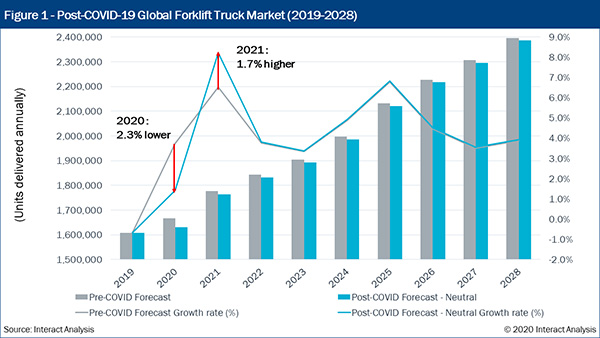

If ever a time was ripe for robotic lift truck sales to take off, right now might be it. With the COVID-19 pandemic accelerating e-commerce demand for many types of goods, factories and fulfillment centers need to move a high volume of pallets to keep stores stocked and e-commerce order-picking systems or manual pick locations topped off with goods.

Vendors say that return on investment (ROI) in two years or less is possible for automated lift trucks, but some complexities are involved, like knowing how to phase them into an operation and identifying automated or semi-automated applications that make the most sense.

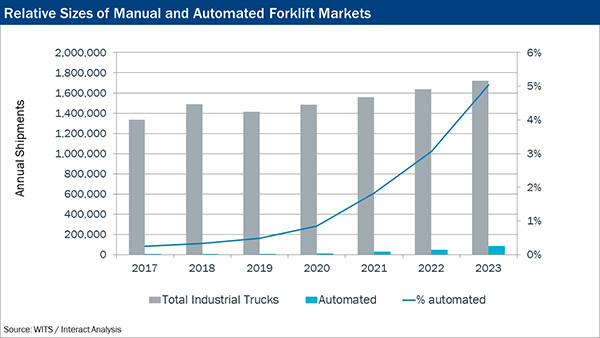

Robots as a share of lift-truck sales

While the COVID-19 pandemic has driven up unemployment in the past year, it remains challenging to secure enough workers—including skilled lift truck operators—to keep goods flowing to consumers. Automation sales stand to benefit under these conditions.

“The market environment in terms of employment has shifted somewhat versus last year, but over the longer term, the labor availability issue is a concern that will help drive this market segment,” said Ash Sharma, managing director at Interact Analysis.

The other reality is that automated lift trucks are still a drop in the bucket in terms of total lift truck sales. User companies will have to figure out how to justify them and think through how the technology is not just another type of lift truck, but a tool in their automation strategy.

Approximately 5,000 automated lift trucks were shipped in 2019, according to Sharma. That may sound like quite a few, but with more than 1 million lift trucks of all types shipped last year, it amounted to 0.3% of the market.

However, with the sharp increase in e-commerce and added pressure on warehouses and other industrial sites to improve on cost efficiencies and order cycle times, Interact Analysis predicts robust growth for robotic lift trucks. In addtion to autonomous vehicles, the analyst firm looked at automatic guided vehicles (AGVs) technology and autonomous mobile robots (AMRs).

Through 2028, Interact Analysis predicts a compound annual growth rate (CAGR) of 64.5% for robotic lift trucks, up from a rate in the 20% to 25% range the past couple of years, according to Sharma. The relentless pressure to find further costs efficiencies, as well as a higher level of safety for automated lift trucks, are key drivers, he said.

“Like other automation areas, one of the key drivers is cost savings,” said Sharma. “A company will invest in automated trucks that do cost more upfront, but it will save costs in the long run because the technology reduces the need for operators, and all the costs associated with that, like dealing with training and employee turnover.”

“The other major factor is that with robotic lift trucks, you get improved safety,” he added. “There are accidents which happen with human-operated lift trucks, and using automated trucks is far safer, not only in terms human safety, but also in reducing the risk of damage to inventory, trucks, or to facility assets.”

The rise of automated lift trucks

Lift truck providers agree that automated vehicles are bound to grow in popularity given the continued challenges. And while warehouse efficiency efforts often focus on automated order-picking systems, goods also need to be handled, staged or stored at the pallet level, which presents opportunities for robotics.

“I firmly believe this pandemic will accelerate the adoption of automated lift trucks, as well as many other forms of materials handling automation,” said Brett Wood, president and CEO of Toyota Material Handling North America (TMHNA), as well as a senior executive officer of TMHNA’s parent company, Toyota Industries Corp. (TICO).

“Part of the reason is the difficulty in finding enough skilled operators, but beyond that, it’s the increased level of customer expectations around a rapid and flawless materials handling process,” he said. “Customer requirements are demanding more efficiency than ever before, and that in turn drives the need for more process optimization—including automation.”

