DETROIT—The robots aren't just coming—they're here, and North American industry has continued to adopt automation at record rates. In the first quarter of 2022, companies in the U.S., Canada, and Mexico ordered 11,595 industrial robots—up 28% compared with the first quarter of 2021, according to the International Federation of Robotics.

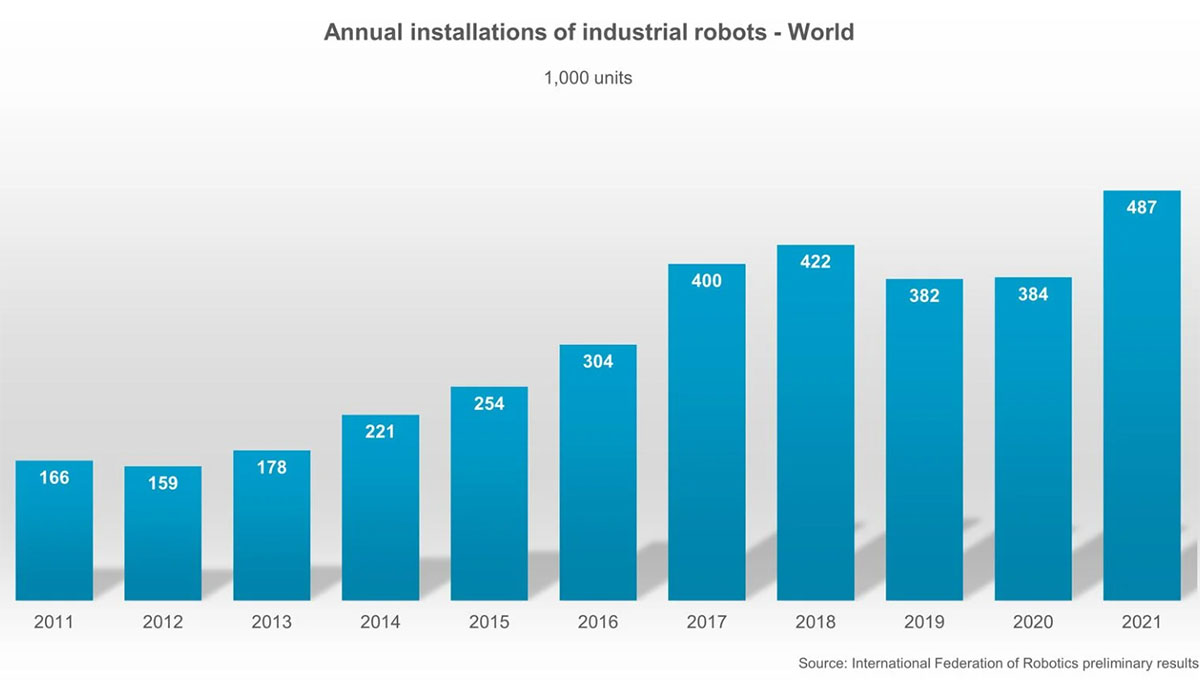

Revenue rose by 43% and reached a value of $664 million (U.S.). The International Federation of Robotics (IFR) said this follows a positive trend worldwide. Its preliminary data for 2021 showed that 486,700 industrial robots were installed globally, for a 27% increase year over year.

“The [COVID-19] pandemic spurred the growth of robotics in the U.S.,” said Dr. Susanne Bieller, general secretary of the IFR. “The 'Big Quit' in response to working conditions has led to labor shortages particular to the U.S.”

How does that compare with other regions? “In Europe, Japan, and China, the problem is an aging workforce,” Bieller told Robotics 24/7 at Automate 2022 here. “But the new record growth in North America is due to many trends.”

Automotive orders increase

In North America, automotive manufacturers and component providers accounted for 47% of robot orders in Q1 2022, growing by 15% year over year, said the IFR. Several car makers have announced investments to further equip their factories for new electric vehicles or to increase capacity for battery production.

These projects will continue to create demand for industrial robots in the next few years, the IFR predicted. The U.S. has the second-largest production volume of cars and light vehicles in the world, following China. Worldwide installations of industrial robots in the automotive sector reached 109,400 units in 2021, a 37% year-on-year increase.

“A strong recovery of the international robotics markets is currently in progress,” stated Milton Guerry, president of the IFR. “Worldwide installations of industrial robots in 2021 even exceeded the record year 2018.”

“In North America, first-quarter order volumes for both units and revenue were at all-time highs,” he added. “Across industries, the post-COVID-crisis boom created double-digit growth over the same quarter of last year.”

Non-automotive sectors surpass automotive

In seven of the past nine quarters, general industry ordered more robots than automotive customers, noted Bieller.

In North America, automotive robotics orders in Q1 2022 were 5,476 units, while non-automotive customers ordered 6,122 units in the same period. Worldwide, the electrical and electronics industry is the strongest adopter, with a record of 132,200 units installed in 2021, reported the IFR.

“The spike in demand in electronics — in part because of everyone working from home and needing new equipment and IIoT [the industrial Internet of Things]—helped drive robotics' growth,” Bieller said.

Robotics and automation transform North American economy

“While the IFR's numbers lag A3's numbers because we and others report to them, they and the strong attendance at Automate indicate the rapid growth in North American robotics,” said Jeff Burnstein, president of the Association for Advancing Automation (A3), which is hosting the trade show and conference.

“A common theme we're hearing is how labor shortages are driving investment into automation,” he told Robotics 24/7.

At Automate yesterday, industry leaders discussed how robotics and automation are transforming the North American economy in an executive roundtable co-sponsored by the IFR and A3. The IFR's YouTube channel will feature key statements of executives from the two organizations, as well as some from FANUC America, Teradyne, UPS, Zebra Technologies, and NVIDIA.

About the Author

Follow Robotics 24/7 on Linkedin

Article topics

Email Sign Up