Managing product that does not sell, is entering the end of its life, or has been returned due to buyer’s remorse is now generally understood to be a critical part of product life cycle management.

Yet this has not always been the case. Historically, most of the attention paid to product management has focused on the introductory phase or on the volume-shipping portion of the product life cycle.

The leaders have greatly broadened this perspective. They know that the difference between a product’s success (and profitability) and failure often depends on how the end of life is managed.

The leaders understand, too, the business importance of taking good care of consumers. They know that customer satisfaction holds the key to long-term success and that enabling them to return products without penalty is a big part of the equation.

The practice of customer returns isn’t really new, but it has become much more cost-efficient in the top-performing companies.

Sears and JCPenney—Pioneers of Customer Returns

The late 19th century saw two of the nation’s most historic retailers emerge, Sears and JCPenney. Both evolved from very simple roots to become retail powerhouses. Sears started in a small train station in Minnesota, while JCPenney began as a tiny general store in Kemmerer, Wyoming.

Both of these retailers operated on a then-innovative business philosophy: an open, liberal return policies where consumers could bring products back with no penalty.

This innovation, which was designed to increase customer satisfaction, did more than that. It actually reduced consumer risk of shopping at Sears or JCPenney. This meant that their stores were likely to attract a long-term consumer because the risk associated with shopping there was reduced.

It was safe to buy something from Sears or JCPenney because the consumer knew that if it didn’t function well, or it was the wrong size, or it just didn’t work, they could return the product and get their money back.

For these two pioneering retailers, taking back product from consumers was a smart marketing move that over the years consistently translated to business success.

This article strives to make the case for building an effective reverse logistics program in your organization. It describes the importance of this key component of supply chain management and outlines how reverse logistics differs from forward logistics.

We then describe some of the key considerations in building a reverse logistics competency and then list key metrics that need to be put in place. Finally, the article offers some practical steps that readers can take to build momentum for a successful reverse logistics program in their organization.

Reverse Logistics: Important and Different

Companies can no longer afford to treat reverse logistics as an afterthought. It needs to be a core capability within the supply chain organization. For years, most firms paid little attention to returns.

That has changed as companies increasingly realize that understanding and properly managing their reverse logistics can not only reduce costs, but also increase revenues. It can also make a huge difference in retaining consumer loyalty and protecting the brand, as we explain more fully below.

Just how big is the opportunity? According to the Reverse Logistics Association, the volume of returns annually is estimated at between $150 and $200 billion at cost.

This represents approximately 0.7 percent of GNP and 6 percent of the Census Bureau’s figure of $3.5 trillion total U.S. annual retail sales. It has been estimated that supply chain costs associated with reverse logistics average between 7 percent to 10 percent of cost of goods.

Capturing the potential benefits begins by clearly understanding the nature of reverse logistics. First off, it is very different from forward logistics. Retailers and manufacturers design supply chains to quickly and efficiently send a continuous flow of product from production facilities to retailers’ shelves.

All of the boxes on a pallet are typically identical and stacked in neat rows. They arrive at the distribution center or retail outlet like clockwork.

The reverse flow is different in a number of ways. First, product arrives whenever customers decide to return an unwanted item, or a retailer decides to pull slow-moving product, or a manufacturer institutes a packaging change, or any number of other possible causes.

Second, the product is not all in new condition. Third, much of the packaging is damaged or shelf-worn. The end result: the company must look at each individual item and make a decision as to its disposition. Exhibit 1 summarizes these and other differences between forward and reverse logistics.

Drivers of Reverse Logistics

The drivers of reverse logistics policies and practices will differ among organizations, in large part depending on the perceived importance of this activity to the business.

In many companies, reverse logistics still is not considered very important—though as we said this is changing. In some organizations, in fact, it is actually viewed as an embarrassment.

This could be the case, for example, where merchandisers responsible for buying product that did not sell well to the consumer are in charge of managing those returns. Often, they resist taking the hit of unsold and obsolete merchandise.

Because writing down the book value of the slow-moving inventory and moving it to the secondary market is an admission that the purchase was unsuccessful, firms tend to postpone the decision. The products in question end up losing much more of their value than if the decision to liquidate the inventory was made more quickly.

