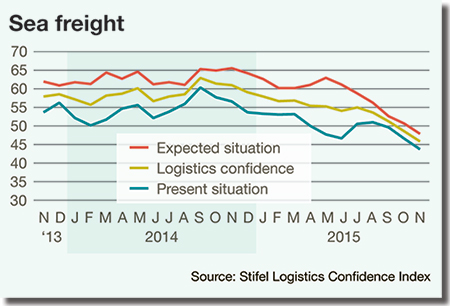

For the last six months of 2015, shippers indicated that they were concerned about sustaining long-term distribution plans.

That anxiety appears to have deepened, say the analysts charged with putting together the Stifel Logistics Confidence Index - a report that saw scores sink to their lowest ebb in three years.

“The continuation of negative macroeconomic trends at the global level - principally emanating from China - represent the chief cause of this decline,” observes John Manners-Bell, chief executive officer of the London-based consultancy Transport Intelligence (Ti) that conducts the index survey.

Chinese retail sales were up by 11 percent year-on-year in 2015, but the country saw exports fall by 6.9 percent over the same timeframe in value terms, while the import decline was even worse at 18.8 percent.

Each month, shippers responding to the Stifel Logistics Confidence Index survey are queried with a unique, “one-off” question, explains Manners-Bell. “The December question was based on the prospects for volumes during the past year’s peak volume season. We asked respondents what they expect to see happen given that China’s economy has been stumbling and global trade volumes have been subdued.”

The largest response group, with 36.4 percent of the total, believed volumes would be adequate, but that last year’s peak was not as pronounced as in previous years. The second largest group, consisting of 33.3 percent of the respondents, anticipated a low peak at best.

“The last two respondent groups each represented 15.2 percent of the total sample, with one set arguing that it’s too early to tell if there was a meaningful peak, and the other expecting a normal post-peak season with healthy volumes,” concludes Manners-Bell.

These findings closely mirror those gathered by Moore Stephens International Limited, a global accountancy and consulting network, also headquartered in London. Their own Shipping Confidence Survey suggests that there may be an eventual reversal of sentiment regarding peak volumes, however.

“Because things were so bad in May 2015, many shippers may be ready to become more optimistic by next May when they begin planning for the next peak season,” says Richard Greiner, a partner in Moore Stephens shipping industry group. “Shipper volumes in 2015 fell to a seven-year low. Perversely, volatility works both ways.”

He notes that the World Trade Organization’s global volume forecast represents a rise from 2.8 percent in 2015 to 4.0 percent in 2016. Again, that’s good news for shipping.

World trade carried by sea is also on the increase and, despite the current difficult economic climate, the longer-term outlook for the industry remains positive as emerging economies continue to increase their requirements for seaborne goods and raw materials.

“Those shippers who are not attracted by the longer-term prospects will doubtless exit the industry, and in the process may help solve some of its problems,” says Greiner. “Meanwhile, we see rates staying relatively low in the maritime and air cargo sectors, but increased volatility in other sectors.”

Oil and Fuel Snapshot

Energy expenses, as always, figure prominently in any discussion of rates across all modes of freight transportation, maintains Derik Andreoli, Ph.D.c., senior analyst at Mercator International.

Andreoli, who is also Logistics Management’s Oil and Fuel columnist, observes that global oil prices fell by half - from $100 per barrel at the beginning of the year to $50 per barrel. Furthermore, a barrel of oil can be purchased for around $45 today. With the exception of the Great Recession, prices haven’t been this low since 2005.

“While diesel price declines haven’t quite matched oil price declines, the same gallon of diesel that set carriers back $3.70 a year ago can be bought today for just $2.45,” says Andreoli. “To put this into perspective, the operating costs of a fleet of 100 long-haul class 8 trucks could be reduced by more than $2 million.”

Consequently, a 33 percent decline in fuel prices has allowed logistics managers to shift their focus to address other operating costs. However, Andreoli warns logistics managers to not become complacent, as prices can rise just as quickly as they fell.

“It’s widely believed that the shale oil boom is responsible for the jump in supply,” says Andreoli. “And while it’s true that domestic production increased by around 1.4 million barrels per day between January and December 2014, domestic production was lower in September 2015 than January 2015, and according the EIA’s monthly drilling report, shale oil production will be lower in December 2015 than December 2014.”

So, where has the additional supply come from this year if not the U.S.? The answer is OPEC. Both Saudi Arabia and Iraq increased production by approximately 750,000 barrels per day for a combined total of 1.5 million barrels per day.

“To the extent that logistics managers will be concerned with energy related issues, the factors that could push prices back up must be at the top of the list of concerns,” says Andreoli.

Breaking News: Crude Oil Crashes Below $30 a Barrel for the First Time in 12 Years

As we enter the new year, domestic demand for transportation fuels will continue to increase while domestic production will likely continue to fall. Ironically, there may continue to be a “glut” of oil stored in Cushing, Okla., but this phenomenon reflects the fact that complex domestic refineries prefer heavy imported crude to light domestic crude. Furthermore, domestic crude is not permitted to be exported to the less complex overseas refineries that are the best source of demand.

