The Cost of 'Shipping'

As reported by The Verge, Amazon’s business tends to oscillate between periods of extreme high-spending and extreme profitability, and the company is now fully in the former.

Amazon posted third-quarter earnings yesterday, boasting sales of $70 billion and profit of $2.1 billion.

While sales blew past analyst expectations, thanks largely to a record-setting Prime Day, the profit came in far under.

The culprit: higher shipping and other fulfillment costs Amazon is now incurring in its quest to deliver ever more packages at a higher frequency.

Amazon said it spent nearly 50 percent more on shipping and fulfillment in the last three months than this time a year ago, up to $9.6 billion.

That includes not just the cost of getting the packages to the customers’ doors through a variety of methods, but also its expansion - on air, land, and sea - in the logistics business.

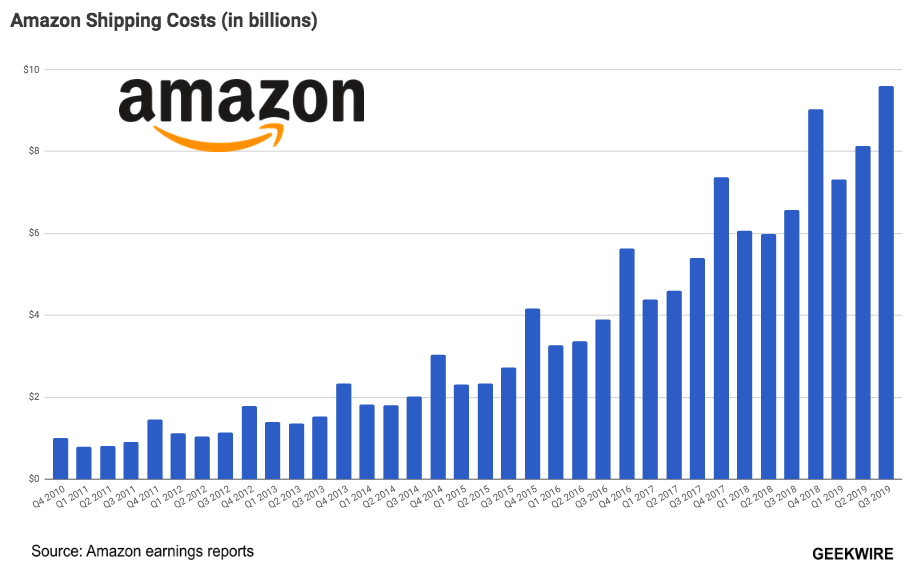

GeekWire reported Amazon’s overall shipping costs have ballooned in recent years as the company aims to speed up delivery, both with products purchased on Amazon.com and via Prime Now, such as Whole Foods orders.

During Q3, Amazon spent a whopping $9.6 billion globally on shipping, up 46 percent year-over-year, and $567 million more than what the company spent in the 2018 holiday quarter.

It’s a safe bet that shipping costs will eclipse $10 billion this holiday quarter, adding to what could be more than $35 billion spent on shipping over 2019. The company is also going on a hiring spree - it added nearly 100,000 people last quarter - in large part to support the one-day program.

The increased expenses may be spooking some investors. Amazon shares were down nearly 8 percent following the earnings report.

Operating income is projected for the fourth quarter at $1.2 billion to $2.9 billion, down from $3.8 billion in Q4 2018.

Read: Taking a Deep Dive into Amazon’s Logistics Pricing

On a call with analysts Thursday, Amazon CFO Brian Olsavsky admitted that there’s “certainly start-up pain in adding new capacity.”

“We are still learning on the one-day costs as we go, about what the long-term cost structure will be.”

Olsavsky said the biggest expense for the one-day initiative is transportation costs. But the company is also spending more to increase both product selection and labor capacity at its fulfillment centers.

In addition, there is forgone revenue from previously charging customers fees for same-day or one-day shipping - now that benefit is increasingly becoming free for Prime members on millions of items.

“It’s a drastic change to the whole network topology,” Olsavsky said Thursday. “We’re glad to do it and we’re working through it. We’ve been down this road before in a number of different incarnations in Amazon’s history.”

Amazon is currently rolling out one-day shipping first in North America and then internationally. The company said in June that free one-day shipping was available to Prime members on more than 10 million products, with no minimum purchase amount.