In addition to corporate perceptions, product attributes are a major driver of reverse logistics. The first, and often most important attribute, is the quality of the product being returned. Items that appear to be first quality are more likely to be worth saving that those that are not.

Product size is another attribute that typically determines how return product is handled. It doesn’t make sense to pay high-cost transportation to return a damaged item that is cumbersome to handle. It’s not a good idea to transport a large item 1,000 miles and then throw it away—whatever the prevailing diesel costs may be.

The position in the product lifecycle is another attribute that drives returns management strategy and tactics. Disposition of a mature product that is nearing the end of its lifecycle will likely differ from that of successful new product introduction. Another important attribute is price point. If the product is low cost, then a lengthy decision process around its disposition is counterproductive.

A fifth driver of reverse logistics is the company’s “go-to-market” strategy. This usually relates to the channels the company uses to connect with its customers. It also incorporates supply chain and marketing processes that guide how the company interacts with customers.

Some go-to-market strategies will dictate how the firm should handle product returns. For example, it could be that market cannibalization is a major concern. In such cases, the final product disposition would have to be routed to a distant secondary market offshore, thereby alleviating that concern.

Finally, there are the financial drivers that come into play. A major one is inventory turns. Companies make an investment in inventory and once that inventory is sold, it moves into the cost of goods sold (COGS) category. When items are returned, they enter back into inventory—and the transaction is reversed.

This reduces the value of the inventory turns metric, which is typically used by management as a measure of the health of inventory management within the firm.

The seller needs to find an appropriate secondary market that will speed up the time in which some value can be gained from the inventory they had hoped to sell.

As is the case with forward logistics, financial flows typically determine the structure of the reverse logistics flow. One recurring problem is that managers are often measured on metrics that suboptimize the structure of the reverse logistics flow.

The Management Mantra: Simplify

With an understanding of the nature and drivers of reverse logistics, you can begin to more effectively manage this activity. The guiding principle here is simplification.

As every good supply chain manager knows, the fewer times you touch an item—and the shorter and cleaner the process—the better the result. This certainly holds true in reverse logistics. Because much of this product is low value, it’s especially important to simplify the process, shorten the time and distance to ultimate disposition, and eliminate unnecessary touches.

Reverse logistics product has likely spent a great deal of time moving through the forward and reverse systems. The longer it continues to stay in the system, the more its value is likely to decline. (As one executive told us, “This is not like fine wine. It does not get better with age.”) Already damaged products or packaging are likely to become further damaged the longer they are in the system.

Products with any kind of technology component to them are losing market value with every passing month. As a result, companies must minimize the time product stays in the reverse logistics system. The more quickly an item gets dispositioned and moved through the system, the more value it is likely can be recaptured.

One of the biggest management challenges in this context centers on the issue of “one of many” vs. “many of one.” In other words, the return flow often consists of low volumes of a multitude of items; by contrast, the forward flow is typically comprised of one, or just a few, items moving in high-volume.

Handling product on an individual basis, particularly product of varying quality, is much more difficult and costly than working with new, perfect-quality product that moves in high volumes. Because of the greater complexity and level of decision-making involved, reverse logistics requires closer attention at the senior management level than does forward operations.

Regardless of whether a product is intended to be sold and then recycled or disposed of in a landfill, systems must in place to ensure proper handling. Some companies may be willing to pay additional costs for proof of secure disposal.

One popular approach to assure brand equity protection is for the company or its 3PL to video the actual product disposition, which often entails destruction of the product.

Managers need to be aware of the regulatory trend requiring firms to develop reverse logistics processes that ensure proper end-of-life management. Electronics waste, or e-waste, is a good example.

Currently, 25 states have e-waste regulations. Twenty-four of those states have Extended Producer Responsibility regulations, and California has an Advanced Disposal Fee program.

These regulations require that certified recycling partners confirm that electronics waste is disposed of properly. One reason for this is to guard against the products being exported to developing countries, which is against the law in most of those countries.

In an October 2011 Dateline segment on Australian television, an investigative journalist in Ghana displayed a collection of computers and monitors that bore stickers from multinational corporations and U.S. state and federal agencies. No company wants that kind of publicity.

Managers also need to be cognizant of new regulations requiring that companies be able to offer proof that their products are what they claim to be.

