Nauticus Robotics Inc. today announced that it has agreed to a merger with CleanTech Acquisition Corp. that will result in Nauticus becoming a publicly traded company. The Houston-based developer of surface and subsea robots, software, and associated services said the transaction will result in a valuation of more than $500 million.

“The passion and conviction of our team at Nauticus has fueled the creation of a truly disruptive and innovative company in the ocean space, and we are eager to take the next step in our growth trajectory as a public company,” stated Nicolaus Radford, founder, chairman, and CEO of Nauticus. “A substantial core of our team has been together, first starting at NASA and now at Nauticus for 15 to 20 years, and I am inspired by their relentless pursuit toward this dream. Their talent and efforts are second to none, and I could not be prouder of what we have and will accomplish.”

Robots address ocean ecosystem and expenses

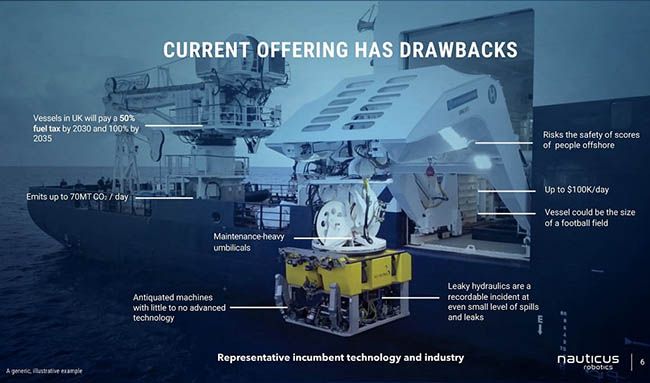

Nauticus said it operates in the $2.5 trillion ocean economy, where it targets the rapidly expanding multibillion-dollar bluetech robotics, data, and services market. Existing approaches use large vessels that can have severe drawbacks. These include operating costs that can reach as high as $100,000 per day, with fuel emissions of up to 70 metric tons of CO2 per day. They largely use antiquated, maintenance-heavy, hydraulic machines with little to no advanced technologies, said the company.

In contrast, Nauticus claimed that its subsea technologies could save customers over 50% compared with traditional methods, eliminate nearly all greenhouse gas emissions, and significantly reduce the need for on-site personnel.

“The ocean will be the epicenter in our fight against climate change, and the offshore ocean services industry has signaled the beginning of a major technology revolution to combat it,” said Radford. “Toward that end, we have brought to market a suite of products and services that can make a significant impact on our customers’ cost profile, carbon footprint, and safety by reducing the reliance on costly and carbon-intensive surface assets that traditionally service the many sectors of this industry.”

Nauticus Software Suite and Aquanaut available through RaaS

Nauticus provides its cloud-based robots and software to commercial and government-facing customers through a robotics-as-a-service (RaaS) business model in addition to direct product sales.

“This modernized approach to ocean robotics as a service has resulted in the development of a range of products for retrofit/upgrading legacy systems and other vehicle platforms,” said the company. “Nauticus’ services provide customers the necessary data collection, analytics, and subsea manipulation capabilities to support and maintain assets while significantly reducing their operational footprint, operating cost, and greenhouse gas emissions, to improve offshore health, safety, and environmental exposure.

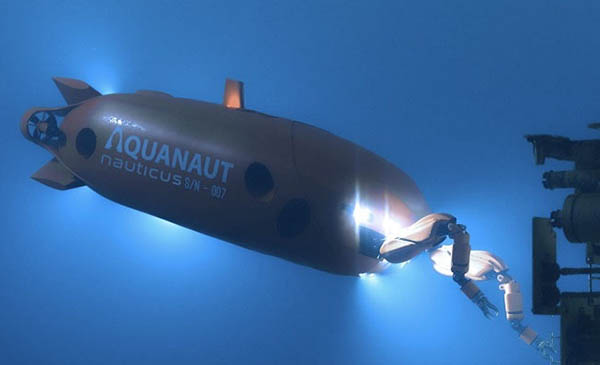

Nauticus said its fleet of autonomous robots is able to operate from the surface to the seabed with the Nauticus Software Suite, an artificial intelligence and machine learning platform. The company said its first product, Aquanaut, is “the world’s first tetherless underwater robot capable of robust decision making for both long-distance ocean data collection and close-in dexterous manipulation.”

CLAQ recognizes Nauticus growth potential

Nauticus' estimated revenues in 2021 are approximately $8.2 million, with strong visibility to achieve robust growth in subsequent years, including currently contracted orders that would more than double revenue in 2022 and reach more than $90 million in 2023. The company said the unit economics of the RaaS model could result long-term corporate earnings before interest, taxes, depreciation, and amortization (EBITDA) margins of approximately 60%.

CleanTech Acquisition Corp. is a special-purpose acquisition company (SPAC) formed in January 2021 that trades on NASDAQ as “CLAQ.” CleanTech Sponsor I LLC and CleanTech Investments LLC, an affiliate of Chardan, are the founders and co-sponsors of CLAQ. Upon closing of the transaction, CLAQ will be renamed Nauticus Robotics Inc., and the combined company is expected to remain listed on NASDAQ under the new ticker symbol “KITT.”

“CLAQ was created to find a great business that has a positive impact on the world’s carbon footprint,” noted Eli Spiro, CEO of CLAQ. “We set a high bar for ourselves and could not be more impressed with Nic and the entire Nauticus team. We believe Nauticus’ RaaS model has the potential for strong returns while operating in a market in dire need of disruption.”

Transaction details

The parties said they expect the pro forma equity value of the combined company to be about $561 million with cash on hand of approximately $222 million, assuming no redemptions.

Estimated cash proceeds to the Combined Company from the transaction are expected to consist of CLAQ’s approximately $174.2 million of cash in trust (assuming no redemptions) and approximately $73 million from a fully committed private investment in public equity (PIPE) in equity and convertible notes anchored by existing investors. The PIPE is anchored by Schlumberger, Transocean, AeroVironment, and Material Impact, as well as a large private university endowment.

Upon the closing of the transaction, and assuming no redeptions or issues of common stock, CLAQ’s public stockholders will own about 33%; the PIPE investors will own approximately 6%; and the co-sponsors, officers, directors and other holders of CLAQ founder shares will own about 8% of the combined company. Current Nauticus stockholders would own approximately 53% of the combined company. These values exclude $75 million of earn-out shares that would be paid in common stock if applicable requirements are met.

The board of directors of each of CLAQ and Nauticus approved the transaction, which is expected to close in the first half of 2022. The transaction will require the approval of the stockholders of CLAQ and Nauticus and is subject to other customary closing conditions including the receipt of certain regulatory approvals. Radford and the current management team will continue to lead the combined company.

An investor conference call from this morning will be available for 14 days. Additional information about the proposed transaction will be provided in a Current Report on Form 8-K to be filed by CLAQ with the U.S. Securities and Exchange Commission (SEC).

Chardan acted as exclusive financial advisor to CLAQ and as sole placement agent on the PIPE. Loeb & Loeb LLP acted as the legal advisor to CLAQ. Winston & Strawn LLP acted as the legal advisor to Nauticus.

Article topics

Email Sign Up