The average age of a U.S. warehouse is 34 years with low ceilings, uneven floors and tight spaces (CBRE), and with e-commerce projected to generate roughly $4.5 trillion in retail sales by 2021, U.S. warehouse facilities won’t be able to keep up with fulfillment needs.

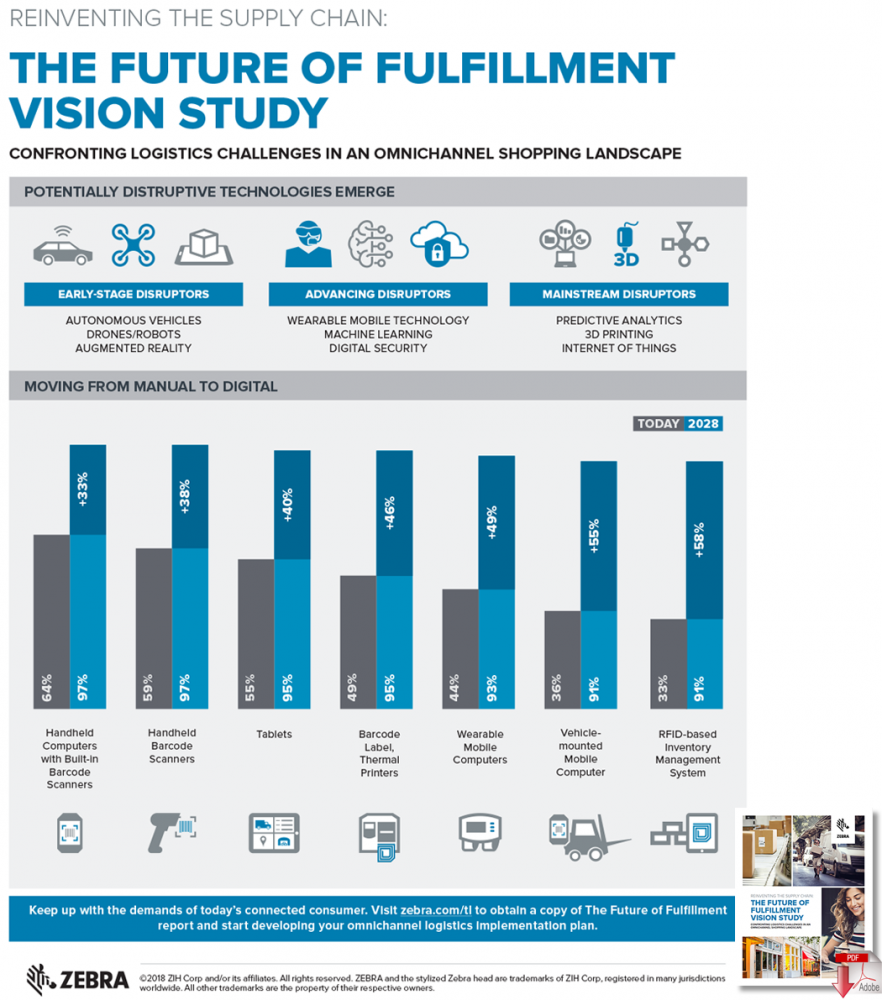

Zebra Technologies, a market leader in rugged mobile computers, barcode scanners and barcode printers enhanced with software and services to enable real-time enterprise visibility, has announced the results of its Future of Fulfillment Vision Study.

The study is a global body of research analyzing how manufacturers, transportation and logistics (T&L) firms, and retailers are preparing to meet the growing needs of the on-demand economy.

In response to today’s online-buying, smartphone-wielding consumer that expects a seamless, faster purchasing journey, the study revealed that 78 percent of logistics companies expect to provide same-day delivery by 2023 and 40 percent anticipate delivery within a two-hour window by 2028.

In addition, 87 percent of survey respondents expect to use crowdsourced delivery or a network of drivers that choose to complete a specific order by 2028.

Jim Hilton, Manufacturing and Transportation and Logistics Global Principal, Zebra Technologies stated;

“Driven by the always-connected, tech-savvy shopper, retailers, manufacturers and logistics companies are collaborating and swapping roles in uncharted ways to meet shoppers’ omnichannel product fulfillment and delivery expectations. Zebra’s Future of Fulfillment Vision Study found that 89 percent of survey respondents agreed that e-commerce is driving the need for faster delivery. In response, companies are turning to digital technology and analytics to bring heightened automation, merchandise visibility and business intelligence to the supply chain to compete in the on-demand consumer economy.”

