FedEx Break Up with Amazon

FedEx is breaking up with Amazon as the e-commerce giant continues to make waves in the shipping industry.

The carrier announced that it will choose not to renew its ground freight contract with Amazon for any final mile delivery, effective September 2019.

This comes only 2 months after FedEx announced that it would end Express air shipments with the e-commerce company.

Amazon made up roughly 1.3% of FedEx’s total sales in 2018.

According to spokespeople from both companies, the breakup is amicable, an Amazon operations executive even tweeting “we wish them nothing but the best, conscious uncoupling at its finest.”

But this conscious uncoupling goes deeper than a simple business incompatibility.

Here’s what you need to know about why FedEx and Amazon have officially parted ways.

Amazon’s Bid to Transform the Shipping Industry

It’s no secret that Amazon has ushered in an era or super-fast, super-convenient online shopping.

The company has become the #1 e-commerce platform, bringing in close to $232 billion U.S. dollars in 2018 net sales.

By promising Prime members free, 2-day shipping on thousands of items, Amazon has built consumer loyalty and changed the way shoppers think about shipping.

Customer expectations have changed and 2-day, or even faster, delivery is now expected. In fact, Amazon plans to make a 1-day delivery standard for Prime members in 2020.

In order to meet these pie-in-the-sky delivery promises, Amazon has decided that a ‘go-it-alone’ strategy is needed for their logistics operations.

Instead of solely relying on established parcel carriers like FedEx, UPS, or the United States Postal Service (USPS), the company is increasingly developing its own shipping networks.

This includes building out their own fleet to fulfill final mile deliveries. Most recently, Amazon announced that they will pay their employees $10,000 and 3 months’ pay to quit and start their own Amazon delivery service.

In addition to expanding their ground fleet operations, Amazon has also added hundreds of fulfillment centers to its logistics network, announced its groundbreaking drone delivery program, and added next-day air capacity with leased jets.

It’s not surprising that FedEx feels the need to distance itself from a company that appears to be stepping into their territory. The company is taking short-term pain over the possibility of continuing a potentially damaging relationship long-term.

FedEx Bets on Walmart and Other Ecommerce Businesses

Amazon officially surpassed Walmart as the world’s largest retailer earlier in 2019.

That isn’t to say that Walmart doesn’t pose a threat to Amazon’s monopoly in the e-commerce world. Walmart has some 2.2 million workers, a number roughly 4 times the number Amazon employs.

It also already owns a vast amount of real estate, strategically dispersed across the USA.

Not to mention that Walmart owns one of the largest private fleets in America.

By building upon this base, Walmart has ramped up efforts to compete with Amazon in the e-commerce sector.

This includes plans to roll out a 1-day delivery program that shoppers can take advantage of without any membership fees.

FedEx appears to be betting on Walmart as Amazon’s primary rival in the fast and free online shopping industry.

According to the founder of SJ Consulting Group, a company providing data and advice to logistics companies, the decision to sever ties with Amazon is a way for FedEx to “get Walmart to realize that they’re not working with Walmart’s biggest competitor and to have Walmart make FedEx their primary carrier.”

To make up for the short-term loss of 1.3% of their business, FedEx also announced in May that they would begin seven-day ground freight services at the beginning of 2020.

This move will likely make them an even more desirable carrier for companies like Walmart, Walgreens, and other retailers in the e-commerce space.

The Future of Final Mile

The breakup of Amazon and FedEx is just another example of the battle lines being drawn between Amazon and the rest of the retail industry.

More SC24/7 Content on FedEx/Amazon

As companies seek to differentiate themselves from the e-commerce behemoth, changes as small as choosing a different carrier can be important.

FedEx appears to already be taking steps to compete against Amazon’s 2-day and 1-day delivery promise.

The future of final mile delivery is still uncertain, but the main competitors are just now entering the ring.