Wood added that automated lift trucks can be a good fit for repetitive movement of pallet loads. “I think automated lift trucks will help with the need to meet higher efficiency goals, because if repetitive processes exist in which goods need to regularly move from Point A to Point B, why shouldn’t that be automated?” he said.

Given the size of the installed base for conventional lift trucks, and the value and flexibility they provide, the shift in fleets toward automated trucks will be gradual, Wood noted. Some companies may choose to use automated lift trucks for only certain workflows or start with semi-automated lift truck features. With a semi-automated lift truck, guidance technology can automatically drive a lift truck along a given route, but the operator can take over when applicable.

“Automated lift trucks are definitely a trend, but an operator driving a lift truck will never go away,” said Wood. “There will always be demand for lift trucks with human operators. A human-operated asset is inherently flexible, and technologies such as telematics can provide data-driven insights on their use to help with the need for increased efficiency.”

Automation for workforce, 'Amazon effect' challenges

Before the pandemic, factors like record-low unemployment and rising wage rates had already made robotic lift trucks attractive to some operations, said Kevin Paramore, emerging technology commercialization manager at Yale Materials Handling Corp.

The labor situation is different now, but due to social distancing measures and health and safety policies requiring workers who are feeling ill to stay home, distribution centers may still have difficulty maintaining their workforce. The end effect is that more operations will see automation as part of the answer to labor shortages.

“When you consider all the factors like the high turnover rate in warehouses, and rising labor rates as part of what some call the 'Amazon effect,' that makes the return on investment timeframe shorter for robotic lift trucks, down to two years or less for multi-shift operations,” Paramore said. “As a result of all these trends, we expect to see sales of robotic lift trucks increase going forward into 2021 and beyond.”

Autonomous lift trucks cost more than their conventional equivalents, acknowledged Paramore, but it’s unrealistic to compare unit costs because robotic units provide both vehicle and operator capacities.

For robotic trucks, a more apt comparison is their cost in comparison with a conventional truck plus the cost of two or three full-time operators. In addition, one has to factor in other costs of using operators, like employee turnover and training. In addition, supply chains should consider other costs, such as how safer operations with robots lead to to less damage to assets and inventory.

“Robotic lift trucks are an entire system,” Paramore said. “When we go to market with them, there is a lot of discovery with each customer organization, finding out what they want to automate and achieve. We work with them to understand their goals with automation, and position it in terms of ROI falling within two years or less.”

Many companies have piloted robotic lift trucks of the past few years, he said, and some of them are now rolling more out to additional sites or for more workflows.

“We’ve had quite a few customers who’ve gone into [robotic lift trucks] with a demo mindset of, ‘Let’s go in with two to eight robots for a given process, to prove out the technology and see if there are unknowns that exist,'” recalled Paramore. “As they see these initial projects working well, they’ll be ready to automate more lift truck processes within the same facility or deploy them at additional facilities.”

Robotics evolution

The types of robotic lift trucks have also expanded in recent years. They can not only perform horizontal moves or short lifts, but they now can also lift and handle at higher rack positions.

Yale offers a driverless truck that can reach and handle loads at just more than 30 feet high, so the “scope” of lift truck applications that can be automated is less limited than it used to be, said Paramore. With the technical barriers less of an issue for robotic lift trucks, what remains are operational factors like available workforce, rising labor rates, and increased cycle times, all of which stack up in favor of increased use of automation.

Some vendors offering AMR technology said that infrastructure-free solutions will open up the market for broader use of robotic lift trucks. AMR-based lift trucks have evolved in recent years to cover more applications. They have progressed from hauling with autonomous tuggers to pallet stackers and high-bay models that can autonomously lift pallets with no need to install guidance infrastructure cues for bay and pick locations.

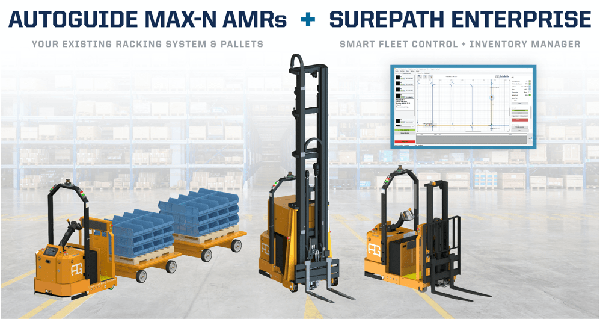

“What we offer are fully autonomous robots where you don’t need guidance infrastructure,” said Rob Sullivan, president of AutoGuide Mobile Robots. “Having units that truly do their tasks autonomously is the key enabler to delivering on the promise of warehouse efficiency.”

