The recent economic downturn has turned traditional supply chain models upside-down.

This impact is likely to continue while the economy revs up again and companies revisit their supply chain strategies.

While customers of logistics services reevaluate their approach to manufacturing and distribution, logistics providers — particularly 3PLs — have the opportunity, and perhaps even face the imperative, to offer more encompassing and specialized services.

Deloitte believes the most successful 3PLs in coming years will be those that make the successful and fastest leap to 4PL capabilities.

Times are tough for many third-party logistics (3PL) outsourcers. Bread-and-butter warehousing, transportation, and fulfillment services are now considered commodities by a growing number of customers. Margins are rapidly shrinking as those customers clamor for ever-lower prices even as they demand better and more consistent quality of service.

Related: Top 50 Global & Domestic Third-Party Logistics Providers

Even some 3PLs that offer a broad portfolio of value-added services are struggling.

Customers are holding their feet to the fire, expecting utterly seamless supply chain services that encompass effective practices in people, processes, and technology at the lowest possible expense.

Handle simple logistics at a reasonable price? That‘s no longer a differentiator. Many customers now seek other, value-added capabilities — smoothly integrating new products into the supply chain, disposing of controlled materials while complying with regulations, executing new customer service requirements, and staying on the leading edge of technology. All this needs to plug and play with customers’ businesses without disrupting their operations in any way.

Increasingly, specialization is the catchword. You could be a great 3PL warehouse operator or traffic manager, yet unless you have specific domain knowledge in a particular functional area or industry vertical, you could miss out on potentially lucrative opportunities. For example, a medical device manufacturer might want an outsourcer that intimately understands its business down to pending regulations that could impact it years down the road. A high-tech manufacturer needs a logistics firm with extensive return-and- refurbish experience. Generalists are quickly going out of favor.

Finally, customers’ traditional business models are themselves evolving. The volatile price of fuel and the increased regulation of international markets coupled with the recent global economic downturn and sluggish recovery are forcing manufacturers to rethink their go-tomarket strategies. Forward thinking 3PLs are nimbly and cost-effectively adapting to what are sometimes quite drastic shifts in direction.

Sound daunting? It can be. But we believe there’s good news here, too. The extreme nature of the recent economic downturn changed the cost equation for manufacturers. Those that have survived are squeezing every penny from operations. More are outsourcing functions that aren’t core competencies. So rather than trying to sustain or develop logistics capabilities themselves, they’re finding it easier and more costeffective to hand over their transportation, distribution, and management to third parties that have the expertise, technical competence, and experience to do it all.

So there’s opportunity here. But can you deliver the goods?

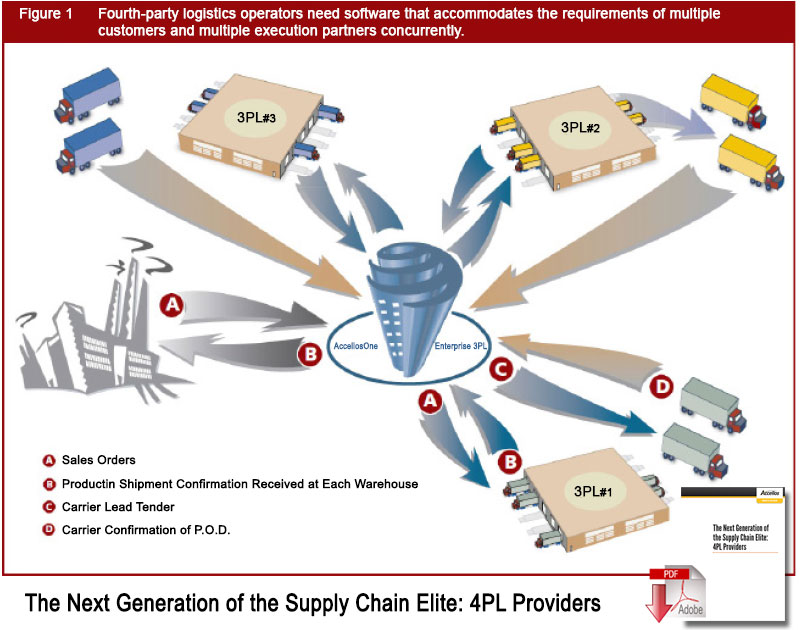

We believe that one way 3PLs can thrive amidst all this chaos is to evolve toward 4PL capabilities. That is, move from simply offering your own portfolio of logistical outsourcing services to subcontracting them to a broad range of more experienced yet specialized supply-chain partners, even including competitors. The goal: to provide a seamless end-to-end experience for your customers.

This means doing everything you’re already doing, but elevating the game to a new level with end-to-end service and management skills.

