As most U.S. shippers can tell from their rising freight bills, carriers have taken advantage of a seller’s market in transportation as the confluence of a strong economy, surging demand and labor and capacity shortages are causing multiple pain points for logistics operations.

That’s the conclusion of the “29th Annual State of Logistics Report” produced by A.T. Kearney in partnership with the Council of Supply Chain Management Professionals (CSCMP) and Penske Logistics. The report was released June 19 at the National Press Club in Washington.

The tightening logistics market, especially in ground transportation, is going to require “creative thinking and innovation” on the part of shippers, the report states, and new technologies and start-ups might provide some “novel solutions to transportation challenges.” However, old-fashioned ingenuity, building relationships with carriers and an increasing knowledge base of best practices may help logisticians ride out the challenges longer term.

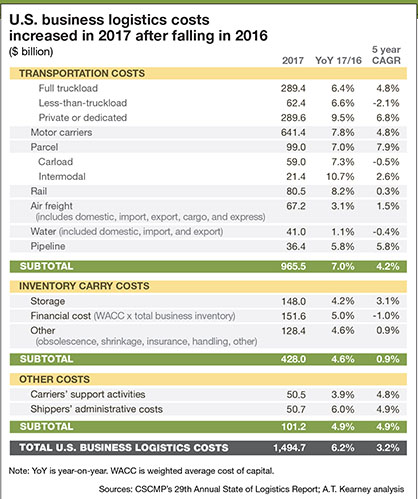

Titled “Steep Grade Ahead,” this year’s report discloses that U.S. business logistics costs, after declining in 2016 for the first time since 2009, were on the rise again in 2017. Business logistics costs rose 6.2% to $1.494 trillion last year. However, the pace of spending increases surged in the fourth quarter of last year, perhaps foreshadowing more of the same for 2018.

The main rising cost drivers were the “robust” economic climate coupled with growing demand, a strong job market, rising wages and the truck driver shortage that’s now estimated by the American Trucking Associations to be more than 50,000. The State of Logistics report, while noting the driver shortage is “nothing new to the industry,” states that the shortage is contributing to sharply higher pay that is eventually being reflected in higher shipping rates.

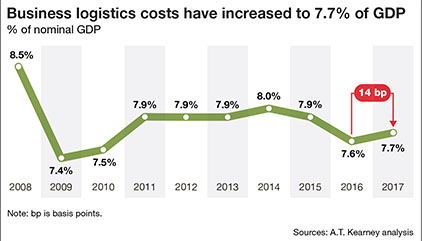

With GDP rising a healthy 2.9% last year, business logistics costs increased 10 basis points last year to 7.7% of GDP, up slightly from 7.6% in 2016. As the report authors conclude, that’s still a bargain by long-term standards. By comparison, in 1979, the last year before trucking was economically deregulated, logistics costs were approximately 19% of GDP—a sure sign that trucking was perhaps the ideal industry to be unshackled from federal economic regulation.

With GDP rising a healthy 2.9% last year, business logistics costs increased 10 basis points last year to 7.7% of GDP, up slightly from 7.6% in 2016. As the report authors conclude, that’s still a bargain by long-term standards. By comparison, in 1979, the last year before trucking was economically deregulated, logistics costs were approximately 19% of GDP—a sure sign that trucking was perhaps the ideal industry to be unshackled from federal economic regulation.

The recently enacted tax cut for some upper- and middle-income Americans is expected to add 0.7% to GDP this year. However, the report noted that some of those gains could be erased by the Trump administration’s fascination with tariffs on exports, specifically aluminum and steel, and the threat to international trade agreements.

Mode by mode: Costs rising

Tightening capacity is only one factor behind the rising costs of freight movement. A country’s transportation system is only as good as its infrastructure, and the report makes clear that logistics operations will pay a price for long-delayed improvements to modernization of the U.S. network of roads, bridges, ports and airports.

That lack of any expansion of infrastructure spending is also expected to be a drag on productivity in the United States. The World Economic Forum’s “Global Competitiveness” report recently graded the United States a score of 5.9 on overall infrastructure quality—behind the Netherlands at 6.2, but ahead of Spain at 5.5.