Amazon has been expanding its own shipping operations - buying its own airplanes and trailers, for example - to help meet delivery demand from customers. Rumors have persisted that Amazon will someday cut out large delivery partners including FedEx, as well as UPS and USPS, as those carriers also become competitors.

In August FedEx said it was ending a ground shipping deal with Amazon.

But Olsavsky reiterated Thursday that “in the long run we’re going to have a combination both of our own capacity, fueled by third party carriers.”

The “last mile” of delivery - getting packages from the closest fulfillment center to a customer’s home - can be particularly costly. To help meet demand, Amazon last year created its own small business program that lets anyone run their own package delivery fleet. The company also uses Amazon Flex, its Uber-like program for deliveries, and smaller third-party partners for next-day orders, which was the focus of a BuzzFeed investigation in August.

Amazon’s push for faster shipping has reshaped the retail industry, with many competitors such as Target and Walmart now offering their own free two-day delivery options. Walmart in May unveiled a one-day delivery on more than 200,000 items with a minimum order threshold of $35.

Read: Taking a Look at Why Amazon Is Bringing Logistics In-House

Amazon's Advantage (over the competition)

Amazon has an advantage over those competitors, in that it can leverage growing profits from other arms of the business - cloud computing, advertising, etc. - to allow its e-commerce operations to run on thin profit margins.

Amazon’s shipping investments include cash spent on developing its entire logistics operation, which besides last-mile delivery efforts also includes the building of warehouse and transportation infrastructure for managing its vast inventory.

The company is also putting money into the development of drones and ground-based robots that it hopes will one day deliver items to customers.

Additionally, it’s looking for ways to cut shipping costs by giving customers the option to collect their online orders from brick-and-mortar stores or Amazon lockers installed in convenience stores, malls, and apartment buildings.

Winning More Prime Members

If Amazon has to spend an extra $800 million a quarter indefinitely to build out its logistics network for next-day shipping, it'll be worth the investment.

The company is on pace to spend about $7 billion on digital media this year, and that's not even the most important part of Prime, according to the vast majority of members.

Amazon uses video and music as a way to attract and retain new subscribers, but next-day shipping will likely do an even better job. Not only is it something consumers have shown interest in, but it's also a differentiated service.

There are a growing number of competing video and music streaming services competing against Amazon Prime, but nobody's offering unlimited next-day shipping on more than 100 million items.

Read: Why Amazon Has a Leg Up On the Online Competition, Thanks To Its Massive Customer Base

Getting More Prime Members is Amazon's Ultimate Goal

Prime members are more loyal Amazon shoppers and spend more than twice as much per year on average compared with nonmembers. And with next-day shipping, Prime members may be spending even more as Amazon could win more time-sensitive sales that would have otherwise gone to brick-and-mortar retailers.

More Prime members spending more on Amazon will make the investments in next-day shipping more than worthwhile.

Related Article: Why Amazon Has a Leg Up On the Online Competition, Thanks To Its Massive Customer Base

In this accompanying video, CNBC.com retail reporter Lauren Thomas discusses how Amazon has major leverage over the competition online, especially on Prime Day, and how Walmart admits it's had to play catch-up.

Related 'Last-Mile Delivery' White Papers

The Ultimate Guide to Last Mile & White Glove Logistics

Shippers must adapt to the changing consumer demands and tailor last mile strategies to mesh well with such demands. In this e-book, “The Ultimate Guide To Last Mile & White Glove Logistics”, details these top lessons that shippers need to know about last-mile logistics in the modern era. Download Now!

Learning from Route Plan Deviation in Last-Mile Delivery

This capstone project studies route deviations in the last-mile deliveries of a large soft drink company. Download Now!

Winning the Battle for eCommerce Last-Mile Excellence

This paper explains why last-mile delivery is the most important – and the most expensive – part of the logistics process, accounting for an estimated 28 percent of overall transportation spend. Download Now!

Final Mile Delivery

A Buffalo-based subscription of the month company found that its current supply chain was incredibly costly and labor-intensive. Looking to move away from large, big box carriers, this subscription of the month company looked to PITT OHIO for a more cost-effective, streamlined customized solution. Download Now!

How Shippers Can Compete in an Ecommerce Logistics Driven Shipping Environment

Understanding e-commerce shipping and logistics are essential to success in the modern era, this white paper details what it takes for shippers in all surface modes to compete and succeed today. Download Now!

More SC24/7: “Last Mile” White Papers

Article topics

Email Sign Up