Finding the path to 4PL

3PLs that don’t take this admittedly big step are likely to struggle in the months and years ahead. After all, more and more of the services they currently provide that are considered value-adding differentiators are going to be commoditized. Ten years ago, claiming 95 percent accuracy when running a pick line in a warehouse was enough to win you accolades.

Today, if you’re not running at 99.8 percent, you can’t even get in the door. If you manage pharmaceutical returns, you’re probably already vying with 30 to 40 other logistics outsourcers across North America. If your cash cycle is 45 to 60 days, and others begin reduce theirs to less than a month, you’ll probably be out.

These and other factors raise significant issues for 3PLs. But for 4PLs, they represent opportunities for new sources of revenue. Although in the past, others’ ability to perform a particular service better than you could was a problem, but now it’s an opportunity. By enlisting them to be part of a 4PL community that you create, you can better position your company to deliver ever more compelling — and higher margin — services to your customers.

The 3PLs we have seen make this transition to 4PL status have excelled in the following areas:

- Picking area(s) of specialization. Are you going to serve the heavy metal industry? Or manufacturers of electronic testing gear for clinical diagnoses? Many 3PLs don’t have the expertise or resources to be all things to all people. Customers are increasingly demanding instant knowledge of their businesses, products, processes, and markets from day one. Forget learning curves. There’s no time for them. Many customers are also looking for providers that have functional specialization within their chosen verticals. For example, 3PLs and specialized distributors that manage the supply of medical and surgical devices to health-care providers are already deeply integrated into actual care delivery networks. They understand the intricate service requirements of hospitals, clinics, and even the nurses and physicians themselves. And all this doesn’t even assure that you’ll win customers — this is simply the price of admission.

- Drilling down deeply into that specialty. Increasingly, 4PLs offer specializations that extend far beyond standard 3PL responsibilities of fulfillment, warehousing, or distribution activities. For example, some highly specialized automotive 4PLs actually offer detailing and finalization of options and finishes as a standard part of their car delivery services. Logistics outsourcers that serve the food industry increasingly are taking on other responsibilities within the value chain. In addition to delivering the right quantity of the right food to the right spot at the right time, they are becoming ingredient and food suppliers themselves. Of course, the challenge then becomes competing with players in those particular niches by offering high-value, costeffective services. But, in general, the broader the supply chain territory your 4PL services encompass, the more attractive an outsourcing partner you’ll be.

- Possessing true plug-and-play technology. Increasingly, customers don’t want to have to buy and implement their own systems. They want all that included in a provider’s service. At this point, transportation, traffic, and warehousing automation are taken for granted — offering customers more, or more detailed, traffic reports won’t be viewed as adding significant value. Instead, customers now seek sophisticated planning and forecasting, inventory management, customer relationship management, and order-to-cash management systems that can be easily and seamlessly integrated into their operational systems and processes. Customers also want logistics providers who can serve as extensions of their internal management team, understanding and acting on critical information rather than simply reporting on it.

- Developing a global reach to accommodate shifting market dynamics. As globalization continues to shape the competitive landscape, we believe logistics outsourcers will be under pressure to change directions as quickly as markets and individual customers do. Take China: 3PLs serving the automotive industry need to get there — and fast — whereas those concentrating on the high-tech industry must retrench. Without the capability to respond flexibly to these market fluctuations, 3PL firms risk losing their ability to compete. Building a 4PL ecosystem of an effective network of 3PLs is the likely future for those providers that want to open up new markets and opportunities.

- Demonstrating management competence within the supply chain. You may be a great traffic manager or run an efficient warehouse, but can you manage the entire end-to-end logistics function and its many moving parts? What is your ability to add value to your customers’ core businesses in a way that actually boosts their margins? Can you effectively influence and modify processes and policies within the customers’ organizations that drive cost higher with no apparent value? These are the questions your potential customers are likely to ask going forward. They’ll be looking for an outsourcer with a strong management team that commands credibility, possesses demonstrated experience, and can deliver on the service commitments you make.

Potential pitfalls when attempting a 3PL-to-4PL transformation

Successfully taking over management of a customer’s supply chain isn’t just a matter of having the right competence and experience yourself. A successful relationship takes two — you and an informed and capable customer that understands and is committed to the idea of outsourcing and everything it entails. This means you should be as cautious about choosing customers as customers are about choosing logistics providers.