“Logistics providers should not expect a sweeping modernization of U.S. infrastructure,” say the authors of the State of Logistics. “Modest upgrades in road, rail and airport infrastructure are likely in the near or medium term. As improvement projects move forward, logistics providers would face delays on affected routes.”

According to the American Society of Civil Engineers, the United States needs to invest $4.6 trillion in roads, bridges, ports and other infrastructure to bring the system up to grade. President Donald J. Trump has often touted an alleged $1.5 trillion, 10-year infrastructure plan that has gone exactly nowhere in Washington. The last plan was for a modest $200 billion federal spending plan, but even that is on a road to nowhere in this election year.

Speaking of dollars, freight transportation costs rose 7% last year compared with 2016. The State of Logistics Report breaks out the modal price rises:

- private or dedicated trucking set the pace with a 9.5% increase;

- less-than-truckload pricing rose 6.6%, while full truckload rates were up 6.4%;

- trucking overall remained the dominant mode of freight transport, garnering $641 billion of the $965 billion total of freight transport bill;

- the $99 billion parcel industry enjoyed a 7% rate gain, mostly as a result of e-commerce traffic;

- the $21.4 billion intermodal industry chalked up 10.7% year-over-over gains;

- the $80.5 billion rail sector had an 8.2% rate gain;

- the $67 billion airfreight sector, dogged by overcapacity and skimming by the trucking industry, had a small 3.1% year-over-year gain;

- the $41 billion maritime industry eked out a 1.1% rate gain;

- the $36 billion pipeline sector rose 5.8%; and

- inventory storage and financial costs rose a total of 4.6%, with administration costs rising a similar 4.9%.

Several shippers and carriers on the panel at the State of Logistics press briefing were queried about how they were handling the new pricing environment. Sylvia Fouhy, vice president of customer experience at Johnson & Johnson, says that capacity constraints are causing her company “to look at transportation as an investment rather than a cost of operations.”

Several shippers and carriers on the panel at the State of Logistics press briefing were queried about how they were handling the new pricing environment. Sylvia Fouhy, vice president of customer experience at Johnson & Johnson, says that capacity constraints are causing her company “to look at transportation as an investment rather than a cost of operations.”

Another member of the shipper panel, Cheryl Capps, vice president of global supply chain at Corning International, said that the capacity situation “has definitely kept us on our toes,” adding that “so far, capacity issues have been a nuisance” for 167-year-old Corning, but nothing more.

Those shippers using surface transport were likely to have the most headaches, as the combination of rising carrier costs and tight capacity caused “sharp” rate increases over 2017 and into 2018. “No sector saw more change last year than motor freight,” the report notes. “Severe capacity pressures sparked sharp rate hikes, and carriers gained pricing power as demand rose and electronic logging devices [ELD] exacerbated driver shortages.”

According to Joe Carlier, senior vice president for global sales a Penske Logistics and a member of the panel, says that his company is definitely feeling the capacity situation, noting that the average age of a truck driver is between 53 and 55 and that the newly enacted ELD rules will also add stress to the system.

“Everything is about people, people, people,” notes Carlier. “Something needs to happen here in the short term. At the end of the day, things desperately have to change.”

Carlier says that developing set schedules for drivers, using relay routes and changing delivery design systems to get drivers home more frequently are keys to fighting the driver shortage. “The ratio of those exiting the business against those entering the business is significantly unbalanced,” he says.

And as trucking challenges and rates rose, rail was able to “raise prices sharply,” the report states, reversing a decline seen in 2016 rail pricing. Productivity improved among the Class 1 railroads with the report noting that some rails embraced what it called “precision railroading” principles.

In the meantime, while international trade accounts for 27% of U.S. GDP—including $1.6 trillion in exports and $2.4 trillion in imports—such rising demand can’t be taken for granted. Trump has talked openly about opening a trade war with China and our allies, and that war is apparently under way, with tariffs on aluminum and steel and the retaliatory tariffs already starting.

“It’s far from certain that strong global trade flows will continue,” the report authors note. “U.S. trade policy has become less predictable as the current administration threatens established trade relationships in an effort to promote ‘reciprocal’ trade with better terms for U.S. companies.”