In the pharmaceutical industry, for example, the California Board of Pharmacy (CBoP) has set deadlines for all manufacturers to be able to show an electronic pedigree and a defined serial number down to the pill bottle level.

Managing the authenticity of forward-moving product is costly. Managing authenticity backwards in the supply chain can be even more costly—and more difficult.

We mentioned earlier that time-to-cash is a key driver of reverse logistics. How effectively you minimize time-to-cash depends greatly on the processes developed around credit reconciliation.

Because returns are not always a standard transaction, credit reconciliation processes that are routed through the CFOs office can be slow. These processes need to be established in advance so that credit reconciliation can happen quickly. Similarly, firms need to make disposition decisions fast. In fact, a sub-optimal disposition made quickly often results in a better cash position than a perfect decision made slowly.

Returned items need to be managed for speed as well as for highest recovery values.

For firms forward in the channel such as retailers, wholesalers, or manufacturers receiving finished product, vendor agreements need to be strategically negotiated—not just accepted blindly.

Supplier agreements must specifically address what should happen with returned products, who is going to pay for each element of the reverse logistics process, and how the credit reconciliation process will function. Large credit write-offs and aging receivables that should have been written down a long time ago can eventually get a company in deep trouble.

Another important issue in many industries is zero returns. This is called by a number of different names such as swell allowance or adjustable-rate policy. What all of these terms basically mean is that the customer does not physically return the item. Instead, it takes a credit allowance from its supplier.

This is common practice in the consumer packaged goods industry. Typically, manufacturers allow retailers a small percentage credit for items that are “unsaleable.” These unsaleables will then be disposed of by the retailer and not shipped back to the manufacturer.

Procter & Gamble pioneered adjustable-rate policies in the 1990s. In the food industry these are now the rule (often leading to some difficult feelings with the manufacturers who may not view such policies in the same light).

Finally, regardless of your particular industry segment, one of the core reverse logistics competencies is the ability to track the movement of products and components—both in the forward and reverse channels.

Product Recalls

Product recalls are part of the reverse logistics process that merit special attention. Recalls can be voluntary or mandatory. But in all cases, they need to be managed carefully in a way that first and foremost protects the brand and is efficiently executed.

Recalls in general are becoming more common. Consider that between Feb. 14 and March 11, 2013 (less than one month), the Food and Drug Administration (FDA) mandated more than 40 recalls. Recalls require more upfront planning than most other return types.

For industries that are susceptible to recalls, like automotive or pharmaceutical, part of designing an effective returns management process is developing procedures for quickly informing customers transparently about a recall and then efficiently handling the return.

Even the best-run companies can run into difficulties with recalls, as evidenced by Johnson & Johnson’s experience in 2009 with its Motrin product. J&J found contaminants in the product that reduced its potency. J&J asked its recalls management company, Inmar, to buy back the drug. Inmar sent contractors into stores to purchase Motrin without explaining the situation to the retailers.

A memo signed by J&J’s McNeil Consumer Healthcare unit told Inmar employees to “not communicate to store personnel any information about this product. Simply visit each store, locate the product and, if any is found, purchase all of the product.”

Mishandling a recall can be extremely damaging to a manufacturer’s reputation and a poor example of risk management. In the Johnson & Johnson case, congressional investigators became involved, forcing J&J to turn over more than 22,000 pages of documentation. It would have been much easier—and less costly—to have performed the recall differently.

It was probably naïve to believe that the FDA and retailers would not notice that all units of a specific SKU were being purchased in every retail outlet carrying those items. What makes this case all the more surprising is that J&J was the architect of one of the most successful recalls campaign in history—the cyanide-tainted Tylenol incident in 1982, which the company handled transparently and skillfully in protecting the brand.

Secondary Markets as Drains

Developing a cost-effective reverse logistics program demands a solid understanding of secondary markets and the related concept of “drains.” A consumer who purchases a refurbished laptop, or a college student who buys a used textbook are good examples of selling on the secondary market and getting additional value out of an asset.

In addition to the revenue aspect, secondary markets provide other important benefits. Notably, they effectively divert a large number of products from landfills and create numerous jobs, thereby resulting in substantial environmental and economic benefit.

