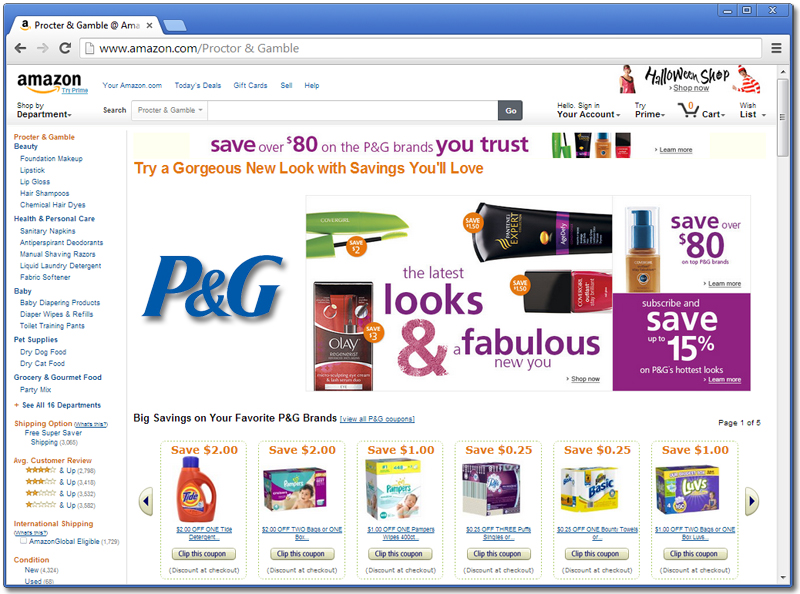

Amazon has a strong advantage over other retailers when it comes to prices, and a new report from The Wall Street Journal shows one reason why.

WSJ: Soap Opera - Amazon Moves In With P&G

E-Commerce Giant Sets Up Shop Inside Warehouses of SuppliersEach day, P&G loads products onto pallets and passes them over to Amazon inside a small, fenced-off area. Amazon employees then package, label and ship the items directly to the people who ordered them.

The e-commerce giant is quietly setting up shop inside the warehouses of a number of important suppliers as it works to open up the next big frontier for Internet sales: everyday products like toilet paper, diapers and shampoo.

In addition to not having to maintain expensive, huge retail stores like competitors including Best Buy and Walmart, Amazon is also now experimenting with opening up for business within the warehouses of its suppliers themselves, like some kind of symbiotic retail being.

The WSJ details what it calls an “ambitious experiment” by Amazon in a report this week, describing how Amazon maintains a fenced off region within a much larger Procter & Gamble Co. facility, which is staffed by its own employees.

The P&G workers load palettes with products destined for Amazon customers, and those then go to the Amazon warehouse-within-a-warehouse, where the online retail giant packages and ships them direct to their customers.

Supply chain management is a defining advantage of most successful modern consumer product companies, including Apple and Walmart.

(More: Amazon and Walmart: Facing the Retail, B2B & Consumer Supply Chain Titans)

Apple has managed to streamline its supply chain so much during the past few years that it almost never maintains any on-hand stock in its own facilities, instead arranging just-in-time production and shipping direct from its supplier assembly facilities to consumers and to its retail partners.

Walmart has been criticized and lauded for its ability to get the lowest possible price out of suppliers, and its “kanban”-style stock monitoring and replenishment system for those same partners.

(More: Amazon Beats Apple in Battle for Supply Chain Leadership)

Amazon’s new program is called Vendor Flex,” and it will especially help with offsetting the cost of selling low-price, high volume staples like diapers and household papers, which have traditionally been considered “too bulky or cheap” to make shipping direct to customer a viable option, according to the WSJ. But Amazon has been working on expanding that side of its business, and a big part of continuing its expansion in that area involves engineering the cost-benefit arrangement to make that growth economically viable.

While this program appears to be dealing mostly with non-perishable items, it’s an ambitious pilot of a type of operations model that could have far-reaching benefits.

AmazonFresh is currently operating in markets outside its launch theatre of Seattle, with further growth planned. Maybe Amazon can make sure the next time it hitches a ride with supply partners, that happens at large-scale industrial farms and food suppliers or bakeries.

Source: Darrell Etherington, TechCrunch

More commentary by Adrian Gonzalez: Amazon Inside P&G Warehouses: A Case of “What’s In It for We”

The article in the Wall Street Journal revealed that Amazon has set up operations inside at least seven P&G warehouses worldwide where “each day, P&G loads products [such as paper towels and diapers] onto pallets and passes them over to Amazon inside a small, fenced-off area.

Amazon employees then package, label, and ship the items directly to the people who ordered them [online].” Amazon’s partnership with P&G started three years ago, and the company is reportedly doing the same, or is in talks to set up similar operations, with Seventh Generation, Kimberly Clark, and Georgia Pacific.

As it turns out, my guests today on Talking Logistics were Kate Vitasek, architect of the Vested business model and faculty member at the University of Tennessee, and Jeanette Nyden, a negotiation expert and adjunct professor at Seattle University.

We talked about their recently-published book, Getting to We: Negotiating Agreements for Highly Collaborative Relationships (more on that in a future posting). I didn’t read the WSJ article until after the show, so I didn’t get to ask Kate and Jeanette about it. But after reading most of the book and reflecting on our conversation today, it struck me that Amazon and P&G are planting an orange tree.

More SC24/7 Coverage of Amazon

Article topics

Email Sign Up