Novanta Inc., which supplies technology to medical and advanced technology equipment manufacturers, yesterday said it has agreed to acquire Schneider Electric Motion USA for $115 million in cash. The transaction is expected to close in the third quarter of 2021.

“SEM is expected to help our expansion into automation and robotic applications through advanced motion-control solutions,” said Matthijs Glastra, chairperson and CEO of Novanta. “The business is also anticipated to increase Novanta’s exposure to the life sciences and medical end markets while broadening our access to sophisticated automation integrators.”

Bedford, Mass.-based Novanta said it combines proprietary technology expertise and competencies in photonics, vision, and precision motion with the ability to solve complex technical challenges. The company claimed that this enables it to engineer core components and subsystems that deliver high precision and performance, tailored to its customers’ demanding applications.

Schneider Electric Motion to join Novanta motion portfolio

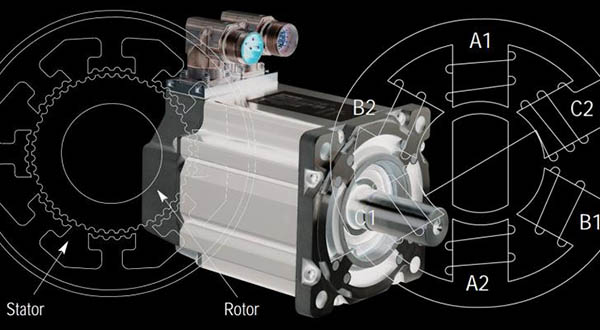

Schneider Electric Motion USA (SEM) makes motion-control components for automation equipment. The Marlborough, Conn.-based company said it specializes in brushless motor technology, integrated motor drives and electronic controls.

Founded in 1986 as Intelligent Motion Systems (IMS), SEM said it develops systems for applications demanding highly precise, controlled movement in areas including medical instruments, lab automation, robotics, and other advanced manufacturing applications. The business has approximately 60 employees.

“The addition of SEM’s technology would expand our precision motion-control portfolio, furthering our ability to serve customers with unique, high-performance solutions,” said Glastra.

The transaction is subject to customary closing conditions, including regulatory approvals. It will be financed using available cash on hand and the Novanta’s revolving credit facility. The acquisition is expected to be accretive to Novanta's free cash flow and non-GAAP earnings per share. SEM’s actual revenue and profit contribution to Novanta's 2021 financial results will depend on the ultimate date of the closing of the transaction, among other factors.

Article topics

Email Sign Up