In short, secondary markets have become a significant portion of domestic economic activity in the United States. Although not reflected in current government metrics, a conservative estimate is that the secondary market represents 2.28 percent of the U.S. Gross Domestic Product.

Several of the secondary markets consist of many small players, so there are no trade associations or other authorities to estimate their size.

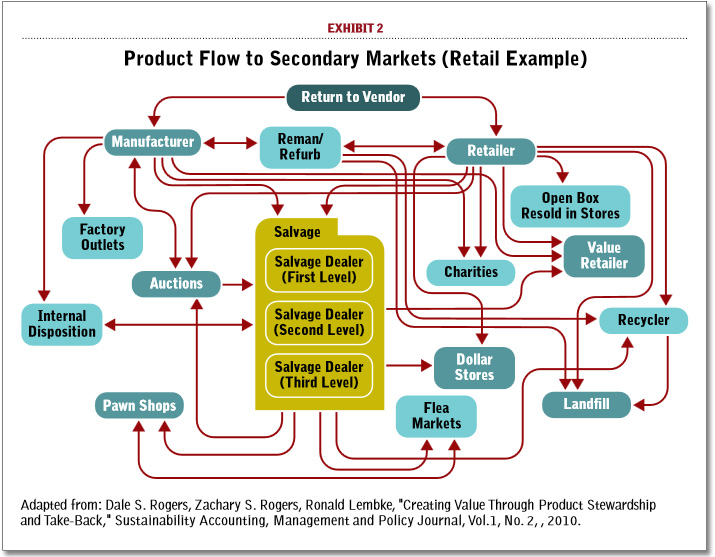

To get a better sense of the secondary market dynamics, let’s examine the retail sector. Exhibit 2 shows a realistic view all of the destinations that product may flow to from a retailer. When a company receives returned product, much of it will be sold off to companies in the secondary market.

The secondary market is not a single marketplace, but the name for the network of companies that buy and sell product that cannot be sold as first quality in the primary channel.

Usually, a retailer’s first choice of disposition is to return the items for full credit back to the supplier. Unfortunately, that option is often precluded by a supplier agreement or by a product customization such as a store-branded item.

One of the most common approaches to product disposition is through salvage brokers. The first level of salvage broker will typically buy in bulk such as a trailer load, and offer a small fraction of the product’s original cost.

The offer might be as low as 10 percent of the wholesale price. When a company sells product to a salvage broker, that broker will turn around and sell that product to another broker or other secondary market, who then may sell it to the public. Or the product may be sold to a series of brokers before it ultimately gets sold to a consumer.

Some of the product may enter the secondary market through other paths. Auctions, international dispositions where the product is shipped offshore, factory outlets, value retailers such as firms like T.J. Maxx or Marshall’s, or dollar stores are places to move product that is not selling well through the intended primary market.

These secondary markets effectively act like drains. Every system needs to have a means to rid itself of excess or unwanted materials. In the human body, for example, the circulatory system’s arteries handle the forward logistics of bringing oxygen and nutrition to the cells while the veins carry the carbon dioxide and waste products to the lungs and kidneys for removal.

Without the veins to carry away waste products, cells would cease to function, literally drowning in their own waste. And no one wants to think about a building that did not have both inbound and outbound plumbing. Having “drains” of one type or another is crucial to the operation of all systems.

Drains are similarly critical to a product supply chain. Items are taken to retail destinations for sale, but not all of it will be sold. Some will be returned, and the system has to have a way to deal with those products.

If there were no drains built into the system, no way to deal with the items, the system would drown in this unwanted material. Imagine what a retail store would look like if all returned and unsold items had to stay at the shop until they were sold. The sleek and chic stores of an upscale mall would quickly look like thrift outlets.

No matter how well the system’s unwanted materials disposal system is designed, there will likely be times when the drains cannot keep up with the load placed upon them. The reverse logistics system is charged with cleaning the unwanted product out of the network, and contributing as much as possible to profitability.

The products sold to the secondary market are generally being sold for far below their original cost, so it might seem strange to speak about reverse logistics systems contributing to profits. However, every additional dollar recovered is one less dollar of loss. The higher the percentage of cost that can be recovered, the better.

