As reported by the Wall Street Journal, the logistics and trucking sectors should see the recent wave of deal-making continue, as an improving U.S. economy and low fuel prices make companies that move goods more attractive, according to consulting firm PricewaterhouseCoopers (PwC).

PwC recently noted that merger and acquisition (M&A) activity in the transportation and logistics space worldwide is going like gangbusters at least thru the first half of 2015, exceeding the 10% growth rate notched during the first half of last year.

PwC further added in its Intersections quarterly analysis publication that such “robust deal activity” in the first half of this year drove gains of 15% in volume and 55% in value, compared to the same period in 2014.

Mergers and acquisitions among logistics companies have already surpassed last year’s total in dollar terms, with deals valued at $14.5 billion in the first half of the year, compared with $12 billion in all of 2014, the firm said.

The same was true for trucking, with deals valued at $24.5 billion through June 30 compared with $23.8 billion in 2014.

Both logistics and trucking are highly fragmented, with hundreds of small, family-owned companies competing with one another.

Many of these firms were hit hard by the 2008 recession, and have only recently become attractive as acquisition targets, said Jonathan Kletzel, U.S. transportation and logistics analyst at PwC.

Low fuel prices and the improving economy both boost the amount of freight that needs to be moved and give companies more money to spend on deals, he added.

“Trucking and logistics companies have cash, their business is healthier… and with the stronger economy we’re seeing higher consumer demand, so more goods are moving around the country,” Mr. Kletzel said. “It’s a perfect storm of good news.”

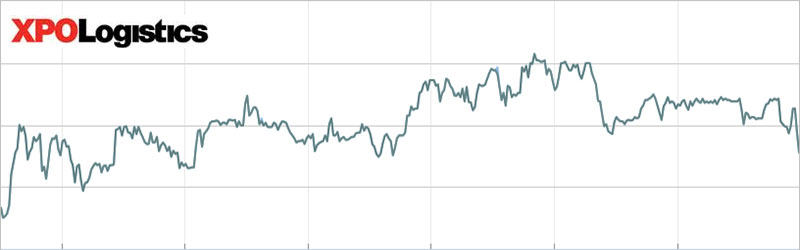

Among the biggest deals so far this year: FedEx Corp.’s proposed acquisition of TNT Express NV for nearly $4.8 billion and XPO Logistics Inc.’s $2.76 billion acquisition of Norbert Dentressangle SA. Last week, United Parcel Service Inc. said it would buy Coyote Logistics for $1.8 billion.

Mr. Kletzel said that while the industry has seen a larger share of “mega deals” than usual, plenty of smaller mergers and acquisitions are happening as well. That’s particularly true in trucking, where many founders of family-owned companies are reaching retirement age and looking to sell. Private-equity firms are also getting in on the action, drawn in by rapid growth in logistics spending.

“It’s a blend of big and small [deals],” he said.

Source: Wall Street Journal

PwC Intersections August 2015

Second-quarter 2015 global transportation and logistics industry mergers and acquisitions analysis

Welcome to Intersections, PwC’s quarterly analysis of mergers and acquisitions (M&A) in the transportation and logistics (T&L) sector. We are pleased to present our second-quarter 2015 summary as part of our ongoing commitment to providing you with a deeper understanding of related trends and prospects in the industry.

Overview*

Deal activity improved in the T&L sector in 2Q15, as volume and value increased both sequentially and year-over year. Driven by substantial megadeal growth (more than 36 percent compared to 1Q15), average deal value also increased, to $564 million.

Megadeals* (deals valued at $1 billion or more)

2Q15 saw strong megadeal activity, with nine deals valued at $23.6 billion, almost 69 percent of deal value for the quarter. Megadeals were primarily driven by the need to fill a specific need or gap, gain scale, and drive profitability. As mentioned in the 1Q15 letter, in April, FedEx agreed to launch a tender offer to acquire the entire share capital of Netherlands-based TNT Express**. This all-cash acquisition, valued at almost $4.8 billion, is expected to improve FedEx’s European capabilities and accelerate global growth. At the completion of the transaction, FedEx will become the largest package delivery provider in Europe.

