to employees also mentioned the shift:

This merger paves the way for our team and Didi’s to partner on an enormous mission, and it frees up substantial resources for bold initiatives focused on the future of cities - from self-driving technology to the future of food and logistics. (via Tech In Asia)

But here’s the thing. Uber-for-freight technology isn’t (so) new.

What is new is Uber-for-freight technology backed by this magnitude of capital and with the promise of infrastructure. There’s a huge potential for vastly lower-priced (and more efficient) autonomous trucks, as well as autonomous cargo planes.

The autonomous component does introduce a fundamental industry shift. Interestingly, this also represents a shift for Uber. Once Uber owns the trucks carrying its goods, it moves away from the marketplace model in the taxi space and becomes an asset-heavy carrier.

Until then, Uber’s marketplace for les- than-truck loads is an evolution in US trucking efficiency, not a revolution.

What’s Working for Uber Freight

Beyond the dominant brand - even its trucking competitors call themselves “Uber for trucking,” - Uber has four competitive advantages:

- Deep Pockets: Uber has raised $8.7 billion dollars, enough to dig in for the long-haul in the long-haul space

- Technology: Field-proven technology for passenger travel can easily power more efficient truck matching (think surge pricing!)

- Global Distribution: As of August 2016, Uber was active in 66 countries and 515 cities, creating a powerful footprint ready to be leveraged.

- Autonomous Vehicles: This is the real revolution that could change US trucking …and live testing of Otto on the open road, means it’s not so far away. Autonomous vehicles not only save the cost of the driver but also the limitation on number of hours driven per day.

Why It’s Not A Done Deal

Despite rampant global success, Uber doesn’t have a perfect track record.

- Experiments for consumer cargo fulfillment in Hong Kong were unsuccessful - Uber Cargo launched in January 2015, but ended operations in August 2016.

- Uber’s parcel delivery service, UberRUSH, is encountering rigorous competition from Postmates.

- Didi Chuxing, which also has deep pockets from the likes of Tencent, Alibaba and Apple, showed that even Uber’s core business isn’t infallible, beating out Uber for the China taxi market.

- Finally, Uber Freight is now coming up against multiple Uber-for-Trucking companies (albeit with a huge branding advantage).

Logistics Technology Going Forward

No matter what happens, more technology in the space means more efficiency. Domestic US trucking has traditionally been an early technology adopter.

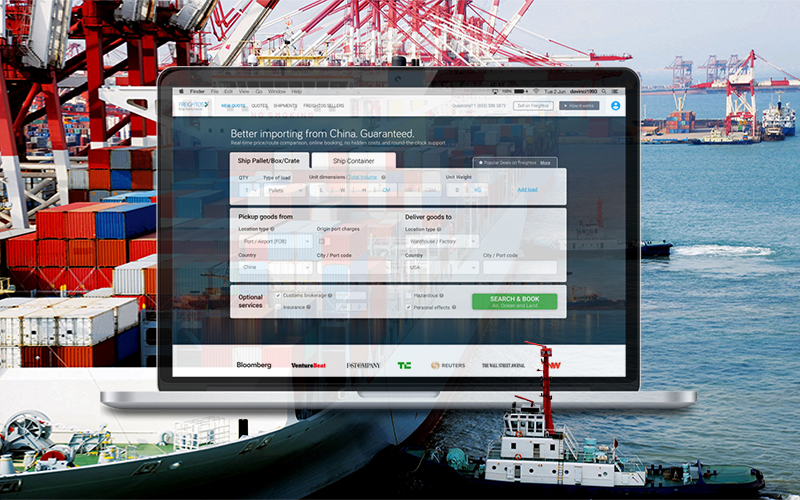

With Freightos’ push to bring international logistics online with the online freight marketplace, we’ve seen time and time again that technology that’s taken for granted in courier delivery (one day delivery, anyone? On-line tracking?) or trucking is non-existent in international freight. That matters. It maybe be 1,100 trucking miles from the Port of Long Beach to Denver, Colorado, but it’s 7,250 miles by boat first.

Either way, more attention to the LogTech space, whether from startups, legacy enterprise forwarders or giants like Amazon and Uber, is finally bringing efficiency to the global logistics industry, which moves $19 trillion dollars of goods a year.

And that’s a great thing.

Related Article: Launch of First International Freight Marketplace to Power $2 Trillion Worth of U.S. Annual Imports

Article topics

Email Sign Up