A company needs to have a well thought-out plan, complete with a network of secondary market partners, that will accomplish all of the following: (1) dispose of product in a timely manner, (2) recover as much value as possible, and (3) protect brand equity.

Importance of Metrics

To monitor progress against its reverse logistics plan, a company needs metrics that measure the financial impact of returns on the firm and on other members of the supply chain.

As part of this process, the company should develop procedures for analyzing return rates and tracing the returns back to the root causes. Measures such as amount of product to be reclaimed and resold as is, or percentage of material recycled, are examples of such metrics.

In analyzing your company’s reverse logistics performance, consider tracking these metrics:

- Disposition cycle time: Cycle times can be an important measure of reverse logistics. The more standardized and streamlined the processes are, the shorter the cycle time should be.

- Amount of product reclaimed and resold: What percentage of product that moves to the reverse logistics system is reclaimed and resold? How much value is recaptured?

- Percentage of material recycled: This metric tracks the percentage of product in the reverse logistics stream that is recycled in an appropriate manner.

- Waste: How much product and other materials are moved to landfills, incinerated, or disposed of as waste? The objective is to minimize product in the waste streams.

- Percentage of cost recovered: Is the firm maximizing the profitability of product that did not sell well or has been returned by consumers?

- Per item handling cost: A cost-per-touch type of metric can be readily computed by dividing total facility costs per month by the number of items processed. This is also a valuable way to compare the efficiencies of different facilities

- Distance traveled: Tracking average distance traveled per item is not nearly as simple as determining per-item handling cost. Generally speaking, the fewer miles that can be put on an item in the reverse logistics network, the better.

- Energy used in handling returns: This metric is used in sustainability programs. It measure how much energy (diesel fuel, electricity, etc.) is used in the reverse logistics process.

- Total Cost of Ownership: What is the total cost of ownership related to originally acquiring the product, reselling it, bringing it back as a return, and moving it through a secondary market or placing it in a landfill?

The Path Forward

Firms need to care deeply about how they manage product that did not sell in the primary channels. Reverse logistics is not an easy task, and many practitioners underestimate its difficulty.

Good reverse logistics and returns management programs are unlikely to appear out of nowhere. Companies have to work closely with their suppliers and customers to make these processes work well.

At first glance, handling the reverse flow may seem roughly equivalent to managing the forward movement of new product moving through primary channels.

However, the process is often much more difficult and the final objective is not as clear. It is obvious that the goal of manufacturing and shipping new product forward is to get it all the way to the retailer and ultimately the consumer.

On the reverse side, quality, distance traveled and the other variables mentioned earlier can determine the path backward and ultimate disposition. The lack of uniformity in the products’ physical condition makes reverse logistics all the more difficult.

It entails the sorting and evaluation of product, which is typically not necessary for new product in the forward channel. Negotiations to sell the product further contribute to the complexity of reverse logistics.

The end result of all this: the reverse movement of products offers many challenges and opportunities not present with forward logistics. Companies need to spend quality management time carefully examining and constructing their reverse logistics processes. They need to work hard to manage these processes or they will experience a constant leak of profit.

A successful reverse logistics program begins with a clear objective: What do we want to accomplish through our reverse logistics efforts? Setting that objective will help the company better determine how to handle consumer returns and unsuccessful product.

As part of this process, disposition options for returned product need to be identified and analyzed for cost minimization and profit maximization. Consideration also must be given to the impact of policies and procedures on the brand and potential cannibalization of sales in the primary market.

Going back to the Sears and JCPenney examples, a company can turn returns into a strength that improves its relationship with consumers.

To manage the complexity that accompanies a good reverse logistics program, companies need to view it as a critical management activity.

In particular, they need to apply management time and expertise required to turn a problem into a strength. Or put another way, to turn trash into cash.

Dr. Dale Rogers ([email protected]) is a Professor of Logistics and Supply Chain Management, Co-Director of the Center for Supply Chain Management, and Director of the new Supply Chain Finance Lab at Rutgers University. Dr. Ron Lembke ([email protected]) is an Associate Professor of Managerial Sciences at the University of Nevada. John Benardino ([email protected]) is the Vice President of Supply Chain Operations for Comcast. Prior to this, he worked at HP for 20 years, holding multiple positions in reverse logistics.

Article topics

Email Sign Up