A critical link in the supply chain, transportation is costly, time-consuming, and sometimes difficult to manage—and it’s going to get even more complex as capacity tightens and rates continue to rise over the course of 2018.

Approached haphazardly, transportation management can quickly eat up human resources, consume a good portion of logistics spend, and can leave customers asking questions like: “Where’s my stuff?” But done right, transportation helps shippers create efficiencies, improve productivity, save money, and provide premium levels of customer service.

And while several strategies can be used to attain these benefits, transportation management systems (TMS) consistently stand out as one of the best tools for streamlining the transportation component of the supply chain.

Acting as the logistics management “hub,” TMS handles route planning and optimization; freight audit and payment; order visibility; carrier management; and other critical functionalities that help shippers digitally manage and optimize their transportation networks. Historically offered as an on-premise software application, TMS has since largely moved into the Cloud and, as such, provides real-time, always-on collaboration across shippers, carriers, trading partners and customers.

In this annual examination of the state of the TMS market, we’ll look at the current adoption trends for this software, show how vendors are innovating and coming up with new functionalities and delivery methods, and discuss what’s ahead in 2018 for what can be the most valuable tool in the logistics manager’s toolkit.

Shifting to the Cloud

Vendor innovation plus the proliferation of e-commerce and omni-channel distribution are both pushing more shippers to consider TMS as part of their overall supply chain management strategy. Bart De Muynck, Gartner’s research director, transportation technology, says adoption is particularly strong for shippers that spend more than $100 million annually on freight.

“Those companies continue to invest heavily in TMS,” says De Muynck. Much of that activity involves shippers that are “changing out” their current TMS and replacing it with modern platforms that come with more bells and whistles than their predecessors could offer.

“We’re seeing a lot of companies moving from older, on-premise platforms to either multi-tenant [when a single instance of software runs on a server and serves multiple tenants] or Cloud-based solutions,” says De Muynck, noting that some shippers are purchasing the software from vendors that they haven’t worked with before while others are sticking with their original software providers. “At this point, a lot of the older TMS solutions are starting to be bypassed, and particularly if their vendors aren’t going to be supporting them anymore.”

Not to be outdone, small to midsized (SMB) shippers are also adopting TMS—a trend that’s being driven by a new crop of Cloud-only solutions that offer quick setup and affordable, or even free, subscription-based models.

“In 2017, we saw a huge growth in TMS usage by the SMB segment,” says De Muynck, who points to AscendTMS as a lesser-known vendor that’s actually the “world’s largest” TMS vendor. “They have over 15,000 companies using their TMS, with a lot of those users being smaller shippers that are using the free version of the software.”

If it’s free…

Just 10 years ago, a company that spent a few million dollars in transportation annually probably didn’t own a TMS. That’s because the software was too expensive, too much of a hassle to implement, and didn’t really drive improved productivity, says De Muynck.

The tide has turned over the last few years, De Muynck notes, and now the market is coming out with solutions that are cheaper, more relevant, and even more user friendly. “These new solutions are so easy to implement and use that companies are very attracted to them, and particularly those shippers that are dealing with challenges around capacity and freight rates,” says De Muynck. “They see TMS as a way to get more productivity out of transportation.”

Vendors have caught onto this trend, and are coming up with solutions that fit the smaller shipper’s budget while also offering all of the bells and whistles that larger systems are offering.

“Companies like Kuebix and Cloud Logistics are saying: ‘hey, if you’re a smaller shipper, we’ll give you our solution for free or at a very low cost,’” De Muynck says. “Within a week these companies are signing on thousands of new users with that strategy.” Cloud Logistics, for example, ran a $500-a-month subscription special in 2017. “We saw a very high uptake in the number of companies using the solution,” he notes.

De Muynck says that these “loss leader” strategies are creating a groundswell of SMB firms taking an interest in TMS—to the tune of tens of thousands of new users across multiple vendors. And because those shippers bring their own carriers onto those networks, they also represent new levels of transactional volume. “This plays into the whole goal of transportation management,” says De Muynck, “which is to become more efficient and make more efficient use of available capacity.”

Strong return on investment

If there’s one factor driving more shippers to adopt TMS it’s the strong return on investment (ROI) that these solutions offer to companies of all sizes.