Cross-border and financial investor activity*

Cross-border expansion and service line expansion were key drivers for many of the 2Q15 deals, particularly in advanced economies. The increase in cross-border deals was primarily driven by strategic investors, who often seek inorganic opportunities to improve geographic reach and long-term growth (e.g., the FedEx-TNT acquisition). At the same time, cross-border activity is less significant in emerging economies given that these companies tend to be smaller and look to acquisitions of local competitors to improve scale and market share.

Growth also remains a key driver of cross-border activity, as T&L companies look to increase geographic reach, add capacity, and enter new markets. For example, in the airline industry, there have been a number of announcements as airlines look to buy stakes in rival carriers. These include a recent United Airlines agreement to buy a five percent stake in Brazil-based Azul SA, potential interest by Delta to invest in Japan-based Skymark Airlines, and European airline IAG’s acquisition of Ireland-based Aer Lingus. All these deals have one thing in common - the opportunity to rapidly expand into a new geography.

Activity by financial investors increased to 44.3 percent in 2Q15, compared to 38.9 percent in the first quarter, as strategic investors divested non-core and underperforming assets. The funds raised by these sellers should strengthen their financial position.

Segmentation activity*

On a segment basis, 2Q15 activity was driven by the trucking and logistics industries, which, when combined, accounted for more than 50 percent of the quarter’s overall deal volume. A significant increase in trucking deals drove 28 percent of the second quarter’s volume, compared to only 22 percent in the first quarter. Historically, the trucking industry has been a significant driver of deal activity (due in part to the highly fragmented industry) as larger companies acquire smaller ones in order to achieve increased market share and increase capacity. Of the nine megadeals in the first quarter, the largest was a logistics transaction, the above-mentioned TNT Express acquisition.

There were three trucking-related megadeals announced, including the fourth largest, in which US-based XPO Logistics acquired a 67 percent interest in Groupe Norbert Dentressangle (a Francebased provider of local freight trucking services) for $2.76 billion. This acquisition is well aligned with XPO’s strategy to become a global supply chain solution provider.

Regional activity

Asia and Oceania continued to be the largest acquirer region with more than one-third of all deals announced. This strong level of activity was driven in part by activity in China where ten of the 21 deals in the region were based.

All ten deals were local-market, which is expected, given the continued growth of the Chinese economy and the government’s efforts to consolidate its infrastructure and compete with other global transportation companies. A growing Chinese middle class and an increasingly export-driven economy were major impetuses for activity as industry players looked to improve scale and efficiency. Despite a recent drop in value in the Chinese equity markets, the costs of doing business remain high and some foreign investors have refrained from making deals.

Outlook

We remain optimistic regarding 2015 as deal activity continues to increase. As a key driver, the US economy remains strong and the US dollar continues to advance against the euro, the yen, the pound, and many other currencies. This makes cross-border acquisitions by US companies cheaper, on a relative basis. Concurrently, emerging economies see continued GDP growth driven by a growing middle class and rapidly urbanizing populations. Companies in these markets see the need for increased efficiencies and scope, which can be achieved through inorganic means. Finally, fuel prices remain low. The Energy Information Agency predicts that gasoline prices in the US are expected to average $2.33 a gallon***, a decline of more than 30 percent compared to 2014. Jet fuel prices have also declined more than 40 percent since July 2014, based on PwC’s analysis. These lower fuel costs make acquisitions more attractive because of lower expenses, which make available additional funds for activities such as M&A.

We hope this analysis serves as a useful tool for monitoring trends and shaping your organization’s business strategy. For a deeper dive into the data, launch the data explorer, or contact us to further discuss our insights.

Authors

Jonathan Kletzel, US Transportation & Logistics Leader, and Julian Smith, Global Transportation & Logistics Leader

Data sources:

* Thomson Reuters (2015) “SDC Platinum Database”

** Press release: FedEx and TNT Express Agree on Recommended All-Cash Public Offer for All TNT Express Shares

***Gasoline price forecast to stay below $3 a gallon in 2015 (PDF)

Related: XPO Logistics Targets $23 Billion in Revenues by 2019 Including New Acquisition Opportunities

Article topics

Email Sign Up