Related Article: Industry Experts Discuss Technology Trends & Solutions for Efficient Ecommerce Logistics

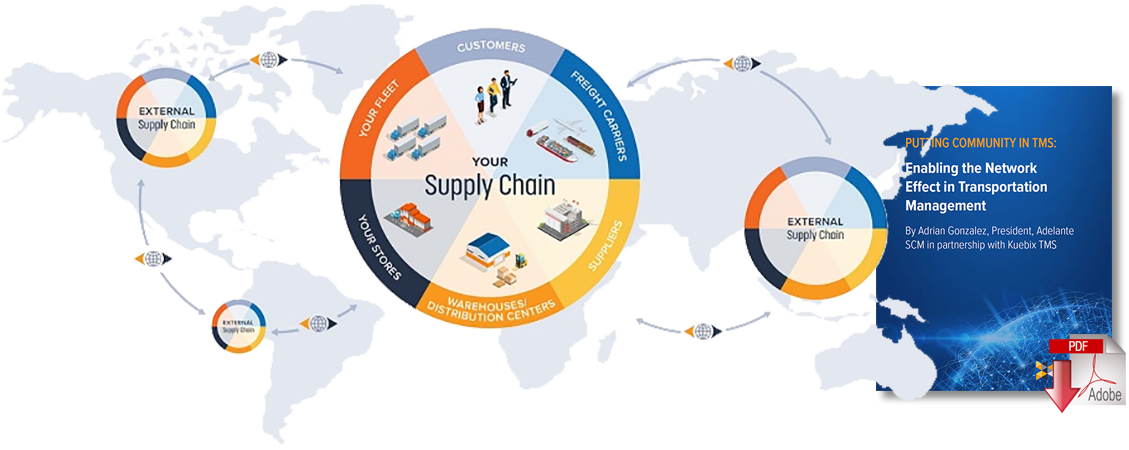

Putting Community in TMS: Enabling the Network Effect in Transportation Management

In this eBook, Adrian Gonzalez, President, Adelante SCM in partnership with Kuebix TMS, describes how transportation management systems are transitioning from being “inside the four walls” applications to becoming operating systems that power transportation communities and enable network effects.

Transportation management systems are transitioning from being “inside the four walls” applications to becoming operating systems that power transportation communities and enable network effects.

Advancements in technology - most notably, cloud computing, software-as-a-service, application programming interfaces, and mobile computing - are making it easier for shippers, carriers, and brokers of all sizes, as well as private fleets and others in the transportation ecosystem, to more easily integrate and transact with one another.

The value-added benefits provided by network-based transportation management systems include smarter and faster freight capacity matching and the ability to leverage network-based business intelligence and analytics to discover and establish new business connections and to benchmark your transportation performance and metrics against the community as a whole.

Download the eBook Putting Community in TMS: Enabling the Network Effect in Transportation Management

Related Kuebix White Papers & eBooks

The Art of the Inbound: 11 Ways to Improve Your Inbound Shipping Operations

This ebook provides a guide to benchmark your company against best practices in the transportation and shipping industry and helps to put together a strategic approach to capitalizing on the opportunities to manage the “art of the inbound.” Download Now!

Driving Supplier, Carrier and Customer Collaboration

This ebook describes how through the use of collaboration portals with various stakeholders, you will be able to effectively manage your cost of goods and consistently meet the expectations of your internal and external customers. Download Now!

The Complete Buyer’s Guide to Transportation Management Systems

There is almost no limit to how a Transportation Management System can benefit your unique supply chain, but the key to success is finding the right one for your goals, so, before selecting a TMS, use the 12 questions in this buyer’s guide to finding the best solution for your company. Download Now!

Effectively Managing Big Data in Your Supply Chain

In this white paper, we’ll explain what the term “big data” means to the typical supply chain, introduce effective strategies for managing and leveraging that data, show how one grocer is using predictive analytics to harness its own big data, and explain the “first steps” that companies need to take down the path to effective management of their big data. Download Now!

More Resources from Kuebix

Article topics

Email Sign Up