“It’s far from certain that strong global trade flows will continue,” the report authors note. “U.S. trade policy has become less predictable as the current administration threatens established trade relationships in an effort to promote ‘reciprocal’ trade with better terms for U.S. companies.”

And in a dire warning directly to international traders, the authors believe that “the industry should prepare risk mitigation plans and consider raising rates or other strategies to protect profit margins as declining international shipments reduce revenue.”

Future trends defined

Analyzing what happened last year appears easy compared to predicting what may lie ahead. However, the SoL report concludes with five trends shaping the future of logistics:

- robust macroeconomic growth rooted in a strong labor market and corporate tax cuts will boost logistics demand;

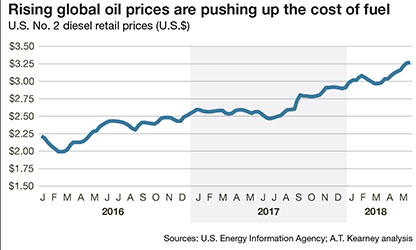

- rising interest rates, tight labor and higher fuel prices will raise logistics costs;

- strong demand patterns and new competitors will challenge old business models;

- a fully digital, connected and flexible supply chain will optimize demand for e-commerce, while same-day delivery will become “essential;” and

- next-generation supply chain will drive efficiencies through Big data-type technologies—predictive analytics, artificial intelligence, robotics and electric or autonomous vehicles will assist these efficiencies.

“Carriers are in control as demand outstrips supply while shippers try to ‘create capacity’ by improving efficiency wherever possible,” contend the authors. “Paradoxically, rising e-commerce volumes will shift attention to the supply chain from digital initiatives.”

And in a stern warning emphasizing the benefits of an efficient supply chain to the bottom line, the report concludes that companies “that recognize and capitalize on this trend will succeed, with smart technology investments and astute strategic choices separating winners from losers.”

Panelist reaction

The panel at the “29th Annual State of Logistics Report” press event was generally in agreement that logistics professionals are entering a new era in managing their logistics and supply chain operations.

Johnson & Johnson’s Fouhy notes that entering into long-term relationships with carriers and third party logistics (3PL) partners is now imperative to gaining improved logistics efficiency. “And that is a paradigm shift for us,” she says. “We strive to be the shipper of choice for our carriers because we’re not in it for the short haul.”

And while admitting that there can be tension with third-party relationships, Fouhy says that the key is getting 3PLs to fully understand her company’s needs and standards. “What we focus on is integrating J&J into the 3PL relationship to help alleviate tensions.”

Joseph Ruddy, chief innovation officer for the Port of Virginia, says that his organization has invested $750 million to enable the state’s six ports to handle as many as 1 million additional intermodal containers to help with the capacity flow. “The biggest concern we have is to continue to create that capacity,” he said, noting he was worried some for-hire trucking companies might be hiring away drivers from ports. “That might cannibalize some of our port capacity,” he said.

New technologies coming online could be at least a temporary balm to help shippers lower their costs and become more efficient, several panel members noted. Eric Hansen, Kansas City Southern’s vice president for intermodal, says that new digital standards such as blockchain technology hosting standardized, process-driven information in a digital environment might be a long-term boost to efficiency. “It’s imminent,” says Hansen. “We’re talking months, not years.”

- John D. Schulz, contributing editor

LTL: Strong market leads to disciplined pricing

According to carrier executives and analysts, the once-beleaguered $36 billion less-than-truckload (LTL) market is enjoying its best pricing and rate environment in at least a decade with no sign that this is a temporary situation.

According to carrier executives and analysts, the once-beleaguered $36 billion less-than-truckload (LTL) market is enjoying its best pricing and rate environment in at least a decade with no sign that this is a temporary situation.

Frank Granieri, COO of A. Duie Pyle, a leading Northeast regional LTL carrier, told Logistics Management that LTL demand right now is “very strong,” and that was before heading into the peak third and fourth quarters.

“Our customers are growing, and we’re growing with them,” says Granieri. “We’re also seeing our customers challenge traditional logistics solutions in the quest to find innovative solutions to improve service, quality, shipment visibility and information flow while containing costs and limiting risk.”