As you evaluate customers, consider whether they:

- Possess a complementary operational mind set. After they decide which logistics processes they want to keep in-house and which ones they are handing off to you, customers need to be prepared to help you with the heavy lifting of integrating your multiple operations into their overall value chain, including sales, marketing, and manufacturing. Simply put, legacy processes that segregate traditional accountability for newly outsourced operations must be revisited quickly to achieve a smooth integration of the customer and the provider. For instance, when a national 3PL took over in-store delivery of daily ingredients for a major pizza retailer, responsibilities for vendor relations, product quality control, inventory management, and even store security had to be reconciled to the new, joint operating model.

- Have adequate personnel capabilities. Outsourcing requires a serious commitment, not only from upper management and distribution leaders, but from professionals throughout the customer’s organization, especially in sales, customer service, inventory planning, forecasting, technology, and financial and value-added services. Leading an integrated outsourcing relationship requires different skills than managing day-to-day operations. The shifting roles can be bewildering, and many people might find themselves out of their depth. After all, operations managers who have been handling daily transportation, warehousing, and distribution issues are suddenly being asked to be part of — and even manage — a complex relationship. Most simply don’t have the know-how. Customers must be prepared to endure a potentially steep learning curve or replace personnel in critical roles with others who have more outsourcing management experience.

- Are flexible. Customers must also relinquish control over how they would run logistics themselves. If they insist on their own techniques and methodologies rather than trusting you to have the experience and expertise to accomplish it more efficiently and cost effectively, the relationship could be doomed from the start.

- Have realistic expectations. Many customers also have trouble reconciling their need for low costs with their desire for premium service. Because finding the right balance between the two is difficult, we have seen many more divorces between 3PLs and their customers than is ideal. In fact, it is usually fairly early in relationships between emerging 3PLs and their customers that the customer steps back and questions the return on its investment in the relationship — call it a sort of buyer’s remorse. Of course, this isn’t unusual in any type of outsourcing arrangement. For emerging 4PLs, it is very important to know that at this juncture they need to drive the process of re-aligning customer expectations and help the customer understand that it is a two-way relationship in which both parties’ needs must be met.

From here to there – making it work

If you plan to extend your service offerings further and make the transition to 4PL status, what are next steps to consider? First, you should establish your end goals and identify potential roadblocks along the way. We believe you will benefit from:

- Creating a strategic roadmap. By establishing where you are today as well as where you want to be tomorrow, you help set the stage for a successful transition. And when specifying your future objectives, you should be extremely specific regarding such things as the degree of commoditization of the services you wish to offer; your target margins; and your functional and industry specializations.

- Performing a SWOT analysis. A SWOT exercise methodically goes through the Strengths, Weaknesses, Opportunities, and Threats facing your business as it attempts to transform itself into a 4PL.

- Strengths: What internal characteristics and capabilities do you already have that will help you achieve your goal? What does your organization currently do well that may translate effectively into a new market or industry vertical?

- Weaknesses: What internal vulnerabilities might get in your way? Remember that your own flexibility to adapt to varied customer needs will be crucial to future success as a 4PL. Can you become a quick-change artist?

- Opportunities: These you probably already know, but it doesn’t hurt to articulate them again. Carefully segmenting your targeted customers can help you in your efforts to pursue the most profitable new business.

- Threats: What external factors could prevent you from reaching your goal? Don’t overlook the competition emerging from non-traditional sources — distributors, group purchasing organizations, and even OEM manufacturers themselves to name a few.

- Maintaining a clear understanding of your competitive positioning. 4PL ecosystems need to withstand the continually shifting nature of the market. New competition can emerge quickly — from non-traditional players as well as the known foes. For example, many high-tech firms are entering the returns-and-refurbishment management fray. If pending legislation on e-pedigrees for controlled pharmaceutical substances goes into effect, the major pharmaceutical distributors will be required by law to have traceability throughout the supply chain — something that will directly impact any logistics outsourcers participating in that industry segment. And competition can also come from traditional wholesalers who are looking at offering logistics management as part of their service suites.

Looking ahead: Is there really a light at the end of this tunnel?

We believe there is. Yet as the economy regains momentum, many customers are going to move slowly and cautiously. Be prepared to spend a good amount of time getting the outsourcing model right.

Customers will be as concerned about risk as cost, too. If we’ve learned anything from recent history, it’s that market conditions can change on a dime. Many businesses are even considering vertical integration of formerly outsourced logistics functions due to the economic instability of so many suppliers.

Customers in these times are looking for reassurance that their vendors are financially viable. They also seek outsourcers that are flexible and agile enough to move swiftly from low-cost offshore markets to near-shore sources and then back again. Demand for value-added 4PL services will be there. Now it’s just a question of how to best position yourself to seize the many opportunities that are likely to arise as a result of that demand.

Related: 3PL vs 4PL: What are these PLs, Anyway? The Layers of Logistics Explained

Article topics

Email Sign Up