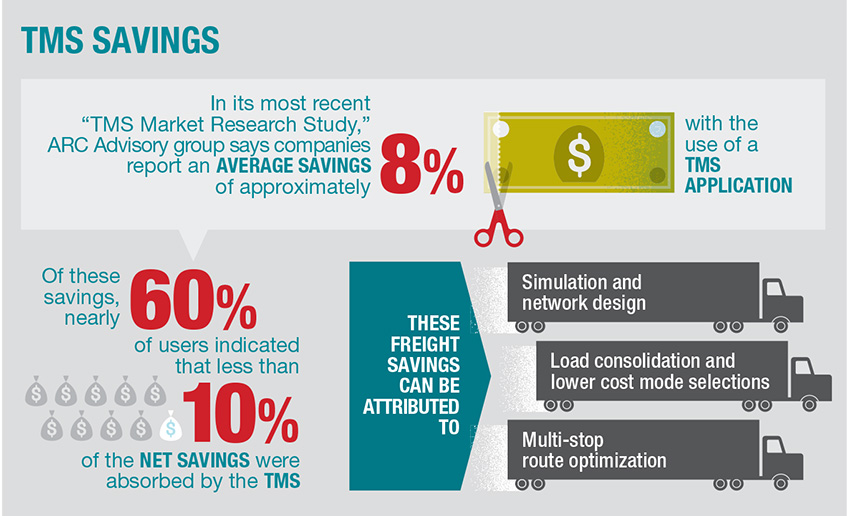

In its most recent “TMS Market Research Study,” ARC Advisory group says companies report an average savings of approximately 8% with the use of a TMS application. Of these savings, nearly 60% of users indicated that less than 10% of the net savings were absorbed by the TMS. These freight savings can be attributed to simulation and network design, load consolidation and lower cost mode selections as well as multi-stop route optimization.

“The growth of e-commerce and omni-channel fulfillment continues to help the market grow as well,” says Chris Cunnane, an ARC senior analyst, noting that in the last five years, e-commerce revenues have increased by 51% and are expected to grow by 42% in the next five years. “This continued growth will make it more important for organizations to utilize TMS. Additionally, it’s not just retailers turning to e-commerce; more brands are selling products directly to the consumer over the web.”

Cunnane adds that one of the key drivers of the TMS market right now are “barriers to entry that are lower than we’ve ever seen.” He credits the continued growth of Cloud-based solutions with pushing those barriers down over time. “Historically, if you didn’t have $20 million in freight spend, purchasing a TMS was out of the question,” he says. “Instead, you would look to a third-party logistics provider to handle it for you. Now, with the number of Cloud applications that are out there, suddenly it’s a lot more cost efficient to bring transportation management in-house.”

“Capacity is tight and companies are out looking for their 2018 bids and seeing

that it’s not easy to secure the capacity that they need. Wanting to control costs,

more of them are likely to turn to technology for help.”

There are also more providers and solutions to choose from, with the lines between enterprise resource planning (ERP) and best-of-breed solutions beginning to blur. “Right now, when you look at the leading TMS suppliers, it’s a mix of both ERP and best-of-breed,” says Cunnane, who points to SAP, Oracle, JDA, Descartes and TMW Systems as a few of the top players right now. “Whereas the rest of the market is focused on offering more of a ‘point’ or best-of-breed solution that fits into a different footprint.”

More speed, please

As he looks around at the TMS marketplace, Amit Sethi, senior manager for logistics and supply chain at Capgemini, says that he’s seeing less focus on transportation optimization and more focus on execution.

“TMS and its vendors have moved toward more online planning, and to flowing orders through automated systems that vet, tender and ship without human intervention,” says Sethi. This, in turn, has pushed optimization online, with a focus on immediate execution—versus “batching” orders for execution at a later time. “This is being driven by shippers that are more interested in speed versus optimization.”

Looking ahead, De Muynck says TMS vendors will likely continue to shape their solutions’ functionalities around shipper challenges like capacity crunches and changing end-user demands. “Capacity is tight and companies are out looking for their 2018 bids and seeing that it’s not easy to secure the capacity that they need,” De Muynck points out. “Wanting to control costs, more of them are likely to turn to technology for help.”

Acknowledging the status of TMS as one of the most mature supply chain software segments, Cunnane says there really is “only so much that vendors can do” to improve upon their platforms at this point. He sees backhaul optimization as a potential area of innovation going forward for TMS vendors that helps shippers figure out how to make the most of their return freight movement.

“It’s a mature market, so innovation may slow down until we see one of the newer players enter the market with something that’s groundbreaking—something no one else thought of,” says Cunnane. “Then suddenly there’s a race to try to get to where that vendor is, but I don’t see any of those entries in the market right now.”

About the Author

Follow Robotics 24/7 on Linkedin

Article topics

Email Sign Up