As retailers face stiffer competition they are discovering and implementing new methods—not just faster fashion—but often introducing new brands and lines to capture distinct customer bases.

Further, they are designing dynamic supply chain practices that hold lower inventories while serving those distinct new markets and customers.

Specific to allocations, rather than having one big push out to the stores, the agile retailer has a data-driven approach to how, where, and when they stock, with dynamic movement of goods for rotating selections based on promotions or location-specific-demand, and fine tuning inventory stocking locations to support Omni-channel.

Think about it: If inventory is constantly in motion, then shouldn’t the transportation strategy be linked to this more dynamic allocation strategy? In fact, agile retailers are beginning to think about their business in a highly integrated fashion, understanding the implications from a sales and cost perspective and how all the parts fit together.

This, de facto, is what separates an agile retailer from others. Not only are they constantly analyzing what is selling, but how to sell it better to create a profit-making enterprise. (Silly me to mention profit, don’t you think?) One only has to look at the lackluster retail financial reports to realize even a few extra pennies per item count. Only the best retailers survive and thrive.

Linking Transportation to Allocation

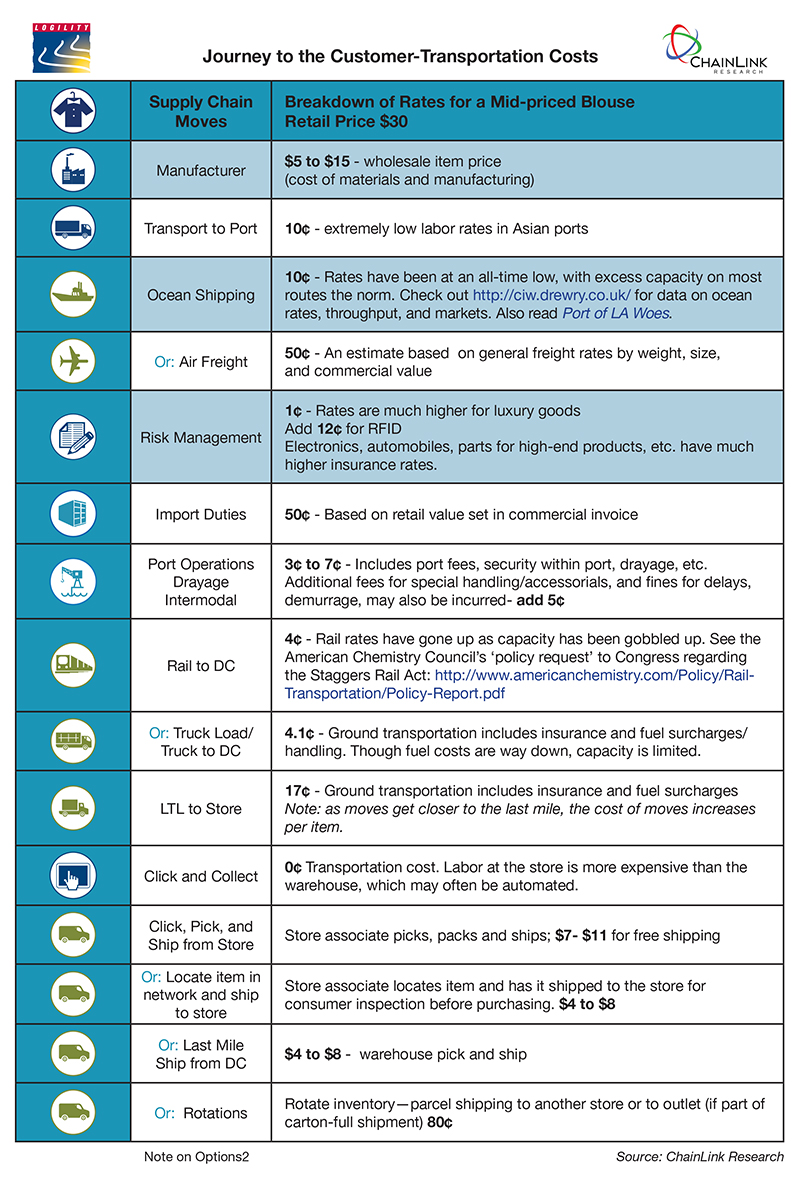

Transportation was not a big focus area for most retailers, but that is beginning to change. Now that they are embroiled in the anyway/anywhere/Omni-fulfillment model, retailers are seeing just how much there is to learn. Each move increases costs. Consider a simple shirt’s journey.