The hunt for certifiable drivers “is an ongoing challenge,” says Granieri, adding that Pyle was fortunate to have put additional driver training and recruitment processes in place the last several years that are now working as designed and keeping driving positions filled. “Having said that, we can always use a few more drivers.”

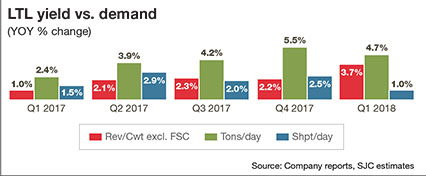

Analyst Satish Jindel, principal of SJ Consulting, a firm that closely tracks the LTL sector, says that LTL carriers have been “very disciplined” in their pricing and keeping capacity in a profitable supply-demand equilibrium. “They’re being very disciplined and not going back to their bad habits.”

Jindel adds that demographics, e-commerce and Amazon have permanently changed LTL market dynamics, which aren’t going back to the old days any time soon. “The LTL sector will continue to remain tight and favorable to carriers until autonomous vehicles are embraced by society and lawmakers,” he says. “Until then, it’s Christmas time for the LTL industry.”

Indeed, LTL carriers can already hear Christmas bells ringing in data of their financial charts. Revenue per hundredweight jumped 3.7% year-over-year in the first quarter with tonnage up a whopping 4.7%. That would indicate a shifting of heavier freight shipments from the TL side to LTL carriers, analysts noted.

Indeed, LTL carriers can already hear Christmas bells ringing in data of their financial charts. Revenue per hundredweight jumped 3.7% year-over-year in the first quarter with tonnage up a whopping 4.7%. That would indicate a shifting of heavier freight shipments from the TL side to LTL carriers, analysts noted.

“The tight market on the TL side is helping LTL because the average weight of shipments is going up,” explains Jindel. “Another thing that will help LTL is that the parcel guys will be moving heavier boxes to LTL because they’re overwhelmed by e-commerce freight.”

Indicative that parcel carriers increasingly don’t want heavy freight clogging up their systems, UPS recently raised its surcharge on shipments over 151 pounds from $500 to $650. “That freight will move to LTL,” says Jindel. “The LTL guys need to find out who’s shipping those heavier packages and sign them up.”

In fact, Pyle, like many other LTL giants, is always looking to increase capacity. “Our strategy is to look out into the future and build for tomorrow and not wait until we’re constrained in a market due to the size of a service center or some other item that could have been foreseen,” says Granieri.

Asked how shippers are coping with rate increases of 6% higher and even 10% higher than old contractual rates, Granieri says that they are coping. “No one likes a rate increase,” hey says. “However, customers are understanding that we need to continuously reinvest in our business to ensure that we retain and attract new employees, keep technology on the leading edge, and build capacity for the future.”

—John D. Schulz, contributing editor

Truckload (TL): The best market in a decade

There haven’t been truckload rates this high since before the Great Recession. Most large truckload (TL) carriers have their pick of freight and are giving more turndowns than a beachfront hotel on a holiday weekend.

There haven’t been truckload rates this high since before the Great Recession. Most large truckload (TL) carriers have their pick of freight and are giving more turndowns than a beachfront hotel on a holiday weekend.

In turn, this is causing some shippers to run budget overruns like the federal government. Welcome to the state of truckload transportation in 2018.

“Solid industrial production and broad-based economic growth have been strong and steady thus far in 2018,” says Jim Gattoni, president and CEO of Landstar. “These conditions have led to tremendous overall demand for truckload services, resulting in a tight capacity market made tighter by the impact of the electronic logging device mandate.”

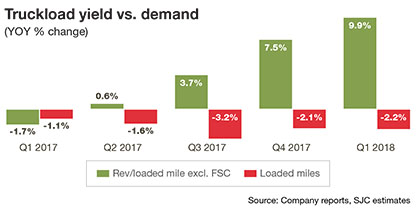

As the adjacent chart indicates, TL revenue per loaded mile (excluding fuel surcharges, which are rising as well) jumped a whopping 9.9% in the first quarter of 2018 compared to the same period in 2017. That coincided with a 2.2% drop in loaded miles, which indicates capacity is tight while freight demands are rising.

