Writing to his cousin after a long illness, Mark Twain assured her that “the reports of my death have been greatly exaggerated.” It appears that the same can be said of our West Coast ports, whose demise seemed certain in the aftermath of the catastrophic labor management struggle of 2014.

But despite that episode, the Pacific Rim gateways have roared back, handling more cargo than ever, while attracting fleets of “mega-carriers” that the newly-expanded Panama Canal will never be ever to accommodate.

The long-anticipated Panama Canal expansion has been finally announced for June 27—more than two years after the original deadline.

Is it any wonder that carriers grew tired of waiting?

The CMA CGM Group, for example, began deploying its flagship fleet of six 18,000 twenty-foot equivalent unit (TEU) vessels between Asia and the U.S.

West Coast last month. This decision was in line with both the growth strategy set by the group in the United States and around the world as part of the optimization of its “mega” ships.

Spokesmen say that the flagship fleet of the group is serving shippers on the most active and dynamic market to date—the trans-Pacific—and supports its ongoing development. In total, six ships of 18,000 TEUs have joined the Pearl River Express service—ships that are among the largest in the world.

Meanwhile, the Pacific Maritime Association (PMA) and the International Longshore and Warehouse Union (ILWU) have pledged to get an early start on contract negotiations in an effort to avoid a recurrence of critical port congestion. A broad coalition of shipper groups is endorsing this effort. In a public letter to Robert McEllrath, president of the ILWU, and James McKenna, chairman and CEO of the PMA, the coalition is urging them to get started.

“These shippers believe a new model for future negotiations needs to be developed, one that stresses early and continuous dialogue,” says Peter Friedmann, executive director of yhe Agriculture Transportation Coalition.

Members of the shipper collective include the American Apparel & Footwear Association, California Trucking Association, Intermodal Association of North America, North American Export Grain Association, Retail Industry Leaders Association and the U.S. Chamber of Commerce.

West Coast rebound

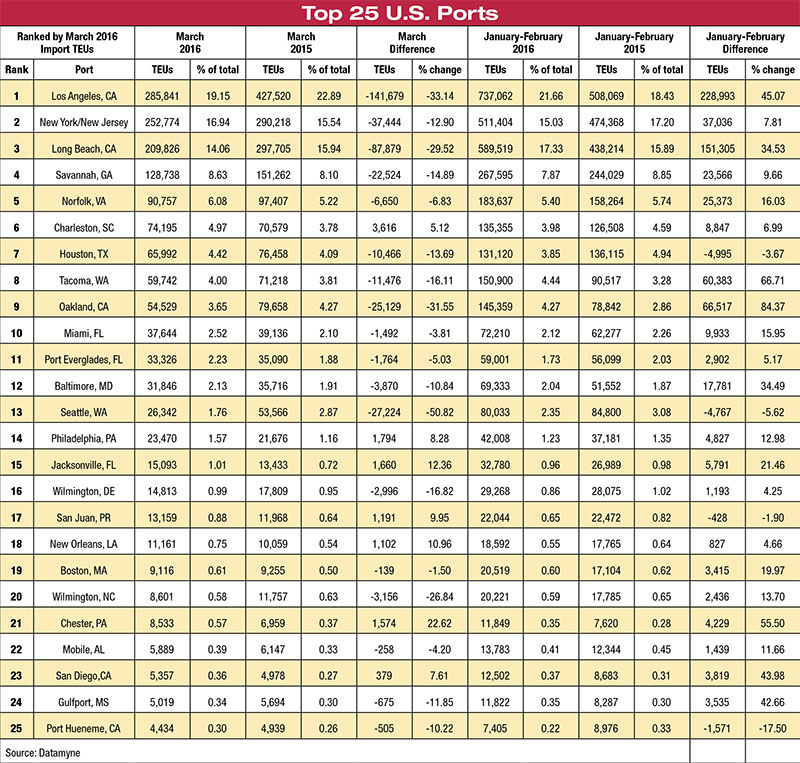

Datamyne, a provider of Web-based international market intelligence, finds that U.S. import volumes, measured in TEUs, have rebounded significantly at West Coast ports so far this year. Imports through the port of Los Angeles increased 36% January through February of 2016 and 30% through the port of Long Beach, compared with the same time period in 2015.

“West Coast ports have indeed made a comeback from the labor disputes and slowdowns that had a negative impact on volumes in early 2015,” says Brendan McCahill CEO of Datamyne. “Combined, Los Angeles and Long Beach made up for 39% of all ocean imports to the United States in January and February of this year, up 4% over the same two months last year.”

The port of Oakland also had a notable 52% increase in import TEUs compared with January and February of 2015.

East and Gulf Coast ports did not see the same sweeping growth. Compared to January through February of last year, the port of New York/New Jersey increased in import volume by 5%, Norfolk was up 17% and Houston declined 4%. The port of Savannah, which looked to have prospered from the western slowdowns last year, has continued to grow by 9% so far this year.

Curiously, some of these ports aspire to host mega-carrier calls this year. Among those who don’t think it will happen is Gerry Wang, CEO of the container carrier leasing giant Seaspan Corp.

“The landside infrastructure is not fully developed to accommodate these huge loads,” says Wang. “Currently, Miami, Norfolk and Baltimore are the only Atlantic U.S. ports that are capable of handling larger ships, while others like New York/New Jersey, Savannah, Charleston and Jacksonville still have harbor dredging work before mega-vessels are able to call there.”

“Big ship obsession”

However, is the “mega-vessel” model about to become moot? Analysts for the London-based consultancy Drewry Maritime Advisors say that, indeed, the current “big ship obsession” may soon come to an end.

The three largest ocean carriers in the world—Maersk Line, MSC and CMA CGM—extended their dominance by taking on the most capacity, with the emphasis placed last year on the big ships.

In fact, deliveries of 10,000 TEU or bigger ships amounted to 55% of all deliveries and now constitute approximately one-quarter of the cellular fleet on the water, having only taken up less than 5% at the end of 2011. That share will only continue to rise as ships of that size currently make up around three-quarters of the total orderbook.

Looking further into the future, ocean carriers will have to continue to juggle new ship capacity with even more dexterity considering that new orders doubled in 2015 to an aggregate capacity of 2 million—90% of which were 10,000 TEU and above. Those will have to find deployment before the decade is out, say analysts.

Most of the new orders occurred in the first nine months of last year as things cooled off in the fourth quarter. New-build prices are still very attractive, and shipyards are very keen to generate business, so the recent slowdown is either a signal that owners have realized that there’s no demand right now for any more new ships or that financial pressure among carriers and non-operating owners is suppressing activity.

“We think there are reasons that the big ship obsession could be about to end,” says Neil Dekker, Drewry’s director of container research.

Recent research done by Drewry suggests that the economic argument for ordering ever bigger ships may diminish and actually be reversed upon reaching 24,000 TEU as ports struggle to turn them around efficiently and the total system cost rises.

“We know that for each individual company the desire for big ships is logical, but the impact on the industry at large has been disastrous, with rock-bottom freight rates that we’re seeing now the end result,” says Dekker.

In fact, carriers are running out of profitable trades to deploy the big ships. “If we’re right that the economic imperative and the financial ability to order these ships is decreasing,” adds Dekker, “we think that there’s a reasonable chance that the much needed breather from new orders will hold firm.”

And if that is truly the case, then the Top 25 U.S. ports may finally be reaching parity.

About the Author

Follow Robotics 24/7 on Linkedin

Article topics

Email Sign Up