It’s become clear that trucking executives, logistics managers, and drivers feel that the federal government has created an environment that restrains the flow of freight following a year of living with the new hours-of-service rule (HOS) that became effective on July 1, 2013.

If you rewind 12 months, varying estimates from positive to pragmatic existed before the new rule became effective regarding the impact of the changes.

However, the grim reality is that trucking stakeholders are now experiencing losses in productivity due to the rule change—and in many cases it’s much worse than was predicted.

The changes to the HOS rule were established to increase transportation safety related to commercial motor vehicles (CMV).

The regulation was aimed at decreasing the amount of CMV accidents due to driver fatigue.

As such, the most impactful change to the HOS rule that became law in 2013 is the use of the restart, which is limited to one time per week—once every 168 hours from the beginning of the prior restart. A compounding effect was the requirement that a valid 34-hour off-duty restart period must include two periods from 1 a.m. to 5 a.m.

According to FMCSA, the costs and benefits of the restart provisions would primarily affect the 15 percent of the 1.6 million over-the-road driving population with the most intense driving schedules.

To ascertain if this was indeed the case, and to gain a better understanding of the impact of the rule change on trucking operations, we conducted two studies.

The first took place in October 2013, at approximately the three-month mark to see how well carriers and shippers were adjusting to the new operating environment.

The second study was conducted in June 2014 as a follow-up to see if a clearer picture had emerged regarding the impact.

It has indeed, and the news for shippers is not good.

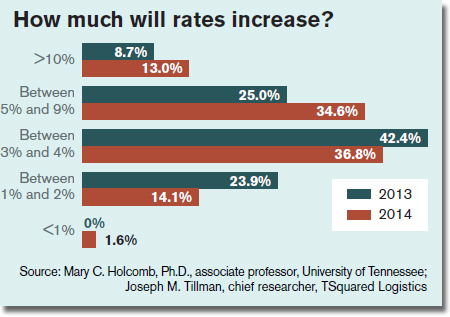

A year after the implementation, the shipper outlook has changed from one that projected a possible rate increase between 3 percent and 4 percent to a new projection that the increase could be much higher.

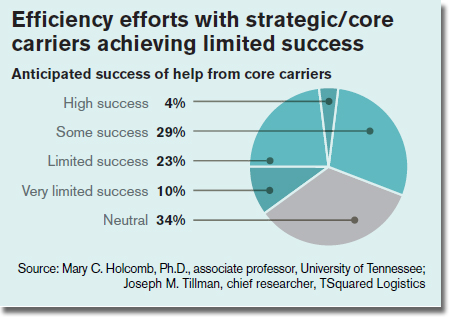

Added to this misery, data from the study show that only about one-third of shippers have experienced any success from working with their strategic carrier partners to mitigate the productivity loss from the rule change. To date, the largest percentage of shippers (34 percent) report a net-neutral position from these efforts.

Assessing the Impact

A total of 417 companies participated in the first study and 474 companies, primarily representing the manufacturing sector, participated in the second part of the study.

The giants of shipping—companies with annual revenues greater than $3 billion—represented 22 percent of total study participants, and small size companies—annual revenues of $500 million or less—accounted for 52 percent of respondents.

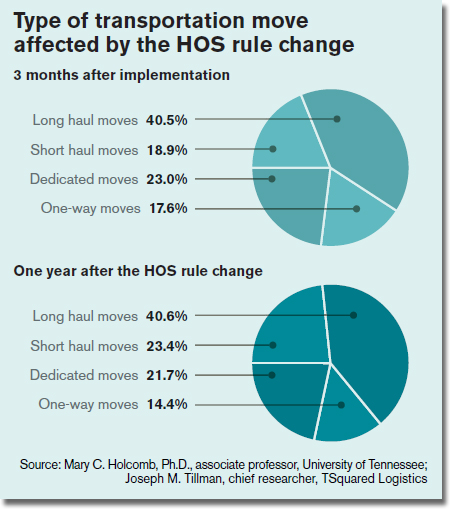

The study participants reported that the type of truck transport most affected by the rule change is long-haul moves, followed by dedicated and short-haul moves. An interesting change from early implementation to a year later is that short-haul moves are now also feeling more consequences.

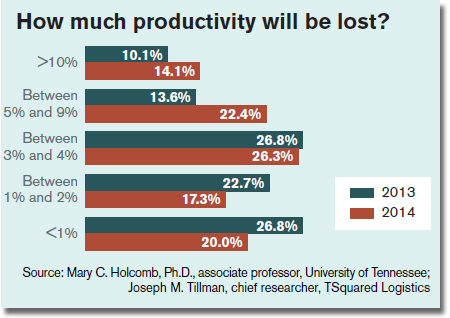

It’s clear that the estimates of the impact on productivity were significantly under projected. Early in the implementation of the HOS rule change, many shippers thought the impact would be in the 1 percent to 4 percent range. The reality is much more grim: The expected loss will be somewhere between 3 percent and 9 percent, with many more shippers anticipating that the deficit to be in the upper end of that range.

Dire Consequences

The loss in productivity cannot, and will not, be absorbed by the carriers.

The data from our earlier study indicated that 47 percent of shippers expected their rates to increase as a result of the HOS rule change. A year into the change and now 73 percent of shippers say they have experienced and anticipate further rate increases.