Truck tonnage jumped 9.5% in April compared with the same period a year ago, according to the American Trucking Associations’ (ATA) monthly for-hire truck tonnage index. In the first four months of 2018, ATA’s seasonally adjusted for-hire truck tonnage index rose 8%, topping the 3.8% rise seen in the same period in 2017. While these figures are for all trucking, about 85% of that tonnage and revenue is for truckload freight.

Truck tonnage jumped 9.5% in April compared with the same period a year ago, according to the American Trucking Associations’ (ATA) monthly for-hire truck tonnage index. In the first four months of 2018, ATA’s seasonally adjusted for-hire truck tonnage index rose 8%, topping the 3.8% rise seen in the same period in 2017. While these figures are for all trucking, about 85% of that tonnage and revenue is for truckload freight.

“TL freight tonnage remains robust,” says Bob Costello, chief economist for the ATA, adding that the tonnage figures don’t yet reflect the traditionally strong spring freight season yet. Meanwhile, truckload carriers, while some are still recovering to capacity levels reduced by the Great Recession, are cashing in on that robust demand for TL capacity.

“These companies are learning that it’s not a crime to make money,” says Satish Jindel, principal of SJ Consulting, a firm that closely tracks all trucking sectors.

In fact, it has gotten so good for carriers that some large, national shippers have recently cited higher transport costs eating into their bottom lines. Officials from John Deere and Procter & Gamble were recently quoted as saying exactly that.

“When I read that shippers like John Deere and Procter & Gamble say margins are down because transportation costs, I love hearing that,” says Jindel. “Freight transportation in this country has been too low for too long because of bad habits of shippers. Now that markets are tight and prices are up, shippers should be able to absorb this extra cost without paying more than they did a year ago by changing their shipping habits.”

So, has truckload freight pricing entered a new paradigm? “Of course,” says Jindel. “Are you still fumbling with quarters on a pay phone like you were 10 years or 20 years ago? Of course not. The market has evolved to smart phones, and it’s the same with transport.”

Clearly, this isn’t your grandfather’s trucking market. Even with this rise in TL rates, analyst Jindel notes “no other developed country has lower costs of transportation as percentage of cost of goods than America.”

Still, with the industry short about 50,000 drivers, some are hoping that the TL driver shortage continues. Michael Dow of Dallas was a driver for more than two decades before he and his brother started a company, Dow Brothers Transportation, this past year.

“Rates have never been this good in more than 20 years, and I hope the driver shortage continues,” Dow recently told The Washington Post. “Skilled drivers like me aren’t cheap right now, and I’m anticipating I’ll make $85,000 to $120,000 this year.”

—John D. Schulz, contributing editor

Rail/Intermodal: Volumes solid as service slowly improves

In the freight railroad market, there are a few stories taking place. One is that the economy is in a better spot than it was a year ago. Another is that service, while better than it was last year, is still not where it needs to be. And then there are the year-to-date volumes for both U.S. rail carload and intermodal that continue to prove the market remains in a decent spot overall.

In the freight railroad market, there are a few stories taking place. One is that the economy is in a better spot than it was a year ago. Another is that service, while better than it was last year, is still not where it needs to be. And then there are the year-to-date volumes for both U.S. rail carload and intermodal that continue to prove the market remains in a decent spot overall.

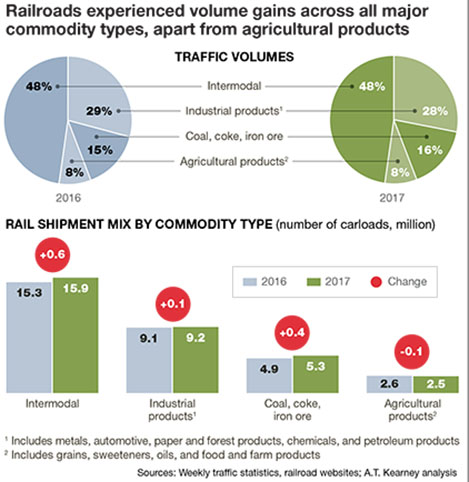

The recently released numbers by the Association of American Railroads (AAR) work toward validating the solid success story in this sector. According to the AAR, U.S. carload volumes are up 1.2%, or 66,071 carloads, through the first five months of 2018 at 5,666,645 with the weekly carload average for May up 3.2% to 263,884, marking the third consecutive month of annual growth at a rate above 3%.