“This, of course, means that the domestic market will be largely influenced by OPEC production,” says Andreoli. “Along these lines, Saudi Arabia is being pressured to cut back production by fellow OPEC members, and there are significant concerns regarding the sustainability of these elevated production rates. Iraq is in a more troubling spot, with ISIS spreading out from Syria and across the country. Suffice it to say that OPEC production could be significantly curtailed at any moment.”

With that in mind, there’s a strong likelihood that Iranian oil sanctions will be relaxed, and if this occurs, there could be a steep decline in oil prices that could potentially knock shale production off the map.

“In the coming year, oil and fuel markets will be subject to extreme supply uncertainty, and this applies equally to global and domestic shippers,” concludes Andreoli. “We may expect carriers in all modes to hedge their bets by trying to raise rates where they can.”

Trucking: Rates Somewhat Flat

For Stifel Nicolaus trucking analyst John Larkin, “uncertainty” in the trucking sector means capacity will remain flat in 2016 while rates move up by 2 percent to 3 percent.

“There’s no point to adding equipment if it’s so difficult to find drivers for a company’s existing fleet,” he says. “A few carriers will add trucks and some will shed a few, but the net result will be no increase in the number of tractors seated with drivers.”

The driver shortage issue is “inelastic,” says Larkin, who invokes the economic term to explain that rate hikes have more to do with surge in demand than manpower expenses. “Increasing salaries doesn’t attract much more talent to the industry,” he says. “So, the driver shortage situation will remain challenging in 2016, and could become severe in 2017 as regulatory mandates are enforced across the board.”

In the meantime, year-over-year rate hikes in the trucking sector have been decelerating in 2015, notes Larkin, as shippers work their way through an industrial recession and a major inventory reduction. “If the economy continues to steadily grow at a 2 percent trend, and provided excess inventories are pared down, rates could reaccelerate as shippers contemplate the capacity reductions embedded in pending federal laws regulating speed and electronic logging devices.”

Larkin also notes that the flurry of merger and acquisition activity in the third party logistics provider sector over the past year have made an impact on trucking, as smaller carriers will have fewer brokers to harness when looking for loads. “Third parties could use their concentrated market power to further leverage the pricing dynamic,” says Larkin, “particularly when it’s a large player negotiating with smaller truckers.”

At the same time, says Larkin, intermodal providers need to get service levels back to where they were in 2012 and the first half of 2013 if they’re to continue to put pressure on truckers. “If the railroads can make this happen, many shippers would likely use more intermodal services given its attractive pricing structure relative to truckload options,” he adds.

Rail/Intermodal: Keeping Pace with Inflation

Tony Hatch, a rail analyst and principal of New York-based ABH Consulting, agrees that intermodal is set to surge due to driver shortage issues and reliance on public spending for highway infrastructure. However, he also points to environmental issues, noting that rail has fewer carbon consequences.

“Intermodalism is set to grow even faster, as more business is conducted in cross-border,” says Hatch. “The North American Free Trade Agreement [NAFTA] is becoming far more cohesive - one only has to look at the what’s happening in the automotive sector to see that.”

Hatch says that while railroads would prefer to have more control over rates, most of that is determined by third-party logistics providers. “Led by continuous market share gains in intermodal, both domestic and international, rails will be even more important to the national and continental supply chain than they are today and rates will keep pace with inflation through 2016,” he adds.

According to Hatch, shippers will, at the same time, remain heavily reliant on motor carriers for most of the movement - especially from the first and last mile.

Frank Harder, a principal with the transport consultancy Tioga Group, believes that we may not see intermodal strengthening to a high degree. “Lower fuel prices, coupled with a waning economic recovery, produces major headwinds for domestic rail and intermodal,” he says. “And we are beginning to see that reflected in the numbers.”

Nor does Harder feel NAFTA will reverse this trend. “Lower North American energy costs will have an impact on manufacturing of goods, for which energy costs are a large component,” he says. “A strong dollar is also working against near-shoring and hemispheric trade.”

Harder says he sees the rationalization of the rail industry - through a series of end-to-end mergers - as a sensible way to keep rail systems viable and cost competitive as coal and oil shipments decline and as motor carriers become relatively more competitive due to cheaper oil prices.

Ocean: Consolidation Concerns

With the pending acquisition of Neptune Orient Lines (NOL) and its maritime asset APL by CMA CGM, new concerns about rate hikes have surfaced in the global shipper community.

Analysts for London-based Drewry Supply Chain Advisors note that CMA CGM is smaller than Maersk in the trans-Pacific and would benefit from access to APL’s large base of high-end textile and other time-sensitive product customers, as well as its profitable U.S. government contracts linked to the use of US-flag vessels.