Sullivan noted that AutoGuide uses the same base unit and autonomous technology for its lift trucks and AMRs, but they have different “adapters.” That means the same base AMR can be a tugger, pallet stacker, or high-bay forklift, depending on customer need.

“It is a similar design approach to [arm-type picking] cobots, which use a base unit with different end effectors for different tasks,” said Sullivan.

'Mobile ASRS'

The need is growing for operations of all sizes to automate the movement of pallets to overcome labor availability issues, Sullivan said.

AutoGuide recently launched what it calls a “mobile ASRS.” Unlike a traditional automated storage and retrieval system (ASRS), the company's AMRs, software, and conventional racking. Sullivan said this costs less than pallet shuttles or unit-load ASRS but achieves similar efficiencies.

“There are many operations that just can’t hire enough people, and many others that struggle with high turnover,” he said. “Autonomous robots can reduce these challenges by automating some key workflows, enabling operations to take their best employees and put them on higher value tasks.”

Sullivan also sees the ROI for autonomous robots coming in at two years or less, with both leasing and buying options, although payback time varies based on labor rates and other factors.

In addition, AutoGuide has looked at how robotics as a service or RaaS might work for paying for robotic lift trucks. However, the model can get complicated and isn’t really needed given the attractive equipment leasing rates that exist and relatively short payback timeframes for AMRs, said Sullivan.

Robotics steppingstone

Perry Ardito, general manager of the Warehouse & Automation Products Group at Mitsubishi Logisnext Americas, also expects strong growth for automated lift trucks. He agreed that many customers will phase them in by using them for select workflows, while using more conventional lift trucks for other tasks.

Another steppingstone to use of fully automated trucks is to use semi-automated products such as semi-automated order pickers or turret trucks. A semi-automated vehicle still has an operator on board, but it also has warehouse navigation and sensing technology to obtain task and location instructions from a warehouse management system, Ardito said. It can automatically take the vehicle and the operator to the correct location by the most efficient route.

Such vehicles are less expensive than fully automated vehicles of the same type, but they carry some of the same benefits, such as use of route optimization and location accuracy, said Ardito.

“For operations that aren’t yet ready to jump into a fully automated solution, or the application doesn’t justify full automation, a semi-automated vehicle provides many of the same efficiencies you get with full automation when it comes to productivity, efficient routes, and picking accuracy,” he said.

Semi-automated lift truck technology is proven and has been around for years, added Ardito. Under the multiple lift truck brands offered by Mitsubishi Logisnext Americas, Jungheinrich launched its first semi-automated products more than 10 years ago and has semi-automated options for order pickers and turret trucks.

Operators still have to engage the throttle to make a semi-automated vehicle move, but such a vehicle can find each location accurately, without the operator having to count rack positions or numbered placards, which tends to distract the operator from other duties. A semi-automated vehicle can also pre-position forks for rapid, accurate engagement and lifting of pallets.

“Semi-automated technology makes the operator and the vehicle more productive. To go from conventional lift trucks to large-scale deployment of fully automated trucks can be a big leap,” said Ardito. “Semi-automation can be one way to achieve some of the benefits for full automation, as can using fully automated trucks for select workflows, and then expanding on that use once you start seeing the benefits.”

Reducing reliance on infrastructure

Jack Kaumo, director of iWarehouse Technology Solutions at The Raymond Corp., agreed that semi-automated vehicles can be good way to step into the benefits of fully automated vehicles. Semi-automation makes it so operators do not have to think about their routes or find the correct picking or drop-off points. “What that does is reduce the amount of errors that can occur in a process,” Kaumo said.

Infrastructure-free, automated lift trucks based on natural feature recognition will also help grow the market because they streamlines deployment details, he added. “The infrastructure free-piece makes it so the customer can literally have an automated truck up and running in one day,” Kaumo said.

Raymond’s fully automated vehicles are gaining momentum, he added. The shift from conventional lift trucks to fully automated ones will be gradual simply because of the huge installed base for conventional trucks that are meeting current needs, as well as the need to assess which workflows should be automated, said Kaumo.

“It will be a gradual process in moving to automation, but that’s OK, because you want to optimize processes before you automate them,” he said.

Before implemeting robotic lift trucks, companies need to carefully assess factors like the rack and storage layout or staging points compared with what existed before. That’s just fine with lift-truck vendors, who’ve evolved from mainly being hardware-focused vendors of conventional industrial trucks. It's important to understand one's own processes before brining in automation to improve them.

“Automated systems are only as efficient as the other facility processes they support,” said TMHNA's Wood. “Automation is not a substitute for defining and optimizing those processes, and automation won’t fix a broken process. You’ll just get broken or flawed results faster—and on a larger scale.”

About the Author

Follow Robotics 24/7 on Linkedin

Article topics

Email Sign Up