Rail intermodal, container and trailer volumes through May are up 6%, or 336,944 units to 5,993,583, which represents the highest year-to-date volume through May for intermodal, ahead of 2017. In the meantime, average weekly intermodal volume, at 279,641 units, is the second highest reading ever recorded, trailing only February 2018.

And, as has been the case for about three years, intermodal unit volumes are outpacing rail carload volumes, something that did not occur consistently in the past, but is now becoming more common.

Indeed, the decent volume numbers speaks to a solid demand environment, which has been evident in pricing as well. However, on the carload side, there has been an underlying theme that even with these volume gains, service levels have room for improvement. What’s more, it has led to many freight rail stakeholders wondering if the railroads can handle, or support, additional demand should things trend up from here.

“The key thing to think about here is that demand is actually accelerating and is clearly there in nearly every category across the board, which is pretty good,” says Tony Hatch, president of New York-based ABH Consulting.

Even though rail carload volume growth is decent, Hatch observes that, in a way, it’s a bit of a mystery when factoring in the current state of rail services. “Service is not getting worse, but it’s not improving to the rate that many industry stakeholders expected it to be by now.”

Hatch adds that service levels are expected to improve this summer and be more in lockstep with what has been a “pretty good demand story” along with solid financial results. “The question to me is what would it have been if the rails had been operating as they did in 2016, and how would they have handled this environment in which you have the best pricing environment in many years, if not a generation,” he says.

On the intermodal side, Hatch notes that the ongoing truck driver shortage and tight over-the-road capacity have affected large pockets of rail carload merchandise, although the biggest impact is on intermodal.

“The reason is that it has allowed the rails to get away with having less than optimal service,” says Hatch. “With the intermodal volume and price numbers still growing, they are able to provide capacity even if it’s not at the same levels that it had been in the past. A big driver in recent months for the gains in intermodal is related to a combination of truckers raising rates, higher fuel prices and fewer drivers.”

—Jeff Berman, group news editor

Ocean: New pricing hikes imposed

For many global logistics managers, the ocean cargo container shipping industry appears to move from one crisis to another without addressing fundamental supply and demand business practices. Further evidence of this surfaced in June when the world’s leading vessel operators announced the introduction of “emergency” bunker surcharges in response to rising fuel costs.

For many global logistics managers, the ocean cargo container shipping industry appears to move from one crisis to another without addressing fundamental supply and demand business practices. Further evidence of this surfaced in June when the world’s leading vessel operators announced the introduction of “emergency” bunker surcharges in response to rising fuel costs.

As a throwback to bygone days of “cartel” action, this tactic was done in unison, placing higher costs on existing bunker surcharges.

Chris Welsh, the current secretary general of the Global Shippers’ Forum (GSF), believes that this is a shortsighted solution at best. “GSF is adamant that few transport operators in other sectors would risk imposing emergency surcharges because of the likely strong reaction from shippers, including the loss of business,” he recently stated in his comments delivered at the GSF Annual Meeting in Melbourne, Australia.

Welsh said that container ship operators need to take responsibility and greater control of their costs rather than announcing vaguely explained sudden unrecoverable surcharges. “The imposition of emergency surcharges has no place in a modern liner shipping market where costs and prices should be mutually agreed upon between shippers and suppliers.”

Finally, Welsh stated that the use of emergency surcharges is a “none too subtle” attempt to impose non-negotiable charges on shippers. “The liner industry needs to employ more appropriate pricing arrangements, in conjunction with its shippers, if it is serious about developing partnership approaches and improving individual relationships,” he says.

Dan Smith, principal with ocean industry consultancy The Tioga Group, observes that the carriers are in financial distress due to overcapacity and depressed rates, and looking for any means to recover.

