Leading global commercial real estate services firm Colliers International Group Inc. issued “From First Mile to Last Mile,” a global logistics report examining the primary factors that will impact the global pattern of warehousing and logistics over the next generation, as well as the elements already shifting global trade flows and retail formats.

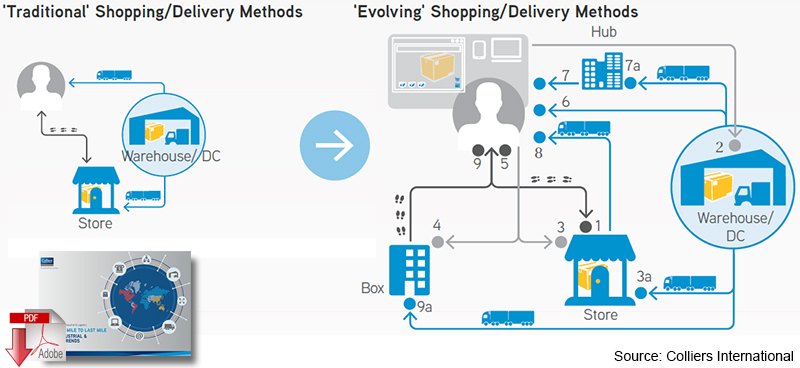

“Our analysis finds that e-commerce and evolving delivery methods are the primary factors driving the shape of the logistics sector both today and in the future as e-retailing is slated to increase significantly in cities and towns across the globe,” says Dwight Hotchkiss, National Director of Industrial for Colliers | U.S. and President of Brokerage Services | U.S.

“This will result in the creation of new and innovative space at the initial ‘First Mile’ level, including mega distribution centers, and the ‘Last Mile’, where there is already a proliferation of e-fulfillment distribution centers on the edge of urban areas”

Colliers’ extensive report focuses on the vast growth potential of e-retail driven logistics and warehousing, reviewing cutting-edge examples and case studies of modern warehousing and distribution space designed to overcome the industry’s most pressing challenges.

The analysis also provides insights on market implications and opportunities in the logistics sector worldwide.

Key highlights of the analysis include:

- Digital Trends Impacting Logistics: In established global markets e-commerce remains primarily a home PC activity; in developing markets, particularly China, India and Turkey mobile users are leading the e-commerce charge. This pattern will accelerate further as Generation X and the Millennials increasingly form a larger proportion of each country’s population, driving the size of the consumer pool which is ‘technologically savvy’.

- Population & Consumption Influences the Future: Increases in urbanization, especially in AsiaPac and Africa, will create more concentrated consumer markets, much like those in North America, and to a degree Latin America. Also, Generations X, Y and the new Millennials will increasingly comprise the majority of the population, bringing a complete change in consumer behavior and logistics/warehousing needs.

- Global Trade Flows Shifting: Since 2000, there has been dramatic growth in containerized traffic around the world, with total shipments increasing by 290 percent in 2013. Because of the pressures of this demand, trade routes have changed to better meet capacity in both the North American and European markets, with activity shifting away from the traditional ports, such as LA/Long Beach in Southern California, or the North Sea ports of Hamburg and Rotterdam.

- Key Clusters & Physical Infrastructure Expanding: To meet growing demand, new infrastructure investments have been made in key clusters worldwide, which are either planned or ongoing, and stand to significantly enhance or alter logistics frameworks and warehouse real estate markets for many years to come.

- First Mile Facilities Expand: Due to the growth of e-retailing and the corresponding space requirements to install more sophisticated facilities, such as automated picking and sortation systems, there is a noticeable trend of the total floor area getting larger, with modern ‘first mile’ distribution facilities comprising a floor area of more than 1 million sq ft.

- Last Mile Space Contracts: As the essential element in improving urban logistics is to limit deliveries to the shortest route, e-commerce retailers have started to include smaller urban warehouses to shorten delivery routes and provide quick delivery services to online customers. These smaller urban facilities within urban community catchment areas, as well as a variety of ‘click and collect’ options for immediate pick up or same delivery options are coming to the forefront.

Evolution of Urban Logistics Needs

Download From First Mile to Last Mile: Global Industrial & Logistics Trends

Article topics

Email Sign Up