Meanwhile, the CMA CGM/APL deal could be dwarfed by the planned merger of COSCO and China Shipping Container Lines, a deal that’s expected to be finalized in the coming months. But according to Stijn Rubens, senior consultant for Drewry, such fears may be misplaced.

“As long as there’s over capacity in the market and sufficient sales channels that are willing to undercut each other, the rates will not increase in a sustained way,” says Rubens. “But on the spot market, it’s a different story.” Indeed, Drewry analysts contend that volatility on the spot markets is increasing to reach “extreme levels” of late.

“This has and will continue to put pressure on exporters and importers to benchmark and re-negotiate both their contracted and spot freight rates,” says Rubens. “In fact we’re advising shippers to adapt their standard fixed-rate annual contract to more flexible pricing arrangements that guarantee that a ‘market conform price’ is in place at all times while keeping the actual price volatility at a minimum.”

Air: Rates Up for Now

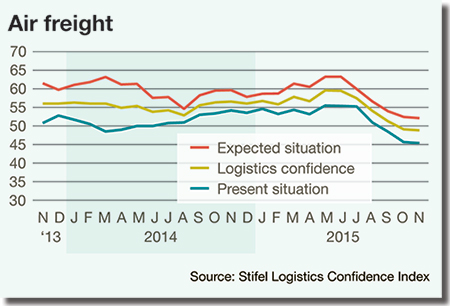

The dramatic decline to ocean freight spot market rates has also served to widen the pricing differential to air rates to record levels, say Drewry analysts. In fact, they report that spot market ocean freight rates are in a rapid tailspin.

Highlighting the extent of the decline, average container rates for December on the backhaul Europe to Asia trade - where ships are barely two-thirds full - were more expensive than they were for the far bigger headhaul Asia to Europe leg.

This was the first time this had occurred since Drewry started benchmarking the aggregate trade rate indices in 2011. Despite similarly sluggish demand trends, airfreight spot rates have held up much better than ocean rates.

Chuck Clowdis, managing director of transportation advisory services for IHS Global Insight, agrees with this observation. He notes that with ocean and air moving in opposite directions, the pricing differential between the two modes has reached a record high. However, he adds words of caution to this assessment.

“Because we had such a soft peak season in 2015, this surge in air cargo spot-pricing may be short-lived,” says Clowdis. “It’s too early to tell if the trend will bleed over into long-term contracting.”

Analysts for the International Air Transport Association (IATA) seem to be on the same page, adding that the outlook for air cargo continues to be “very difficult.”

“While there was some optimism from third quarter growth, it has all but disappeared as the industry basically flat-lined,” says Tony Tyler, IATA’s director general and CEO. “Cargo capacity has grown largely in lock-step with the continued robust demand.”

As a result, freight load factors have sunk to the 44 percent range - a level not seen since 2009. “Early signs of improvement in export orders may bode well for trade and air cargo, but this is unlikely to prevent air cargo finishing 2015 on a low note,” adds Tyler.

Parcel: Increasingly Complex

Jerry Hempstead, president of parcel express analyst firm Hempstead Consulting, observes that the parcel sector is becoming increasingly complex, and that pricing will reflect that this year.

“Shippers who are spending the time to model their business and benchmark their costs against the carriers rate increase announcements now long for the simplicity of the increases of the past,” says Hempstead, adding that this year’s general rate increases are muddied by a myriad of “yield improving” mechanizations that make the calculus of Einstein look like child’s math.

“On the surface, the increases look similar to the increases of year’s past,” says Hempstead. “However the devil is in the details. For example FedEx recently announced an increase to its fuel surcharge index because it had been charging less than UPS. UPS countered by increasing its fuel surcharge index. It’s like watching two guys playing high-stakes poker.”

As in the past, the rate increases are much higher in the lower weights, where most of the shipments reside, and lower than the “average” in the higher weights. According to Hempstead, this makes it hard for most shippers to determine how the announced changes will affect their book of business without professional tools that can deal with the variables of service level, zone, and weight.

The new “tax” on shipping, says Hempstead, is a 2.5 percent up charge on the total bill if a shipment is tendered to UPS and third party billed. In fact, third party billing has been a feature of parcel shipping for at least 50 years and adds no incremental cost to a carrier than “bill sender” or “bill recipient.”

“UPS has announced this new fee because they can,” says Hempstead. “FedEx may choose to exploit not having the fee for some period, convert some UPS customers, then grandfather those accounts with an exemption if they decide to mirror UPS,” he adds.

Both UPS and FedEx are also adding some significant financial pain should shippers tender transactions that are “outsized” or heavy. Hempstead feels that shippers will begin to opt for alternative routing in these situations. “Shippers would actually be doing themselves and the carriers a big favor by moving this freight on other modes,” he adds.

Related: Is the U.S. Trucking Industry Entering a Profit-Killing Era of Overcapacity?

About the Author

Follow Robotics 24/7 on Linkedin

Article topics

Email Sign Up