“Industry consolidation facilitates what used to be called ‘price signaling’ in which one seller announces prices and others follow, or ‘barometric’ price leadership, in which some implicitly chosen metric signals higher prices,” says Smith. “We’re down to under 10 major carriers, but herding 10 cats is still tough unless they all want to go in the same direction anyway.”

According to Smith, when capacity was tight at the beginning of this century, the Transpacific Stabilization Agreement (TSA) and its predecessors looked like strong cartels. When capacity was loose, TSA could not sustain higher prices against its members’ desire to fill their ships.

As widely anticipated, the TSA dissolved itself earlier this year. Since the effective demise of tariffs, the world is split into contract rates and spot rates. Smith now says that the question is this: which shippers are complaining about their current contract rate?

“Are these emergency surcharges permissible under existing contract terms? Are major importers going to pay it? If so, the carriers may have found a loophole, but that loophole is likely to be closed tight in the next round of negotiations,” says Smith. “Shippers have long memories.”

Philip Damas, head of Drewry’s logistics practice, says that the new rate hike will not affect any shipper who has a “no new carrier surcharge” clause in their contract. However, medium companies and spot buyers who don’t prohibit new surcharges will definitely be exposed and face large, unexpected cost increases.

“The ocean carriers who have just introduced this new emergency surcharge at the same time have a lot of explaining to do, and shippers will be suspicious about this coordinated response by carriers,” says Damas. “It’s a fact that fuel prices have surged from $320 to about $460 per metric ton in the past year, but the fuel adjustment formula should be the sole mechanism to deal with increases in external costs like fuel—not new surcharges.”

—Patrick Burnson, executive editor

Air: Disruption continues to rule the day

The concern for traditional air carriers continues to be how to compete with Amazon in the near future. Chuck Clowdis, managing director of the consulting firm Trans-Logistics Group, Inc., believes that the initial challenge will come from Amazon’s ability to move cargo in “back-haul” or empty-miles directions.

The concern for traditional air carriers continues to be how to compete with Amazon in the near future. Chuck Clowdis, managing director of the consulting firm Trans-Logistics Group, Inc., believes that the initial challenge will come from Amazon’s ability to move cargo in “back-haul” or empty-miles directions.

“Existing air cargo service providers must decide if they want to compete on these lanes, with possibly reduced rate levels, and maintain their market share,” says Clowdis. “Or they may wish to simply abandon these lanes to Amazon. At this stage, it’s my opinion that Amazon’s fleet may disrupt traditional movements in only select lanes.”

At the same time, Clowdis feels that the traditional providers will not be facing a major revenue challenge in the short term. “In fact, as e-commerce develops, there will likely be plenty of freight to fill any void,” he adds.

Another trend capturing his attention is the use of artificial intelligence (AI) in air cargo operations. Clowdis maintains that it may play a major role sooner than many shippers expect. “With the alignment of so many technologies—scanning, tracking, routing—AI will be the next to emerge,” he says. “Logistics managers will then be making decisions based upon expected variables. And while it will not be 100% accurate at its inception, safeguard measures will prevent major errors as systems are refined.”

Clowdis cautions that data alone, however, will not suffice. He notes that the logistics manager without correct data “is just a person with an opinion.” Big Data certainly faces the same challenges, he says. “It isn’t how much data can be captured, but rather how it would be used to solve problems in visibility, traditional movements, freight history, diversion and analysis,” Clowdis says.

Ludwig Housemann, a partner with McKinsey & Company in Munich, teamed with consultant Manuel Bäuml to write the recent report “Airfreight forwarders move forward into a digital future.” The authors contend that digital challengers can’t replace every step in the value chain, at least for now, adding that logistics managers should expect a “transformation” over time, however.

According to McKinsey, digitization will change both supply and demand, but the course of technological progress is harder to predict now than it was in past disruptions. Also to be factored in, says McKinsey, are the substitution of flows from one form of transport to another, and the ability of 3-D printing to displace significant volumes of air cargo.

Meanwhile, The International Air Transport Association (IATA) reports that global air cargo markets continue to grow. Cargo demand year-to-date increased by 7.7%, representing the strongest quarterly growth since 2015. Furthermore, demand outstripped capacity for the 19th month in a row—a positive sign for airline yields and the industry’s financial performance.

