Cepton Technologies Inc. yesterday announced that it has entered into a $100 million binding investment agreement with partner and shareholder Koito Manufacturing Co. The company said it will use the funding for its next stage of growth as it scales lidar systems for mass production and deployment.

“We are excited to further strengthen our partnership with Koito and remain deeply grateful for Koito’s continued support,” stated Dr. Jun Pei, co-founder and CEO of Cepton. “This investment solidifies Cepton’s financial position and allows us to continue our execution excellence as we focus on commercialization and mass-market deployment of our lidar sensors.”

Founded in 2016, Cepton has developed lidar-based systems for advanced driver-assist systems (ADAS) and autonomous vehicles, smart cities and spaces, and industrial applications. The company said its patented sensor technology achieves “a balanced approach to performance, cost, and reliability, while enabling scalable and intelligent 3D perception solutions across industries.”

Cepton's leadership includes industry veterans with a wide range of experience in lidar and imaging technologies. The San Jose, Calif.-based company has a center of excellence in Troy, Mich. It also has a presence in Germany, Canada, Japan, India, and China to serve its global customer base.

Cepton builds partnerships

Cepton, which is engaged with all Top 10 global OEMs, has collaborated with Koito since 2017.

Tokyo-based Koito said it has been a leader in automotive lighting for safety since its establishment in 1915. Today, the Koito Group consists of 31 companies located in 13 countries worldwide.

The Tier 1 supplier said it responding to the transformation of mobility by developing next-generation lighting technologies and related equipment and control systems, as well as environmentally friendly products, materials, and production methods.

Cepton and Koito received an ADAS lidar series production award from General Motors Co. that they claimed was the largest known award in the industry.

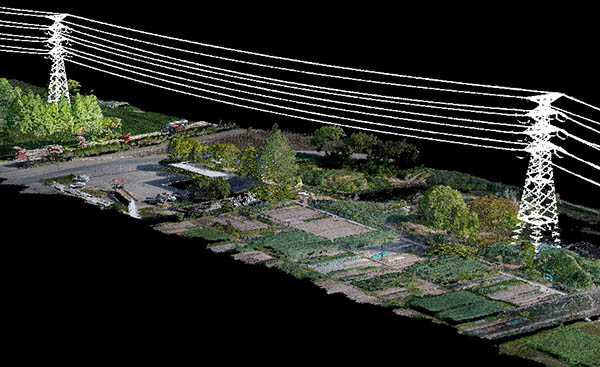

Last week, Cepton announced that it is working with LidarSwiss Solutions GmbH to deploy its technology. Cepton's Sora sensor will be included in LidarSwiss' Nano 360 drone-based mapping and analytics sytem for infrastructure management and engineering design applications.

“The prominent features of the Nano P60 are its high stability, point density, and intelligence,” said Robert Kletzli, founder and chief technology officer of LidarSwiss. “This lidar-enabled system addresses the critical gap of 3D accuracy with traditional camera and stereo imaging technologies.”

“Now, instead of needing two images to see a single point and detect its elevation, Nano P60 utilizes lidar’s intrinsic 3D imaging capabilities to achieve maximized efficiency, making real-time processing and analytics possible,” he added.

“Cepton’s Sora lidar is among the most compact, lightweight lidar sensors that we have tested and offers an unparalleled combination of high resolution, longer range in the same category, and cost efficiency,” Kletzli said. “Its unique lidar architecture allows seamless integration, making Nano P60 a true plug-and-play system with solid-state reliability.”

Koito makes third investment

“We are pleased to announce our third investment in Cepton as we work towards developing and commercializing next-generation automotive sensor technologies,” said Michiaki Kato, president of Koito. “Our partnership has developed over the years, and Cepton remains a critical partner for us.”

Cepton announced a special-purpose acquisition company (SPAC) deal in January, and it began trading on the Nasdaq Capital Market in February.

Under the terms of the investment agreement, which has been unanimously approved by Cepton’s board of directors, Koito will purchase $100 million of convertible preferred stock, with a purchase price of $1,000 per share.

The preferred stock will be convertible, beginning on the first anniversary of the issue date, into shares of Cepton’s common stock at an approximate initial conversion price of $2.585 per share. This will represent a 10% premium to Cepton’s volume-weighted average price over the trailing 20 trading-day period ending on Oct. 26.

The initial conversion price also represents a 13.4% premium to Cepton’s closing price on Oct. 26 and a 7% premium to Cepton’s average closing price over the past five trading days. At Cepton’s election, the preferred stock carries a 4.25% per annum dividend if paid in kind or a 3.25% per annum dividend if paid in cash, in each case paid quarterly in arrears.

Consummation of the investment is subject to, among other things, the approval of Cepton’s shareholders and satisfaction of applicable closing conditions. The investment is expected to close in the first quarter of 2023.

More information will be included in a Form 8-K to be filed by Cepton with the U.S. Securities and Exchange Commission (SEC).

ICR Capital LLC is serving as exclusive financial advisor to Cepton, and O’Melveny & Myers LLP is serving as legal counsel to Cepton. SMBC Nikko is serving as exclusive financial advisor to Koito, and Davis Polk & Wardwell LLP and Nishimura & Asahi are serving as legal counsel to Koito.

Article topics

Email Sign Up