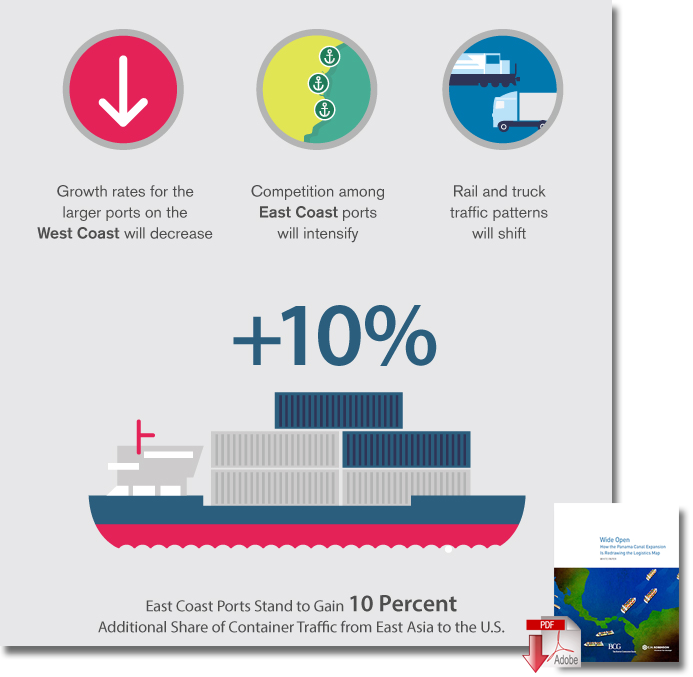

According to research conducted jointly by The Boston Consulting Group and C.H. Robinson, as much as 10 percent of container traffic between East Asia and the U.S. could shift from West Coast ports to East Coast ports by the year 2020 .

Small percentages translate into big numbers in container traffic on high-volume lanes between East Asia and the U.S.

This trade represents more than 40 percent of containers flowing into the U.S.

Rerouting 10 percent of that volume, therefore, is equivalent to building a new port roughly double the size of the ports in Savannah and Charleston.

This shift will have profound effects.

The larger ports on the West Coast will experience lower growth rates, altering the competitive balance between West Coast ports and East Coast ports. (With global container flows rising, West Coast ports will still handle more containers than they do today.)

It will also shape the investment and routing decisions of rail and truck carriers, magnify the trade-offs that shippers make between the cost and the speed of transportation, and potentially alter the location of distribution centers.

West Coast ports currently receive two-thirds of container flows from East Asia, with much of that cargo moving by rail and truck as far east as the Ohio River Valley, about three-quarters of the way across the U.S. But once the big, efficient “post-Panamax”container ships begin passing through the wider, deeper canal, the shipping dynamics will change.

For shipping to many destinations, using West Coast ports will still be the fastest option - but it won’t necessarily be the cheapest. For price-sensitive cargo that is relatively expensive to move, routing shipments through East Coast ports to inland destinations will become more cost competitive and increasingly attractive.

Unlocking the Logic of the Panama Canal Expansion

The expansion of the Panama Canal will address two issues of capacity that are hampering the canal’s competitiveness in its second century of operation.

First, the volume of cargo that passes through the canal sometimes exceeds the amount for which it was designed, causing traffic jams at peak times.

Second, the canal is too small for the so-called post-Panamax vessels, which carry two to three times as much cargo as the ships that now squeeze through the canal.

These new vessels, the length of four U.S. football fields, make up about 16 percent of the global container fleet but carry 45 percent of container cargo. Within 15 years, these vessels will carry nearly two-thirds of global container traffic. They currently travel from Asia to the U.S. West Coast and to Europe through the roomy Suez Canal. Few East Coast ports can currently accept these leviathans.

The Changing Logistical Landscape

The Panama Canal expansion will address both capacity issues with a new set of locks and wider, deeper channels, allowing more vessels and larger vessels to travel through the canal. The capacity of the canal will double, and the operating costs of shipping between East Asia and the East Coast could fall by up to 30 percent because the labor and fuel costs per container are lower on these larger vessels. (We assume that carriers will pass along these cost reductions to shippers, since the industry is highly competitive and capacity is abundant.)

To accept the larger vessels, East Coast ports are widening and deepening their channels and installing larger off-loading cranes. At the New York–New Jersey port, a bridge even needs to be raised so these 160-foot-high vessels can reach the docks.

Two maritime battles are under way: one between West Coast and East Coast ports, and the other between the Panama and Suez canals. Two-thirds of container traffic from East Asia currently arrives at West Coast ports, one-fifth travels through the Panama Canal for eastern destinations, and 14 percent reaches the East through the Suez Canal. The East Coast has steadily been gaining ground in container traffic from East Asia; in fact, its share rose from 32 percent in 2010 to 35 percent in 2014.

In the battle between the two canals, the Suez is picking up market share. From 2010 to 2014, the Suez’s share of East Coast container traffic rose from 32 percent to 38 percent. After the Panama Canal expansion, the two canals will be in fierce competition for traffic between East Asia and the East Coast. Passage through the Panama Canal will be faster. But the Suez is also undergoing modernization to allow for faster transit and two-way traffic, even of larger vessels.

Source: BCG Perspectives

Related: Panama Canal Expansion Reshaping America’s Ports

Download: How the Panama Canal Expansion Is Redrawing the Logistics Map

Article topics

Email Sign Up