There’s much more certainty on the carrier side as to what the future holds. Some 90 percent of the carriers that participated in the second study reported that they foresee a rate increase for their customers.

So the question remains: How much are rates going to increase?

The data suggests that there’s some difference of opinion on this topic. Some 37 percent from the second study (2014) participants reported that the rate increases would be between 3 percent and 4 percent, while 35 percent stated that the increases would be between 5 percent and 9 percent.

Through leverage of their freight volumes and other efficiency efforts, further analysis shows that the giants of shipping anticipate rate increases predominantly between 3 percent and 4 percent.

In the early stage of implementation, 58 percent of respondents reported that they would pass the rate increases on to their customers. That percentage has now risen dramatically to 76 percent. The fact is that the carriers or the shippers can’t entirely absorb the rate increases that have already been instituted along with the ones that will shortly become reality because the loss of productivity is just too large.

How to Stem the Tide

Many shippers are relying on their strategic and core carriers to help them minimize any rate increases. Indeed, in our first study, the data indicated that 66 percent of the shippers were actively working with their carrier partners to increase the efficiency of their operations. Some 50 percent of those shippers believed that these efforts would be successful.

Eight months later and the reality is a bit different. In our second study, only 21 percent of the shippers reported that their strategic and core carriers are actively working with them to increase efficiency.

There’s also awareness that shippers were too optimistic about what could be achieved. As our data show, only 4 percent of shippers have realized high levels of success through improved partnering. For most, the results have been, at best, neutral.

There’s little doubt that shippers are aggressively working to mitigate the impact of the HOS rule change.

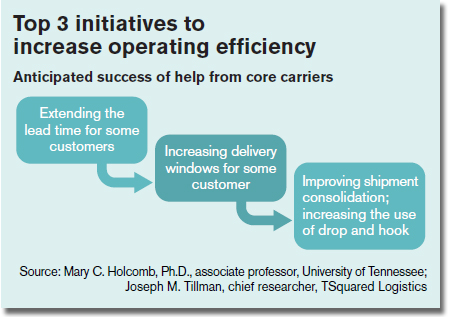

In our first study, the top three initiatives being implemented by shippers indicated a strategic approach to the problem.

They reported that they segmented their customers and determined which ones could—or would—accept longer lead times and larger delivery windows.

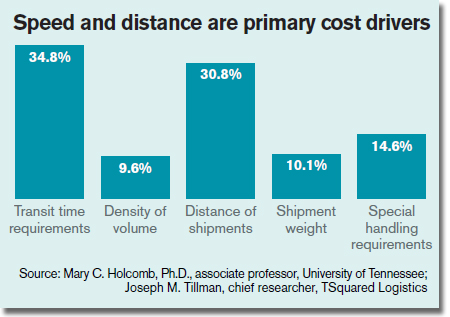

It comes as no surprise that, nearly a year later, shippers are still utilizing the top two initiatives in an attempt to increase operating efficiency since those initiatives target the two main cost drivers respondents reported in our first study.

Speed and distance have the biggest impact on cost.

In a business environment where customers and consumers are anxious to have lead times reduced, it seems somewhat implausible that transit time requirements can be manipulated to any great extent.

Perhaps a more viable solution, albeit more long-term in nature, is the distance factor.

The study data indicate that while 31 percent of shippers are considering a change to their network as a result of the change, a vast majority (69 percent) are not at this time.

Shipment consolidation, however, has moved much further down the list in terms of actions.

The use of drop and hook has continued to be one of the top initiatives and it has been joined with the use of dedicated transportation as a means to improve productivity.

Is Intermodal the Answer?

Early in the implementation of the new HOS rule, 70.1 percent of the study participants reported that they did not anticipate moving more freight to intermodal, while 30 percent indicated that they would be shifting more volume to intermodal.

That percentage has dropped some, however, and as transportation costs have increased the use of intermodal shows signs of rising.

In our second study, 37 percent of responding shippers now report that they will be moving more freight via intermodal. Just how much freight will be shifted to this method? The data suggest that 3 percent to 4 percent of the current volume moving over-the-road will be shifted to rail.

What is not obvious is the railroads ability to absorb this volume of freight. Efforts to expand rail capacity to meet the growing demand for intermodal and other traffic have not kept pace with the demand. This suggests that shifting over-the-road freight to this other mode will not totally curtail rising transportation costs that will have resulted from the rule change.

A cautionary tale is unfolding for shippers and carriers. Carriers held the key prior to the HOS rule change. They continue to do so, as capacity continues to shrink and demand rises for their services.

In this position, carriers have the ability to raise rates beyond the cost increases caused by the rule change. However, carriers would be wise to show restraint in the new operating environment, as history will almost certainly repeat itself and firm foundations will quickly turn to salt and sand.

Related: Study Indicates New Trucker Rest Rules Could Mean Higher Consumer Costs

About the Authors

Mary C. Holcomb, Ph.D., University of Tennessee; Joseph M. Tillman, TSquared Logistics

The authors would like to thank Dean Vavalides of Pilot Flying J Corporation for his contribution to Part 1 of this study.

More SC24/7 Coverage on Hours-of-Service (HOS)

Article topics

Email Sign Up