We analyzed this once before for a customer, considering only ship to store vs. an ecommerce/ship from DC sale, but we never considered dynamic allocations as part of the plan. Probably most retailers make that same mistake, not realizing fully the cost of transportation. But just consider this simplified view of the movement of one shirt that starts its journey in a bulk container shipped across the ocean.

When you look at that table (surely a simplified view of what might be happening) you see several approaches to reaching the consumer. Not only does each move cost money, but behind the scenes each move is often associated with a price markdown. Ouch! This does not mean that these moves should not be done. Selling off the merchandise is critically important to the brand. If consumers find your brand at a liquidator, they will realize that this is no longer the exclusive or fashionable brand they loved and the initial ticket prices and the velocity of the sales will suffer over time.

If transportation is not considered part of the overall strategy to sell off all merchandise, the thin profits a retailer makes are at risk. To maintain profit and brand it is obvious that your transportation may need some fresh thinking—that is, optimization. Here are a few recommendations:

Create a full end-to-end picture of your transportation, moves, modes, and spend. From there, many alternatives can be analyzed. Often, firms have not put all their data into their TMS (transportation management system) since they have different tactics for each leg of the journey and thus, they don’t truly know their total spend. Therefore, they cannot develop insights on a better path forward.

Evaluate stocking locations or even the overall fulfillment strategy. What gets product to market at the lowest price in the shortest time? Trade-offs between transportation and inventory stocking should be considered. Possibly a new distribution network could be developed. Many retailers today are doing just that to support Omni-channel.

Evaluate modes and carriers. Today, with Omni-channel the hot topic, many carriers are rapidly changing their services. For example a TL-only carrier may now do LTL and even parcel/last mile. A carrier is likely to provide a much better rate for a bigger share of the spend. And many LTLs provide better parcel rates than the major parcel carriers.

Provide carriers with a full view of your shipping plans. Often there are opportunities for carriers that have existing routes or back haul. These opportunities save the carrier and, thus, the retailer, money.

Align demand data with transportation bidding. Providing the carrier early warning, or even a forecast, can go a long way to securing better, more reliable service and consistent (and lower) rates, avoiding the last minute high or expedited rates.

- Clean up you TM data! Get your TM spend and administrative tasks under control. Often organizations cherry-pick or ‘decompose’ their transportation activities rather than putting everything in the TMS. They consider that 3rd parties are doing much of work, so, “why do we need to pull this data together?” In fact, getting all the planning and administrative work in one place allows an organization to take advantage of better planning, which will allow for reduced rates as well as optimized loads, further reducing the cost per item. Well organized administrative transportation departments can take advanced of self-invoicing which will often allow further discounts from carriers.

Considering that the margin on most items is so low, even a few pennies per item savings on transportation spending can increase those thin margins or even turn markdowns from red to black. And that is a real fashion statement!

Call to Action

Traditionally, retailers have poor connectivity between merchandising and transportation departments, if they have it at all. However, to be successful in these new agile models, the transportation element is crucial, and if left on its own, the least optimal approach will generally be chosen. That means less cash for new and dynamic collections as trends and seasons change. That is the death knell to a retailer.

Retailers will need to create a more integrative approach between the merchant and the logistician—and that means using modern transportation software to create an agile and optimal strategy for retail logistics.

Though firms like Amazon and other retailers investing in their own dedicated or private fleets get all the headlines, behind the scenes the investments in TMS continue at a healthy pace, driven to a great degree by the need for retailers and consumer-oriented enterprises to develop a more comprehensive and aligned transportation strategy.

For the agile retailer, everything has to support only a few key operational ideas, really: putting merchandise in front of the consumer, in the right channel; and once the consumer wants to buy, ensuring exceptional fulfillment. These goals can only be supported by linking transportation to allocation, certainly, and also the whole cycle of the business.

Article topics

Email Sign Up