There are, however, signs that the best of the upturn for air cargo has passed. According to Alexandre de Juniac, IATA’s director general and CEO, the positive outlook for the rest of 2018 “faces some potentially strong headwinds.” These include escalation of protectionist measures into a trade war. “Prosperity grows when borders are open to people and to trade, and we are all held back when they are not,” he says. - Patrick Burnson, executive editor

Third parties strive to forge new partnerships

In a move that may augur a new global strategy for third-party logistics (3PL) providers, CEVA Global Logistics and IMS Worldwide recently entered into a strategic Alliance to offer the benefits of foreign trade zone (FTZ) services to shippers in the United States. According to the companies, the partnership’s focus is the development of a “zone managed services” offering that’s rooted in compliance, efficiency and experience.

Based on analysis of their customer’s supply chains, CEVA and IMS say that they can offer to integrate certain activities into FTZ environments, and therefore achieve improved efficiency and substantial savings in terms of duties or import fee reductions as well as cash flow improvements through reductions in working capital.

According to CEVA executives, the alliance with IMS, a leader in FTZ consulting and operations in the U.S., allows the global 3PL “to enhance, grow and expand its current FTZ offerings to all of their ocean and air gateways in North America as well as utilize their contract logistics expertise and footprint to offer further benefits to shippers within the FTZ.”

The move by CEVA certainly validates trends indicating that large multinational and global manufacturers, distributors and retailers are increasingly inclined to choose 3PLs that they designate as global preferred providers, contend analysts for Gartner.

The consultancy’s annual Magic Quadrant is intended to chart the evolution of the best candidate 3PLs as they develop their abilities to become global preferred providers for their customers. According to Gartner analysts, all of the providers in the third-party logistics industry are progressing at different speeds along a maturity spectrum to supply these customer preferences and requirements through a combination of acquisition and organic growth strategies.

Barriers to entry are also coming down, say Gartner analysts, who note that competition for established 3PLs is increasing as new technology-based 3PLs enter the market. Companies such as Flexport and FLEXE are offering shippers another way to outsource their logistics needs and access logistics services.

Barriers to entry are also coming down, say Gartner analysts, who note that competition for established 3PLs is increasing as new technology-based 3PLs enter the market. Companies such as Flexport and FLEXE are offering shippers another way to outsource their logistics needs and access logistics services.

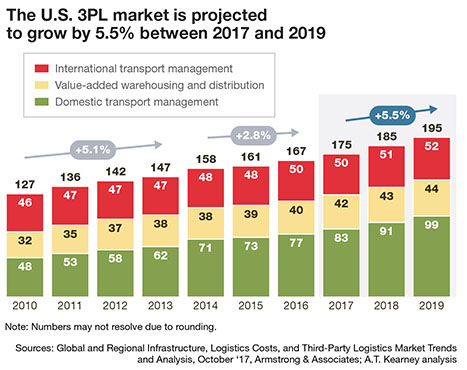

Meanwhile, the consultancy of Armstrong & Associates Inc. maintains that 2017 was an overall banner year for 3PLs. According to the consultancy’s annual market research, the industry’s net revenues expanded 5% over 2016 to $77.1 billion and gross revenues increased 10.5% over the same time period to $184.3 billion.

“Tight carrier capacity pushed shippers to dedicated contract carriers in 2017,” says the consultancy’s president, Evan Armstrong. “As a direct result of this move, dedicated contract carriage revenues increased 10.2% over 2016—significantly higher than its compound annual growth rate of 7% since 1995.”

He also notes that international transportation management is benefiting from tight airfreight capacity due to the global growth in e-commerce and an overall strengthening of global economies. International transportation gross revenues increased 10.5% in 2017, while net revenues, reflecting capacity pressure, increased 4.3%. However, the first quarter of 2018 has seen better growth for Expeditors, Kuehne + Nagel and DHL. Expeditors’ gross revenue was up 9.7% and net revenue grew 9.9% in the United States.

—Patrick Burnson, executive editor

Article topics

Email Sign Up