Key Survey Findings

- Only 39 percent of supply chain respondents reported operating at an omnichannel level. The survey found reducing backorders was the biggest challenge to reaching omnichannel fulfillment for one-third of respondents followed by inventory allocation and freight costs.

- 76 percent of surveyed retailers use store inventory to fill online orders, and 86 percent of retail respondents plan to implement buy online/pick up in store in the next year. Retailers are investing in retrofitting stores to double as online fulfillment centers and shrinking selling space to accommodate e-commerce pickups and returns.

- Globally, 87 percent of respondents agreed that accepting and managing product returns is a challenge. The increase in free and fast product delivery corresponds with an increase in product returns, a costly concern that retailers struggle to manage effectively across many different purchasing models. Seven in 10 surveyed executives agree that more retailers will turn stores into fulfillment centers that accommodate product returns. More than 60 percent of retailers that currently do not offer free shipping, free returns or same-day delivery plan to do so while 44 percent expect to outsource returns management to a third party.

- Although 72 percent of organizations utilize barcodes today, 55 percent of organizations are still using inefficient, manual pen-and-paper based processes to enable omnichannel logistics. By 2021, handheld mobile computers with barcode scanners will be used by 94 percent of respondents for omnichannel logistics. The upgrade from manual pen-and-paper spreadsheets to handheld computers with barcode scanners or tablets will improve omnichannel logistics by providing more real-time access to warehouse management systems.

- Radio-frequency identification (RFID) technology and inventory management platforms are expected to grow by 49 percent in the next few years. RFID-enabled software, hardware, and tagging solutions offer up-to-the-minute, item-level inventory lookup, heightening inventory accuracy and shopper satisfaction while reducing out of stocks, overstocks and replenishment errors.

- Future-oriented decision makers revealed that next generation supply chains will reflect connected, business-intelligence and automated solutions that will add newfound speed, precision, and cost-effectiveness to transportation and labor. Surveyed executives expect the most disruptive technologies to be drones (39 percent), driverless/autonomous vehicles (38 percent), wearable and mobile technology (37 percent) and robotics (37 percent).

Regional Findings

- The need for inventory accuracy will continue to rise in North America. Manufacturers, logistics companies, and merchants ranked current inventory accuracy at 74 percent and reported needing to be at 83 percent to handle the rise of omnichannel logistics.

- Retailers in Europe and the Middle East are filling digital orders directly from their physical stores. Retailers and operations leaders are calculating that a network of stores can get digital orders faster and more efficiently than a handful of centralized warehouses. More than 80 percent use store inventory to fulfill orders and 29 percent expect this to increase by greater than 10 percent over the next five years.

- 95 percent of respondents in Asia Pacific rate e-commerce as the driving need for faster delivery. The region expects to implement same-day delivery faster than any other region, and 42 percent of those surveyed ranked drones as one of the most important disruptive technologies.

- Shipping fees and returns are undergoing a makeover in Latin America. Approximately 40 percent of respondents plan to discontinue free shipping, 55 percent expect to end free return shipping and 61 percent forecast the elimination of separate returns facilities that are managed by third-party companies.

Survey Background and Methodology

- Zebra’s Future of Fulfillment Vision Study surveyed more than 2,700 professionals in transportation and logistics, retail and manufacturing firms on their plans, implementation levels, experiences and attitudes toward omnichannel logistics.

- Surveys were conducted in conjunction with research partner Qualtrics in 2017 across the United States, Canada, Brazil, Mexico, Colombia, Chile, France, Germany, United Kingdom, Italy, Russia, Spain, China, India, Australia and New Zealand.

Related Resources

2017 Manufacturing Vision Study

Download this study to find out what the future of manufacturing will look like - and how to prepare your operation for real-time growth. Download Now!

Building the Smarter Warehouse: Warehousing 2020

This online survey asked IT and operations personnel in the manufacturing, retail, transportation, and wholesale market segments to share their insights and business plans over the next five years, in light of a rapidly changing industry. Download Now!

Reinventing Retail: 10th Annual Zebra Shopper Study

This study highlights and key findings from the 2017 Global Shopper Study, the 10th annual survey analyzing shopper satisfaction and retail technology trends. Download Now!

Future of Fulfillment Vision Study New!

Zebra Technologies commissioned a global research study to gain a richer understanding of how manufacturers, retailers, and logistics firms are preparing to meet the growing needs of the on-demand economy, the surveys were designed to reveal plans, implementation levels, experiences and attitudes toward omnichannel logistics. Download Now!

More Resources from Zebra Technologies

Article topics

Email Sign Up